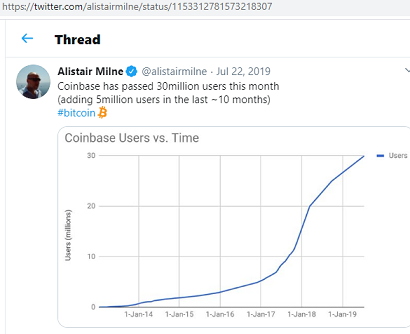

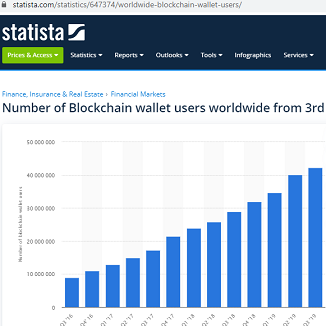

In recent years, cryptocurrencies and Bitcoin have been in and out of the news, and there have been many debates about whether they will become a significant part of the financial world going forward. In my new book The Peaceful Investor I discuss them in Chapter eight (which is about Day Trading) and in Chapter 27 (about Crisis, Opportunity, and Bubbles), and I also suggest reading some background on Cybercash here. I don't consider cryptocurrencies (or traditional currencies) to be investments, but I wanted to go into a little more depth about cryptocurrencies, given that Coinbase claims over 30 million users and the graphics below show the dramatic growth in the number of cryptocurrency users.

In my opinion, there are several logical reasons to buy cryptocurrencies. The first logical reason is for wealthy investors that want to invest their portfolio to be consistent with the world portfolio. In Chapter 13 of The Peaceful Investor I discuss the Global Investing Universe. A strong argument can be made for the logic of investing in a portfolio that attempts to replicate the world's wealth, since it reduces risks and historically would have provided strong returns. CoinMarketCap is a website that dynamically calculates the market capitalization of bitcoin and the other cryptocurrencies. In January 2018 cryptocurrency valuations exceeded $800 billion, but recently the total has been around $300 billion. By comparison, Gold’s market cap has been around $8 trillion recently (and oil and gas are much larger percentages of the global ecomony). So the bottom line if you are trying to replicate the world's wealth, you should have about 45 times as much gold as bitcoin (at recent valuations).

The second reason to buy cryptocurrency is because you need something that can only be paid with cryptocurrency. If you travel to a foreign country with its own currency, you may be asked to pay in that local currrency, in which case you would typically exchange your currency for the local currency. I have a client that told me years ago he bought some bitcoin as a precaution in case one of his websites got hacked and the hacker demanded ransom in bitcoin to release the site. Unfortunately, many organizations have had to a pay for ransomware attacks in bitcoin. There is another legitimate argument that it could potentially be cheaper, simpler, and/or more secure to pay for some items with cryptocurrency someday (but that doesn't seem to be the case yet). I'm certainly not an expert in that area, but I know if I need to pay for something I can usually do it fairly easily and cheaply with a credit card, paypal, bank transfer, zelle, wire, or another option, all of which seem to work fine close to 100% of the time.

I consider cryptocurrencies to have two groupings. The first group is cryptocurrencies that are linked to some asset. There are apparently dozens of so-called stablecoins. For instance Tether, is supposed to be linked to the dollar (but may not be). Facebook's proposed cryptocurrecy Libra was proposed to be linked to the value of other currencies. On a tangent, Wikipedia notes that stablecoin project Basis, which had received over $100 million in venture capital funding, shut down in December 2018, citing concerns about US regulation, which remains a factor for many of the cryptocurrencies. Personally, I think Libra, or other linked cryptocurrencies that are being discussed by various governments and other organization, could have negative implications for the second group of cryptocurrencies, which are unlinked cryptocurrencies, like bitcoin.

Cryptocurrencies that are not linked to a more tangible asset represent a separate class that is much more difficult to value and they are often very volatile. Their prices depend on the traders that are willing to buy and sell at any given time. Given they have no intrinsic value, many have grouped them under the the greater fool theory.

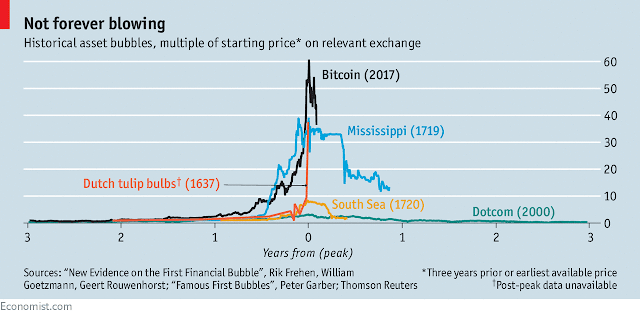

- According to Wikipedia in finance and economics, the greater fool theory states that the price of an object is determined not by its intrinsic value, but rather by irrational beliefs and expectations of market participants. Wikipedia lists bitcoin in that category along with Economic bubble, Tulip mania, Beanie Babies, and others.

- According to Investopedia, the greater fool theory states that it is possible to make money by buying securities, whether or not they are overvalued, by selling them for a profit at a later date. This is because there will always be someone (i.e. a bigger or greater fool) who is willing to pay a higher price. Investopedia even states "In recent times, bitcoin price is often held up as an example of the greater fool theory. The cryptocurrency does not have intrinsic value, consumes massive amounts of energy, and consists simply of lines of code."

- Howard Mark's had similar comments on CNBC - “This is what we called, when I was a kid, ‘the greater fool theory,' ... Bitcoin is “not an investment ... it’s a trade”

- Bill Gates expressed similar thoughts on CNBC - "As an asset class, you’re not producing anything and so you shouldn’t expect it to go up. It’s kind of a pure ‘greater fool theory’ type of investment." The interview starts with Charlie Munger stating "Bitcoin is worthless artificial gold."

- Warren Buffett has also been an outspoken critic of bitcoin in that interview and on other occasions including in 2019 when he said "Bitcoin has no unique value at all ... It is a delusion, basically." Previously, in 2018 Buffett said "Bitcoin is 'probably rat poison squared.'" Charlie Munger, also said trading in cryptocurrencies is "just dementia."

- Evan Feng argues there are weaknesses in the argument for including cryptocurrencies under the greater fool umbrella in Facing the Greater Fool, which arguably reverts to my second argument for buying cryptocurrency, which is that it has a value if you need it for a specific purpose (like your website was hacked and you can't gain control back without the cryptocurrency).

- Economist included a graphic comparing bitcoin to prior bubbles in a January 2018 article.

I think most would agree that a large percentage of cryptocurrency purchases fall into the category of people that think they will be able to sell later for more than their purchase price. The reason I consider that to be a logical reason to buy cryptocurrency is because you can make an argument (a third logical reason) that there are a lot of foolish people out there. I still consider it speculating, not investing, but a large percentage of people speculate and gamble with their money on a regular basis.

Recent surveys have found that cryptocurrency use has been accelerating, for instance according to this article the number of Americans who own a cryptocurrency almost doubled from 7.95% in 2018 to 14.4% in 2019 (citing average and median values in the thousands and hundreds of dollars) and apparently a majority of those believe they are "investing." Cryptocurrency use varies by country, but we know it is more prevalent with younger men (some data suggest more than 90% of bitcoin users are male). Yet, of those not owning cryptocurrencies, a not insignificant percentage think it is a scam, when asked why.

For comparison, gambling generates about $500 a year per American (Australians, Chinese, and Japanese also have relatively high gambling rate) and Americans also average over $200 a year buying lottery tickets, up from just over $100 a year in 1995.

So how much cryptocurrency should you buy? Personally, I spent a tiny amount on a bitcoin related product that I explain here, but there are plenty of more experienced people that have jumped in to various degrees. Aaron Brown presented an interesting perspective last year in Cryptocurrency Winners Are Starting to Emerge. He wrote "All crypto investments are high risk. Market volatility is high, investor protections are low and the entire sector could go to zero tomorrow. But there are plausible scenarios in which crypto grows to become a significant part of the economy, and I personally try to keep 2% of my portfolio in a diversified crypto exposure." That's more than I would suggest for the vast majority, but at least he's honest about the risks. And I still disagree with associating the term "investment" with buying or trading cryptocurrencies. I would keep an eye on what Visa does going forward (like this), since their profitability could be threatened by cryptocurrencies if one or more of the cryptocurrencies dramatically increases the number of users, and becomes a more viable option for inexpensive payments.

Gary Karz, CFA

Author of The Peaceful Investor and Publisher of InvestorHome.com

twitter.com/GKarz (email)

Check out Peaceful Investor at Amazon

Please send suggestions and comments to Investor Home

Last update 2/19/2020. Copyright © 2020 Investor Home. All rights reserved. Disclaimer