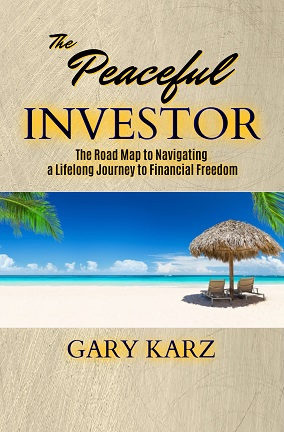

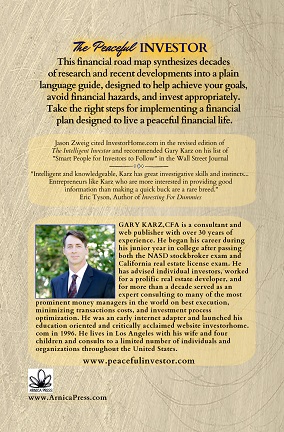

Buy The Peaceful Investor at Amazon

Table of Contents and Launch Site

I am offering the online chapters of the book using "The Honor System." Tip options at the bottom of the page.

True or False?

A surgeon perfects her surgeries, and increases her rate of success as she performs surgeries more often. Likewise, an investor perfects his trading and increases his rate of success as he trades more often.

![]() In the late 1990's there was a flurry of interest in the practice of day trading and numerous day trading firms sprouted up around the United States. There were a number of studies of day traders at specific firms that attempted to answer the question of whether day traders make money. The vast majority of the evidence points to a conclusion that most day traders are not successful.

In the late 1990's there was a flurry of interest in the practice of day trading and numerous day trading firms sprouted up around the United States. There were a number of studies of day traders at specific firms that attempted to answer the question of whether day traders make money. The vast majority of the evidence points to a conclusion that most day traders are not successful.

![]() More recently, trading by high frequency traders and hedge funds has become a significant percentage of activity in many markets. High frequency traders use automated platforms that use computer algorithms to trade rapidly in multiple venues. These types of traders tend to have extensive financial resources and extremely sophisticated technology allowing them to trade in fractions of a second. That competition and the very limited evidence of success among day traders likely explain why many of the companies that catered to day traders seem to have disappeared.

More recently, trading by high frequency traders and hedge funds has become a significant percentage of activity in many markets. High frequency traders use automated platforms that use computer algorithms to trade rapidly in multiple venues. These types of traders tend to have extensive financial resources and extremely sophisticated technology allowing them to trade in fractions of a second. That competition and the very limited evidence of success among day traders likely explain why many of the companies that catered to day traders seem to have disappeared.

![]() We can piece together various sources of information and come to some general conclusions about day traders. An initial problem was defining the term "day trader" and determining exactly how many day traders there were, and still are. Additionally most day traders do not publicly disclose their results. Day traders were described in the preliminary prospectus for All-Tech (which filed to go public in 1998, but didn't actually have an initial public offering) as those who engage in the buying and selling of securities many times during the course of a day based on short-term price volatility.

We can piece together various sources of information and come to some general conclusions about day traders. An initial problem was defining the term "day trader" and determining exactly how many day traders there were, and still are. Additionally most day traders do not publicly disclose their results. Day traders were described in the preliminary prospectus for All-Tech (which filed to go public in 1998, but didn't actually have an initial public offering) as those who engage in the buying and selling of securities many times during the course of a day based on short-term price volatility.

![]() Day traders may be active in multiple asset classes, for instance many of them focus on foreign exchange trading, or commodities, but the term “day trading” was typically associated with trading in stocks. They typically close out open positions by the end of trading day in order to manage risk when the markets are closed. Positions are sometimes closed within minutes of the initial purchase or sale. Some estimates of the number of dedicated "day traders" (that operated at day trading firms) were around 5,000 in the late 1990s.

Day traders may be active in multiple asset classes, for instance many of them focus on foreign exchange trading, or commodities, but the term “day trading” was typically associated with trading in stocks. They typically close out open positions by the end of trading day in order to manage risk when the markets are closed. Positions are sometimes closed within minutes of the initial purchase or sale. Some estimates of the number of dedicated "day traders" (that operated at day trading firms) were around 5,000 in the late 1990s.

![]() A November 2018 article in Money Magazine noted that there were over 300,000 members of the message board Wallstreetbets at reddit.com.1 Others estimated that there may have been another 250,000 people that used some kind of software or dedicated systems to trade full time from home. These people should be differentiated from people that have online accounts and that might occasionally place one or more trades.

A November 2018 article in Money Magazine noted that there were over 300,000 members of the message board Wallstreetbets at reddit.com.1 Others estimated that there may have been another 250,000 people that used some kind of software or dedicated systems to trade full time from home. These people should be differentiated from people that have online accounts and that might occasionally place one or more trades.

![]() In recent years so-called crypto-currencies have become popular and in November 2017 it was reported that Coinbase (a leading Bitcoin trading firm) had over 11 million customers, which exceeded the number of active accounts at Charles Schwab.2 In 2018 it reportedly had over 20 million accounts3 with a September 27, 2018 Fortune article estimating it had reached 25 million users.4 I’ll discuss crypto-currencies further in chapter 27, but for the moment I’ll just note that I do not consider currencies (or crypto-currencies) to be investments.

In recent years so-called crypto-currencies have become popular and in November 2017 it was reported that Coinbase (a leading Bitcoin trading firm) had over 11 million customers, which exceeded the number of active accounts at Charles Schwab.2 In 2018 it reportedly had over 20 million accounts3 with a September 27, 2018 Fortune article estimating it had reached 25 million users.4 I’ll discuss crypto-currencies further in chapter 27, but for the moment I’ll just note that I do not consider currencies (or crypto-currencies) to be investments.

![]() There have been many studies that have concluded that the majority of day traders lose money, but there have also been some studies that documented successful trading by day traders for specific periods of time. At some firms that were studied a very high percentage of day traders lost money

There have been many studies that have concluded that the majority of day traders lose money, but there have also been some studies that documented successful trading by day traders for specific periods of time. At some firms that were studied a very high percentage of day traders lost money

![]() Supporters of day trading can refer to a study that was published in the March/April 1998 edition of the Journal of Financial Economics. In “The Trading Profits of SOES Bandits,” Jeffrey Harris and Paul Schultz studied several weeks of data from two day trading firms and did indeed find evidence that the traders made money at the expense of market makers. “SOES bandits” was the term used to describe individual investors who used Nasdaq’s Small Order Execution System (SOES) for day trading. 1000 shares was the maximum size allowed in SOES at the time of the study, but SOES trading rules changed after 1996, removing some of the day traders' advantages. Harris and Schultz studied data from two different firms and found that in aggregate, traders at both firms made money after commissions for the several weeks studied.

Supporters of day trading can refer to a study that was published in the March/April 1998 edition of the Journal of Financial Economics. In “The Trading Profits of SOES Bandits,” Jeffrey Harris and Paul Schultz studied several weeks of data from two day trading firms and did indeed find evidence that the traders made money at the expense of market makers. “SOES bandits” was the term used to describe individual investors who used Nasdaq’s Small Order Execution System (SOES) for day trading. 1000 shares was the maximum size allowed in SOES at the time of the study, but SOES trading rules changed after 1996, removing some of the day traders' advantages. Harris and Schultz studied data from two different firms and found that in aggregate, traders at both firms made money after commissions for the several weeks studied.

![]() Harris and Schultz discussed the fact that SOES bandits were able to trade profitably with market makers even though they had less information. They suggested that because the bandits kept the profits and bore the losses from their trades they had greater incentives to trade than the employees of market-making firms. The Bandits typically closed positions by placing limit orders through Instinet or SelectNet (a system that allowed bids and offers to be sent electronically to all market makers in a stock). The principal advantage of SelectNet and Instinet to SOES bandits was that they allowed trades within the bid/ask Spread.

Harris and Schultz discussed the fact that SOES bandits were able to trade profitably with market makers even though they had less information. They suggested that because the bandits kept the profits and bore the losses from their trades they had greater incentives to trade than the employees of market-making firms. The Bandits typically closed positions by placing limit orders through Instinet or SelectNet (a system that allowed bids and offers to be sent electronically to all market makers in a stock). The principal advantage of SelectNet and Instinet to SOES bandits was that they allowed trades within the bid/ask Spread.

![]() The authors found that "SOES bandits make money only if they can close out positions within the spread through SelectNet or Instinet. Bandits who both initiate and close positions through SOES usually lose money." Interestingly, they found that trading profits declined when the holding period exceeded one minute and twenty seconds. Bandits lost money in positions held for more than five minutes.

The authors found that "SOES bandits make money only if they can close out positions within the spread through SelectNet or Instinet. Bandits who both initiate and close positions through SOES usually lose money." Interestingly, they found that trading profits declined when the holding period exceeded one minute and twenty seconds. Bandits lost money in positions held for more than five minutes.

![]() It is important to note that theoretically, there is a simple reason why it is possible for market makers and traders to make money buying and selling stocks or other securities. In fact, some professionals (market makers and professional traders) consistently make money, as I discussed in the prior chapter on trading costs and the bid/ask spread, but the SOES Bandits episode was a temporary condition and the evidence on day traders that follows is much less encouraging.

It is important to note that theoretically, there is a simple reason why it is possible for market makers and traders to make money buying and selling stocks or other securities. In fact, some professionals (market makers and professional traders) consistently make money, as I discussed in the prior chapter on trading costs and the bid/ask spread, but the SOES Bandits episode was a temporary condition and the evidence on day traders that follows is much less encouraging.

![]() According to a 1999 CNNfn article titled “Saints or sinners?” "Finance professors are, in fact, divided about the viability of day trading" and Professor Schultz suggested it's a game best left to young people with good memories because of the fast pace of trading.5 One study frequently cited was by Ronald Johnson for the North American Securities Administrators Association. Johnson concluded in “An Analysis of Public Day Trading at a Retail Day Trading Firm - Report of the Day Trading Project Group Findings and Recommendations” that the majority of traders studied lost money and the vast majority of traders ran the risk of losing their entire stakes.6

According to a 1999 CNNfn article titled “Saints or sinners?” "Finance professors are, in fact, divided about the viability of day trading" and Professor Schultz suggested it's a game best left to young people with good memories because of the fast pace of trading.5 One study frequently cited was by Ronald Johnson for the North American Securities Administrators Association. Johnson concluded in “An Analysis of Public Day Trading at a Retail Day Trading Firm - Report of the Day Trading Project Group Findings and Recommendations” that the majority of traders studied lost money and the vast majority of traders ran the risk of losing their entire stakes.6

![]() In an administrative complaint filed against a now-defunct day-trading firm, Massachusetts securities regulators alleged that only one of the branch's 68 accounts made money. According to a 1999 NYTimes article, day trading had exceptionally high "washout rates" and "regulators who have examined the books of day-trading firms say that more than 9 out of 10 traders wind up losing money. Because most of these people disappear quietly when their cash runs out, few who replace them in the trading rooms know about them or their failures."7

In an administrative complaint filed against a now-defunct day-trading firm, Massachusetts securities regulators alleged that only one of the branch's 68 accounts made money. According to a 1999 NYTimes article, day trading had exceptionally high "washout rates" and "regulators who have examined the books of day-trading firms say that more than 9 out of 10 traders wind up losing money. Because most of these people disappear quietly when their cash runs out, few who replace them in the trading rooms know about them or their failures."7

![]() Gretchen Morgenson also discussed the topic with Harvey Houtkin in a NY Times article titled “2 Brokerage Firms Well Known in Frenzied Day-Trading World.” Morgenson spotted the following statement on the All-Tech web site: "Electronic Day Trading attracts people dead-ended or unhappy in their current field of endeavor and people with a desire to make trading their life's work."8

Gretchen Morgenson also discussed the topic with Harvey Houtkin in a NY Times article titled “2 Brokerage Firms Well Known in Frenzied Day-Trading World.” Morgenson spotted the following statement on the All-Tech web site: "Electronic Day Trading attracts people dead-ended or unhappy in their current field of endeavor and people with a desire to make trading their life's work."8

![]() According to a 1999 Washington Post article, Mr. Houtkin estimated that one in three people survive to become full-time day traders while one of All-Tech's regional managers estimated the figure to be more like one in ten.9

According to a 1999 Washington Post article, Mr. Houtkin estimated that one in three people survive to become full-time day traders while one of All-Tech's regional managers estimated the figure to be more like one in ten.9

![]() In "Day trading is a quick road to financial ruin" (May 5, 1999), Humberto Cruz of the Sun Sentinel cited Laura Walsh, a certified financial planner who said she prepared 40 tax returns the prior year for investors doing online trading, and not one made a profit. According to Walsh none of the traders had any idea about the concept of the spread.

In "Day trading is a quick road to financial ruin" (May 5, 1999), Humberto Cruz of the Sun Sentinel cited Laura Walsh, a certified financial planner who said she prepared 40 tax returns the prior year for investors doing online trading, and not one made a profit. According to Walsh none of the traders had any idea about the concept of the spread.

![]() A study by Houston-based Momentum Securities Management Co. apparently came to mixed conclusions. The study had not been released to the public (as far as I know) but was described in several articles including a comprehensive article in the Los Angeles Times by Walter Hamilton titled “Study Finds Beginning Day Traders Lose Money.” The study of 107 traders for several months at six of Momentum's Texas offices found that 6 of 10 newcomers and more than one-third of experienced traders lost money. After a three-to-five-month "learning curve," the study found that profitability of traders improved with 65% making money and 35% losing money. Regulators pointed out that the study covers only a narrow group of traders over a brief period and survivorship bias may be an issue with the study. Additionally it apparently was not compiled by an independent source.

A study by Houston-based Momentum Securities Management Co. apparently came to mixed conclusions. The study had not been released to the public (as far as I know) but was described in several articles including a comprehensive article in the Los Angeles Times by Walter Hamilton titled “Study Finds Beginning Day Traders Lose Money.” The study of 107 traders for several months at six of Momentum's Texas offices found that 6 of 10 newcomers and more than one-third of experienced traders lost money. After a three-to-five-month "learning curve," the study found that profitability of traders improved with 65% making money and 35% losing money. Regulators pointed out that the study covers only a narrow group of traders over a brief period and survivorship bias may be an issue with the study. Additionally it apparently was not compiled by an independent source.

![]() A December 7, 1999 article in the Wall Street Journal titled “Single-Stock Swappers Trade One Stock and One Stock Only” described day traders Gary Ratner (who traded CMGI) and Jeff Easton (who traded Yahoo!) who suggested that they routinely made more than $2,000 a day. According to the article, Mr. Friedfertig said that through Nov. 30, 67% of Broadway's 400 active traders -- those who trade at least 3,000 shares a day -- were profitable for the year, and 78% of those who've traded for more than a year made money.

A December 7, 1999 article in the Wall Street Journal titled “Single-Stock Swappers Trade One Stock and One Stock Only” described day traders Gary Ratner (who traded CMGI) and Jeff Easton (who traded Yahoo!) who suggested that they routinely made more than $2,000 a day. According to the article, Mr. Friedfertig said that through Nov. 30, 67% of Broadway's 400 active traders -- those who trade at least 3,000 shares a day -- were profitable for the year, and 78% of those who've traded for more than a year made money.

![]() In “The Profitability of Day Traders” published in the November/December 2003 edition of the Financial Analysts Journal, Douglas Jordan and David Diltz found that about twice as many day traders lost money as made money. Approximately 20 percent of sample day traders were more than marginally profitable.10

In “The Profitability of Day Traders” published in the November/December 2003 edition of the Financial Analysts Journal, Douglas Jordan and David Diltz found that about twice as many day traders lost money as made money. Approximately 20 percent of sample day traders were more than marginally profitable.10

![]() We also have international evidence thanks to Brad Barber, Yi-Tsung Lee, Yu-Jane Liu, and Terrance Odean. In their paper “Do Individual Day Traders Make Money? Evidence from Taiwan” they found that day trading by individual investors was prevalent in Taiwan – accounting for over 20 percent of total volume from 1995 through 1999 (individual investors accounted for over 97 percent of all day trading activity). They found that heavy day traders earn gross profits, but their profits were not sufficient to cover transaction costs and that in the typical six month period, more than eight out of ten day traders lost money. Yet they still found evidence of persistent ability for a relatively small group of day traders to cover transaction costs.11

We also have international evidence thanks to Brad Barber, Yi-Tsung Lee, Yu-Jane Liu, and Terrance Odean. In their paper “Do Individual Day Traders Make Money? Evidence from Taiwan” they found that day trading by individual investors was prevalent in Taiwan – accounting for over 20 percent of total volume from 1995 through 1999 (individual investors accounted for over 97 percent of all day trading activity). They found that heavy day traders earn gross profits, but their profits were not sufficient to cover transaction costs and that in the typical six month period, more than eight out of ten day traders lost money. Yet they still found evidence of persistent ability for a relatively small group of day traders to cover transaction costs.11

![]() A March 26, 2012 Wall Street Journal about success rates of foreign-exchange traders was titled “The Customer Is Too Often Wrong at FXCM.” According to the article, based on data from the public company, "In each of the last four quarters [2011], more than 70% of FXCM's U.S. accounts were unprofitable for those trading them."12 Another Wall Street Journal article in 2015 stated that “more than 60% of FXCM’s U.S. clients lose money each quarter. And that number generally holds true across the retail forex industry."13 In February of 2017 FXCM agreed to pay a $7 million penalty to settle a suit from the U.S. Commodity Futures Trading Commission after determining a closely related company was acting as the main market maker for its trades and FXCM lied to its customers. FXCM withdrew its CFTC registration and agreed not to re-register in the future, which is effectively a ban from trading in the United States. Several top managers resigned and the majority owner of the firm changed its name at the start of 2017 and that firm filed for bankruptcy in November of 2017.14

A March 26, 2012 Wall Street Journal about success rates of foreign-exchange traders was titled “The Customer Is Too Often Wrong at FXCM.” According to the article, based on data from the public company, "In each of the last four quarters [2011], more than 70% of FXCM's U.S. accounts were unprofitable for those trading them."12 Another Wall Street Journal article in 2015 stated that “more than 60% of FXCM’s U.S. clients lose money each quarter. And that number generally holds true across the retail forex industry."13 In February of 2017 FXCM agreed to pay a $7 million penalty to settle a suit from the U.S. Commodity Futures Trading Commission after determining a closely related company was acting as the main market maker for its trades and FXCM lied to its customers. FXCM withdrew its CFTC registration and agreed not to re-register in the future, which is effectively a ban from trading in the United States. Several top managers resigned and the majority owner of the firm changed its name at the start of 2017 and that firm filed for bankruptcy in November of 2017.14

![]() Another paper published in 2016 about currency speculation cited evidence from a century of data and suggested some evidence of successful speculation, but also suggested “making money from currency speculation is challenging and often requires taking substantial risks.”15

Another paper published in 2016 about currency speculation cited evidence from a century of data and suggested some evidence of successful speculation, but also suggested “making money from currency speculation is challenging and often requires taking substantial risks.”15

![]() Another interesting question that follows along the same lines is whether it is possible to train individuals to become successful traders. The question was asked several times by Jack Schwager in his interviews with successful traders in his best-selling book Market Wizards. While hardly scientific, the following observations from the book are certainly interesting. Richard Dennis described an experiment where 40 of 1000 applicants were chosen and 23 were eventually trained. According to Dennis "It’s frightening how well it worked." Three dropped out, but the successful 20 (which the nicknamed “turtles") averaged 100% profits per year. However, others interviewed in the book were apparently less successful in training others and less optimistic about probabilities of success. Bruce Kovner discussed trying to train perhaps thirty people, and only four or five turned out to be good traders. The other 25 left the business and according to Dennis "it had nothing to do with intelligence." Marty Schwartz discussed hiring four people but nobody lasted. According to Brian Gelber five or less out of every 100 people who go to the floor to become traders make at least a million dollars within five years and at least half will end up losing everything they came in with. Tom Baldwin responded that less than 20 percent of those who come to trade on the floor are still around after five years and one percent are successful to the point of making and keeping at least a couple million dollars.

Another interesting question that follows along the same lines is whether it is possible to train individuals to become successful traders. The question was asked several times by Jack Schwager in his interviews with successful traders in his best-selling book Market Wizards. While hardly scientific, the following observations from the book are certainly interesting. Richard Dennis described an experiment where 40 of 1000 applicants were chosen and 23 were eventually trained. According to Dennis "It’s frightening how well it worked." Three dropped out, but the successful 20 (which the nicknamed “turtles") averaged 100% profits per year. However, others interviewed in the book were apparently less successful in training others and less optimistic about probabilities of success. Bruce Kovner discussed trying to train perhaps thirty people, and only four or five turned out to be good traders. The other 25 left the business and according to Dennis "it had nothing to do with intelligence." Marty Schwartz discussed hiring four people but nobody lasted. According to Brian Gelber five or less out of every 100 people who go to the floor to become traders make at least a million dollars within five years and at least half will end up losing everything they came in with. Tom Baldwin responded that less than 20 percent of those who come to trade on the floor are still around after five years and one percent are successful to the point of making and keeping at least a couple million dollars.

![]() The percentage of profitable day traders is certainly an important number, especially for those considering day trading as a potential career opportunity, but another relevant question is whether day traders in aggregate make or lose money. After all, in many industries a small percentage of the players make the majority of the profits. For example, let's hypothetically say that only 10% of day traders make money (which may not be a bad estimation). Just that information certainly isn't encouraging. But what if we now assume that the average loss for each of the 90% that lose money is $100,000, while the 10% of profitable traders go on to earn an average of $2 million. We could then say that the expected return for all day traders in aggregate positive. If most lose money, but the successful ones earn millions, we now have a different scenario. Regardless, it should be obvious that choosing day trading as a potential career is best left for people in the financial position to sustain the probable losses.

The percentage of profitable day traders is certainly an important number, especially for those considering day trading as a potential career opportunity, but another relevant question is whether day traders in aggregate make or lose money. After all, in many industries a small percentage of the players make the majority of the profits. For example, let's hypothetically say that only 10% of day traders make money (which may not be a bad estimation). Just that information certainly isn't encouraging. But what if we now assume that the average loss for each of the 90% that lose money is $100,000, while the 10% of profitable traders go on to earn an average of $2 million. We could then say that the expected return for all day traders in aggregate positive. If most lose money, but the successful ones earn millions, we now have a different scenario. Regardless, it should be obvious that choosing day trading as a potential career is best left for people in the financial position to sustain the probable losses.

![]() Another important issue for potential day traders to consider is their opportunity costs. For instance, let’s say a prospective day trader has $125,000 in capital, currently makes $100,000 a year, and quits a job to start day trading. Let's say the trader expects to use $25,000 for living expenses for the next six months and the remaining $100,000 for risk capital to trade. At the end of six months, if the trader has lost half the capital he is left with $50,000. The question is then how much has the trader lost from making the decision to day trade? The answer is not $50,000. The trader has trading losses of $50,000 but that’s not all. The trader also gave up $50,000 in income from the job left behind, which brings us to a $100,000 pre-tax difference. Plus there is an opportunity cost of not investing the $125,000. So in reality a decision to day trade can cost you a lot more than the capital you lose trading. The time and opportunity costs should also be considered in evaluating the profitability of day trading for any individual. Regardless, investors should not confuse the activity of trading with the activity of investing.

Another important issue for potential day traders to consider is their opportunity costs. For instance, let’s say a prospective day trader has $125,000 in capital, currently makes $100,000 a year, and quits a job to start day trading. Let's say the trader expects to use $25,000 for living expenses for the next six months and the remaining $100,000 for risk capital to trade. At the end of six months, if the trader has lost half the capital he is left with $50,000. The question is then how much has the trader lost from making the decision to day trade? The answer is not $50,000. The trader has trading losses of $50,000 but that’s not all. The trader also gave up $50,000 in income from the job left behind, which brings us to a $100,000 pre-tax difference. Plus there is an opportunity cost of not investing the $125,000. So in reality a decision to day trade can cost you a lot more than the capital you lose trading. The time and opportunity costs should also be considered in evaluating the profitability of day trading for any individual. Regardless, investors should not confuse the activity of trading with the activity of investing.

![]() The question at the start of the chapter was asked by Meir Statman in a 2017 article in the Wall Street Journal titled “How Financially Literate Are You Really?” The vast majority of evidence agrees with Statman’s conclusion that the statement is false.16 Investors that trade more often tend to reduce their rate of success, not improve as with many other professions.

The question at the start of the chapter was asked by Meir Statman in a 2017 article in the Wall Street Journal titled “How Financially Literate Are You Really?” The vast majority of evidence agrees with Statman’s conclusion that the statement is false.16 Investors that trade more often tend to reduce their rate of success, not improve as with many other professions.

![]() I am offering the online chapters of The Peaceful Investor using "The Honor System." If you don't plan to purchase a version of the book, yet you think it was worth your time and you learned a significant amount, you can tip or compensate me in a number of ways. This will probably not be tax deductible for you, but I will report and pay taxes on any payments.

I am offering the online chapters of The Peaceful Investor using "The Honor System." If you don't plan to purchase a version of the book, yet you think it was worth your time and you learned a significant amount, you can tip or compensate me in a number of ways. This will probably not be tax deductible for you, but I will report and pay taxes on any payments.