Buy The Peaceful Investor at Amazon

Table of Contents and Launch Site

I am offering the online chapters of the book using "The Honor System." Tip options at the bottom of the page.

Imagine you were living during the time of the caveman. Your primary needs were food and shelter, and your primary possessions were probably clothes and tools. You hopefully controlled the territory where you lived, foraged, and hunted. With the introduction of agriculture, land control became more important and valuable because you could grow food and trade for other foods and needs.

With the introduction of currency, rather than keeping food and other goods, you could store money. Then, when banks and similar institutions were developed you didn’t need to hide your money or valuables, because you could deposit it at the bank. You may or may not get any return on your deposits and that return may not be more than inflation, so your money may become less valuable over time.

You can still hide your money and valuables under your bed, in your walls, in a safe, or somewhere else, but investing directly in assets and businesses usually makes more sense because the value (usually) grows over time instead of becoming less valuable over time due to inflation. Public investment markets and vehicles allow investors to become lenders or partial owners with securities that can also be sold when needed.

During times of war, many people that needed to flee their homes, land, and businesses would try to physically transport valuables like gold or diamonds. I'll discuss precious metals in more depth later, but it is worth noting that ETFs provide an option for buying gold (and many other commodities), which alleviates the need to physically buy and store them.

Bonds and debt instruments are one of the largest investment asset classes and are generally a safe, but relatively low return option for investors. Business ownership originally was only available privately, but with the evolution of stock markets and exchanges we now have public avenues for investing in businesses and other types of investments.

Real Estate has been one of the primary investment asset classes for thousands of years, but some clarification is appropriate to categorize types of real estate. Unused land does not provide a current return when it is not being used or rented and I consider it to be more of a commodity than an investment. It tends to appreciate over time, but that appreciation tends to be in line with inflation. You may also have costs for maintaining land and you may have to pay property taxes.

Farmland on the other hand has historically been an investment category. With farmland you can grow food and raise livestock for your personal use, or to sell. Some consider their home to be an investment, but many others consider it a separate asset and not a true investment since you have to live somewhere.

When John Paulson’s hedge funds entered into trades betting against the housing market in advance of the global financial crisis, his firm and his clients went on to make billions of dollars, and those bets were the basis for Greg Zuckerman’s book The Greatest Trade Ever (as well as being a main storyline in Michael Lewis’ book and movie The Big Short). But another story from thousands of years ago was arguably the greatest trade and is also helpful for elaborating on the concept of the investing universe.

In the book of Genesis, Joseph is sold by his jealous older brothers and transported to Egypt, where he is falsely accused and ends up in jail. The story turns into an example of bad things happening that eventually turn out to be beneficial in the end. Joseph interprets Pharoah’s dreams and is appointed Viceroy, second in command to Pharoah. He is put in charge of the entire Egyptian economy to prepare for the seven years of abundance that are expected to be followed by seven years of famine. Joseph established a system to store the grain during the good years and when the famine starts, Egypt is well prepared. When the citizens run out of bread "All the earth came to Joseph to buy provisions" including his older brothers, who don't even recognize him. He eventually tells his brothers not to be fearful for having sold him, for the events were providential so he would be able to provide for them and others. As the famine continues, all of Egypt and Canaan bring all their money to Joseph to buy more grain. When the money is exhausted they bring their livestock, and then eventually Joseph acquires all of the land in Egypt for Pharoah (except for the priest's land).

If we can imagine owning all the wealth of an entire country (like Joseph acquiring all the wealth of Egypt) including the money, goods, businesses, and the real estate it can serve as an analogy for owning an investable universe. Diversification is one of the core concepts of modern portfolio theory and taken to its logical extreme, an investor could strive to invest in the equivalent of the entire world's wealth. The theory is that the market portfolio is optimal and results in the best risk-return trade-off. Therefore an appropriate default portfolio for passive investors could be the global portfolio. Of course risk tolerance, liquidity needs, time horizon, and other factors would impact an investor's decision on how and when to invest, but a global long term investor can arguably start with the world market portfolio and then adjust based on their own goals and circumstances.

We can summarize the various investments options into these categories.

- Cash or Currency, and Cash Equivalents

- Commodities (precious metals, foods, materials, art/collectibles, etc.)

- Bonds and Debt Securities (government securities, private loans, financial institution bonds, non-financial corporate bonds, securitized loans, non-securitized loans)

- Real Estate (land, homes, farmland, and income producing property like homes, apartment buildings, retail, storage, commercial properties, etc.)

- Businesses (public equities/stocks and private businesses)

Multiple organizations and professionals have been making the effort to estimate the value of the investable universe and the global capital stock. Academics and professionals have been analyzing and calculating the values of all the available investment asset classes and we have relatively good estimates of the values and percentages of the aggregate. Publicly traded assets allow us to calculate aggregate values (although they fluctuate) and many of the private investments and asset classes can also be estimated. There are plenty of caveats involved (for instance, real estate is often included in business values of entities that own it), but it is a worthwhile exercise and allows for benchmarking of performance.

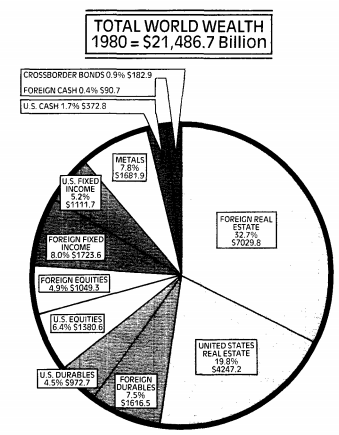

In 1983 Roger Ibbotson and Laurence Siegel published “The World Market Wealth Portfolio” in the Journal of Portfolio Management.1 They suggested that modern theories "suggest that the ideal portfolio should represent each asset class in proportion to its prevalence in the world market - the ultimate index fund." Though each investor is unique, they suggested the construction was less for actual purchase than for "insights it might reveal about the behavior of our capital markets." They estimated a World Wealth Portfolio as of the end of 1980 had a value of over $21 billion, while the "investable" portfolio was over $11 billion. Over the period they studied, the World Market Wealth Portfolio, excluding metals, had a compound annual return of 8.36%.

Ronald Doeswijk, Trevin Lam, and Laurens Swinkels used to term “The Global Multi-Asset Market Portfolio” for their paper about investable assets published in 2014.2 Their estimate for the global market portfolio at the end of 2012 was $90.6 trillion (36% equities, 29% government bonds, 18% "investment-grade credits" - primarily corporate bonds and mortgage-backed securities, and 5% real estate, plus a few other categories).3

Hewitt EnnisKnupp published a report in 2014 that estimated the total size of the global invested capital market as of June 2013.4 They estimated world public (stocks) and private (non-public businesses) equity at around 38% of the global portfolio with bonds at 47%, real estate at 11%, and cash at 4%.

Gregory Gadzinski, Markus Schuller, and Andrea Vacchino compiled an even more comprehensive effort in a 2016 paper, and a later version was published in 2018 in the Journal of Portfolio Management.5 Using publicly available databases and prior research they estimated the value for 11 asset classes from 2005 to 2016 as a proxy for the global market portfolio. They calculated the world’s global capital stock at $532 trillion in 2016. They estimated world businesses/equity at about 33% (13% public and 20% private), with debt at 37% (18% public), real estate at 22% (2% land), and cash and cash equivalents at 8%.

Cullen Roche suggested a relatively simple "Global Financial Asset Portfolio" made up of four ETFs.6 At the start of 2018 it consisted of 22% US Bonds (BND), 32% Foreign Bonds (BNDX), 18% US Stocks (VTI), and 28% Foreign Stocks (VXUS).

Data for more than 60 years suggests that the return from a global market portfolio was over 8% (keep in mind inflation averaged over 3%).7 In the next few chapters I’ll go into detail on the main investing asset classes and which asset classes have provided the strongest performance.

Notes - The Footnotes in the Book are sequential and for this chapter start at #250 and end at #256.

1. Roger Ibbotson and Laurence Siegel, “The World Market Wealth Portfolio,” Journal of Portfolio Management, Winter 1983

https://jpm.iijournals.com/content/9/2/5

https://larrysiegeldotorg.files.wordpress.com/2014/08/ibbotson-siegel-1983.pdf

2. Ronald Doeswijk, Trevin Lam, and Laurens Swinkels, “The Global Multi-Asset Market Portfolio 1959-2012” Financial Analysts Journal March/April 2014

https://www.cfapubs.org/doi/abs/10.2469/faj.v70.n2.1

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2352932

3. T. Erik Conley allocates 5.7% to global real estate based on the IMF Global Financial Stability Report

https://www.zeninvestor.org/how-to-design-a-tailor-made-diy-portfolio-that-fits-you-like-a-glove/

4. http://www.aon.com/attachments/human-capital-consulting/2014_HEK_whitepaper_Global_Invested_Capital_Market.pdf

5. Gregory Gadzinski, Markus Schuller, and Andrea Vacchino, The Global Capital Stock: Finding a Proxy for the Unobservable Global Market Portfolio, Journal of Portfolio Management, Summer 2018

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2808438 October 2016

6. https://www.pragcap.com/2018-global-financial-asset-portfolio/

7. Ronald Doeswijk, Trevin Lam, and Laurens Swinkels, Historical Returns of the Market Portfolio, November 11, 2017

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2978509

I am offering the online chapters of The Peaceful Investor using "The Honor System." If you don't plan to purchase a version of the book, yet you think it was worth your time and you learned a significant amount, you can tip or compensate me in a number of ways. This will probably not be tax deductible for you, but I will report and pay taxes on any payments.

If you don't think the material was worthwhile, I would appreciate emails letting me know what you read and whether you disagree with anything in particular. I would also appreciate anyone letting me know if they find any typos, mistakes, or suggestions how to improve the material.

- Paypal me at gkarz@aol.com

- Pay me by credit card. Email me (proficient at aol.com) with an amount you'd like to donate and I will email you an invoice via Square.com. I will not have access to your information - you would enter it on the secure square website.

- Before you make purchases at Amazon, link through one of my links. As an Amazon Associate I earn from qualifying purchases.

- Contact me to inquire about a review or second opinion of your finances.

Gary Karz, CFA

Author of The Peaceful Investor and Publisher of InvestorHome.com

twitter.com/GKarz (email)