Buy The Peaceful Investor at Amazon

Table of Contents and Launch Site

I am offering the online chapters of the book using "The Honor System." Tip options at the bottom of the page.

How much monthly or annual (after tax) income do you expect to need during retirement? How much money would you need to have the option to stop working and be at peace knowing that you have enough to provide for yourself and those you care about for the rest of your life?

Investors face a virtually unlimited number of options. But risks are interwoven into the process and investors face an obstacle course of challenges. To navigate a multi-decade journey to financial independence, most investors will need to save, invest intelligently, avoid shooting themselves in the foot, and not allow others to fleece them along the way. I wrote this book to help as many investors as possible learn about themselves, and the finance world, so they can prepare for and execute a financial plan intended to set them on a path to achieve a peaceful financial future.

Decades ago it was common to work for a company or government agency and then retire with a fixed monthly income from the employer's pension plan. Combined with Social Security or other government programs, many could retire happily ever after. But in recent decades there has been a massive shift away from retirement plans that provide a steady cash flow. Some employees have an option to save through their employer’s plan, but that places the responsibility on the worker, rather than the employer to provide for their retirement. Most breadwinners now must save for themselves, invest, and plan for their own retirement, with or without help from their employer.

In 1990, three-quarters of private-sector pension participants had defined benefit plans, which typically would provide a monthly payment known in advance. By 2012, private-sector defined benefit plans had almost 40 million participants in the U.S. while defined contribution plans (where the employee allocates part of their earnings and benefits depend on investment outcomes) had about 91 million. This trend has also been spreading from the private sector to the public sector and the trend will likely continue, given underfunding of many state and local pension plans.1 This shift is occurring globally.

More than half of the people in the U.S. workforce in private industry have no pension coverage and just under a third report that they and/or their spouse have no savings set aside specifically for retirement. Roughly half of households age 55 and older have no retirement savings. The percentage of workers at risk of not having adequate funds for retirement has been increasing in recent decades (estimated at 50% in 2010).2 A 2018 retirement savings survey estimated that 42% of Americans could retire broke (although that percentage has been dropping in recent years). Women tend to save less than men because they tend to work and earn less.3

Political leaders and academics in finance and economics have been debated how to solve the retirement crisis that many nations face for decades. We all want to have enough money (or assets) to provide for our basic "needs" including having a place to live, food, and healthcare. Plus, hopefully we'll have money left-over for our "wants" (things we like to do and have). Some people can count on the government, family, or former employers that have committed to providing for some, or all of those financial needs. But many investors are literally and figuratively on their own for the bulk of their retirement planning.

Fortunately, people are also living longer, which requires more planning. Charles Ellis has noted that the common retirement benchmark age of 65 was set in Germany in the 1890s when life expectancy was below 50 (now life expectancy is the 80s in many countries).4

Governments and regulators have taken steps to help through the creation of retirement plans like 401(k)s and IRAs that typically offer tax and other advantages. Most large employers do still provide some retirement benefits, like tax deferred retirement contributions, often by matching their plan participants own voluntary contributions, which are deducted from paychecks on a pre-tax basis. But the employee is usually in charge of making contributions, and choosing how to invest the money. The employer determines the plan options that will be made available to employees, likely through another firm that administers the plan (at a cost).

However an estimated half of U.S. employees have no access to a retirement plan through their work. They will need to save even more on their own. Those that plan ahead, work, save, invest intelligently, and avoid major mistakes have a good chance to eventually retire comfortably. But those that don't plan, don't educate themselves, or get taken advantage of, are more likely to face major financial challenges down the road.

While it is much less common now than it was in the past to work an entire career at one organization, saving is a primary problem for most that are not prepared financially for retirement. Only 52 percent of adults in a 2017 Bankrate.com survey claimed to have more money in emergency savings than in credit card debt.5

According to another Bankrate.com survey, less than half of adults have any money in the stock market. The top reason cited for staying out of the stock market was not having enough money, followed by not knowing enough about stocks to invest. Other deterrents included the belief that stocks are too risky, lack of trust in stockbrokers or advisors, and fear of high fees.6 Other reasons cited in another study include having used retirement savings for an emergency and prioritizing paying down debt.7 Another recent survey found just under a third of respondents have investments in stocks, bonds, mutual funds, or other securities outside of retirement accounts, continuing a very slight downward trend in recent years.8

Yet, not only is there hope, there is a proven path to follow. One of the intentions of this book is to help you pivot, from this potential threat of not enough government or employer sponsored retirement funding, to a proactive perspective where you have the ability to control your finances and reap the benefits as a result. Governments and the finance industry are far from perfect. Politicians and financial professionals make mistakes and they have conflicts of interests. But the playing field that has evolved provides tremendous opportunities and advantages for investors.

Financial Literacy

Given the need for individuals to plan their own retirement, education is crucial. The Organisation for Economic Co-operation and Development (OECD) is an international group that researches global education. You may want to take a deep breath before reading these two definitions, but it’s worth the effort to have some perspective regarding how education impacts personal finance.

The OECD defines financial education asYou don't necessarily have to score high on a financial literacy test to be a successful investor. But being better educated should help. Socio-economic status and gender have modest correlation with financial literacy. But having a bank account and receiving monetary gifts favorably impacts financial literacy, while mathematics and reading scores have high correlations according data from “The Programme for International Student Assessment” (PISA). The organization assessed financial literacy in 13 OECD countries and economies by testing 29,000 15 year old students. U.S. students ranked right in the middle of the pack, above the Russian Federation, but below Latvia and Poland. Shanghai-China was the outlier with substantially better results than all the other countries and the Flemish community in Belgium came in second. The U.S. was the leader in only one category (for financial education being taught as a separate subject).11

“the process by which financial consumers/investors improve their understanding of financial products, concepts and risks and, through information, instruction and/or objective advice, develop the skills and confidence to become more aware of financial risks and opportunities, to make informed choices, to know where to go for help, and to take other effective actions to improve their financial well-being.”9The following definition of "financial literacy" was endorsed by the G20 (an international forum of large governments and central bank governors) leaders in 2012.

“Financial literacy is a combination of awareness, knowledge, skill, attitude and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being”10

We can learn more about solving the retirement problem by looking at how current millionaires achieved their wealth. In 1996, Thomas Stanley and William Danko published the often cited book The Millionaire Next Door. The authors set out to study the traits and characteristics of Americas’ millionaires and many of their conclusions surprised the authors and contradicted many common stereotypes of wealthy people. The primary trait that most of the millionaires shared was the tendency to be "frugal" with their money rather than spending recklessly and flaunting their wealth. They tended to be efficient rather than reckless with their money, time, and energy. They found that while millionaires did tend to own stocks, they tended not to trade often (in one of their studies they found that 42 percent had made no trades whatsoever in the prior year).

Recent data from other sources reaches similar conclusions.

- Steven Kaplan and Joshua Rauh published a study in 2013 that analyzed the percentage of Forbes 400 members that were self-made versus those that inherited their wealth. The percentage of millionaires that were self-made rose from 40% in 1982 to 69% in 2011.12

- A 2013 BMO Capital Markets study concluded "two-thirds (67 percent) of high-net worth Americans are self-made millionaires, earning their wealth mostly on their own. Only three percent attributed their wealth to receiving an inheritance."13

- A 2016 U.S. Trust report summarized their survey of 684 high net worth and ultra-high net worth adults (with over $3 million in self-reported assets, not including the value of their primary residence).14 They found only 10% gained their wealth through inheritance, while 86% made their biggest gains with buy-and-hold strategies. The vast majority of respondents (77%) grew up middle class or poor, and their success was attributed to hard work, ambition, and family upbringing.

- In October of 2018 Forbes summarized that less than half the people on The Forbes 400 in 1984 "were self-made; in 2018, 67% of the 400 created their own fortunes."15

In other words, any suggestion that you have to have an advantaged upbringing to become financially secure (at least in the United States of America) is totally contradicted by this data. There were an estimated 2.5 million people in the United States when it was founded in 1776. By 2019 there were estimated to be more than 5 million millionaires in the United States (according to Wikipedia)16 and the percentage is approaching 2% of the population.

A 2016 Peterson Institute study summarized the global wealth environment as follows.17

"Among emerging markets, East Asia is home to the large-scale entrepreneur. In contrast, the Middle East and North Africa is the only region where the share of inherited wealth is growing and the share of company founders is falling. Other emerging-market regions fall somewhere in between ... In Europe, inherited wealth still makes up the majority of billionaire wealth, while the growth in US billionaires has been driven by self-made wealth."

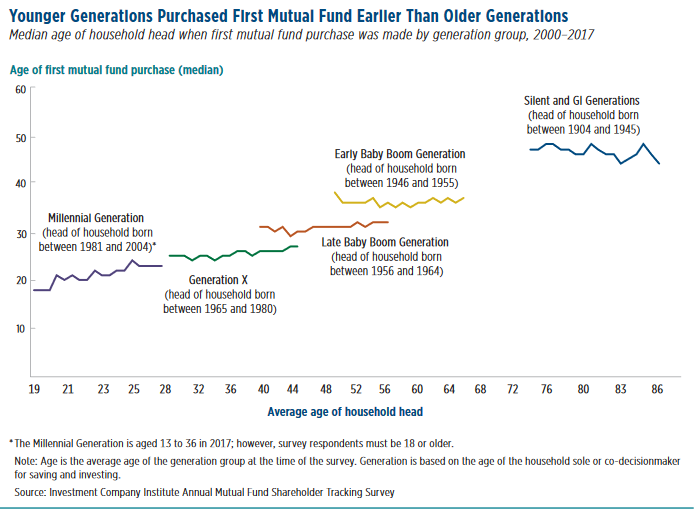

A 2017 Investment Company Institute report found that saving for retirement was a financial goal for 92 percent of mutual fund–owning households, and 75 percent indicated that retirement saving was the household’s primary financial goal. Employer sponsored retirement plans are encouraging more people to invest and those that participate are more likely to invest outside of the plan. Mutual fund owners also commonly own other investments including individual stocks, real estate, and bonds. Once someone starts investing, they are more likely to continue investing, and people are opening investment accounts at younger and younger ages.18

Each of my four children became mutual fund owners in their first year because I opened Uniform Gift to Minor Act accounts (there are other good investing and savings options) for them using the gift money they received. I think it’s important to introduce saving and investing as early as possible. Since mutual funds were introduced, the average age of first time mutual fund purchases has been steadily dropping.19 As my kids get older I am gradually educating them and they are learning how their money grows over time when it is invested well. The sooner people start investing, the better (even if someone else actually does it for them) and the more likely they are to become lifelong investors.

The Big Picture

Recent estimates place the number of people in the world at about 7.5 billion and the United States population at more than 320 million. The average life expectancy worldwide is about 71 years, while Americans are currently expected to live 78 years on average. Women live roughly five years longer than men on average. Japanese women have a life expectancy of 86 years, while Swiss men have an average life expectancy of 81 years, but those living in some less developed countries have much shorter life expectancies (some are in the 50s).

Roughly 130 million babies are born and about 55 million people pass away every year worldwide according to recent estimates. That works out to about 360,000 births per day and over 150,000 deaths per day. About one out of every 135 people passes away each year. I point that out, because it puts you in a different frame of mind when you wake up each day and recognize that over 100,000 people that were alive yesterday did not wake up today and are not alive to share the world with us.20

We can group the amount of time we spend on different activities into a relatively small number of buckets. On average, we sleep about a third of the time, we have to eat and drink (over an hour a day), we spend over an hour a day commuting, and most of us spend a not insignificant amount of time cleaning. Then we have school, work, or homemaking, which leaves free time for exercise (hopefully), sports, watching television, browsing the internet, using electronics, going out and spending time on other activities.

There are 24 hours a day, which equals 168 hours per week. Now let’s look at the amount of time spent working. If you work for 40 hours a week, that's about 24% of your time in a given week. If you work for 40 years at 40 hours a week, that translates into about 80,000 hours of work, or more than 9 years.

The primary goal of retirement investing is to get to the point of having the option not to work anymore, rather than having to continue working because you need to. If you work because you want to, you are one of the lucky ones, and everyone should try to have a positive attitude about work. But most people have to work to pay the bills and to save so they can retire someday. One goal is to reduce the amount of time spent working and commuting so you have more free time for playing, travelling, volunteering, or other activities.

The more successful you are saving and investing, the more you can reduce the amount of time you need to work before you can have the option of retiring. Making mistakes early can result in having to work much longer, sacrificing the way you live in retirement, or reducing your ability to live comfortably. When you think about investment losses and opportunity costs (the money you did not earn if you had money in cash instead of investing in higher return options) in terms of how much longer you will have to work to reach a target value, it becomes real (and potentially depressing), very quickly.

Returning to the question at the start of the chapter, we can use recent data and averages to get some general numbers that are more meaningful on a personal level. Many people prefer specific goals and more structure, but others prefer to take life as it comes and adjust accordingly. Not everyone should, or needs to have a specific (or rough) number in mind for a target retirement portfolio value, or a target monthly income number. Whether you want to write down a target or just have a number in mind is up to you. But my experience is that most people will benefit from having a written target to go along with a formal written plan for getting where they want to be some time in the future.

Saving $10,000 per year for 30 years results in $300,000 saved. But over long periods, if that money is successfully invested it can grow dramatically and multiply over time, thanks to the magic of compounding.

- At 1% interest that $300,000 grows to over $351,000

- At 2% that $300,000 grows to over $413,000

- At 3% that $300,000 grows to over $489,000

- At 4% that $300,000 grows to over $582,000

- At 5% that $300,000 more than doubles to over $695,000

- At 6% that $300,000 more than doubles to over $834,000

- At 7% that $300,000 more than triples to over $1,005,000

Saving a little more, let’s say $1,000 a month or 12,000 per year for 30 years results in $360,000 saved. If you invest $12,000 today and another $12,000 once a year for another 29 years the numbers improve.

- At 1% that $360,000 grows to over $421,000

- At 2% that $360,000 grows to over $496,000

- At 3% that $360,000 grows to over $587,000

- At 4% that $360,000 grows to over $698,000

- At 5% that $360,000 more than doubles to over $834,000

- At 6% that $360,000 more than doubles to over $1,001,000

- At 7% that $360,000 more than triples to over $1,206,000

A very general assumption is that you can plan to withdraw 4% of your portfolio per year in retirement.21 That figure can be debated extensively based on age and by adjusting simple and complex assumptions and calculations, but for simplicity it’s a good number to start with. The U.S. government actually requires you to take minimum distributions from retirement accounts once you reach 70 and the percentage you must withdraw escalates as you get older based on the assumption that your life expectancy gradually decreases with age.22 The initial distribution rate is less than 4%, but it gradually accelerates with age to over 5% at 79 years old and more than 10% at age 93. The withdrawal rates are actually based on distribution periods that are chosen at rates that are longer than actuarial tables (as pointed out by Morningstar)23 so hopefully most people will not exhaust their funds.

Charles Schwab asked 1,000 401(k) plan participants in 2019 how much they needed to retire. On average they said they needed $1.7 million.24 Assuming a 4% withdrawal rate from your portfolio implies the following annual income.

- A $1,000,000 portfolio implies $40,000 a year ($3,333 per month)

- $2,000,000 implies $80,000 a year

- $3,000,000 implies $120,000 a year

- $4,000,000 implies $160,000 a year

- $5,000,000 implies $200,000 a year

The standard assumption is you will need 70% to 85% of preretirement household income in retirement. Once someone has saved enough for retirement, they no longer need to earn extra money (beyond their spending) to set aside for the future. Those that stop working also don’t have payroll and some other taxes. So the income needed to live in retirement is usually lower than pre-retirement income. They also may not need to spend money on commuting to work and other work related costs.

Social Security

The U.S. government created the Social Security program to provide some forced retirement saving and those that participate and contribute in their younger years (and meet the minimum requirements) receive social security benefits in their later years.25 But social security is not designed to be a primary source of retirement funding. It is best viewed as a supplement and hopefully provides one of several sources of income. There are legitimate concerns that social security in its current form cannot survive in the long run, but for now it is reasonably safe to assume that it will be a source for some cash flow for future retirees in the United States. Those in other countries may have similar programs that they can count on for income.

If you have, or are expecting Social Security benefits, they can be viewed as a kind of defined benefit plan. The U.S. government projected over 63 million Americans would receive approximately $1 trillion Social Security benefits in 2018. That translates into an average of about $16,000 per year. Social Security benefits are estimated to represent about one third of the income of the elderly. For those aged 65 and older, Social Security remains the largest component of household income in retirement (52 percent of household income on average).26 For those that have a pension, defined benefit, or other income source, the relevant question becomes how much more do you need from social security and your portfolio to live comfortably.

The mean household income in the United States, according to the U.S. Census Bureau 2014 Annual Social and Economic Supplement, was $72,641.27 Data from the Federal Reserve Bank of St. Louis suggests higher numbers with the Mean Family Income in the United States in 2017 at just about $100,000,28 but let’s use an example of a family that earns $75,000 per year and needs to retire with $60,000 a year to maintain the same standard of living. The retiree expects about $16,000 annually from Social Security, leaving a gap of $44,000 a year. Therefore, assuming a 4% withdrawal rate would result in a target portfolio of $1,100,000. If that person saved and invested $1,000 a month for 30 years and gets a 6% return, that would translate into just over $1,000,000. So either the person would need to save for more than 30 years, or get more than 6% return on the portfolio.

This is obviously just an example using some basic averages and there are a lot of assumptions that may or may not be relevant to others, but it can be useful to have a simple example to work from. Keep in mind that if the savings are in a pre-tax account like a 401(k), the money withdrawn will be taxed and you have to adjust the numbers to reflect that. We also want to factor in some extra money for emergencies, and recognize that projecting into the future we also have to adjust for inflation.

In a recent survey 85% of U.S. investors strongly agreed that it's important to have a guaranteed income stream in retirement to supplement Social Security. Yet, only 27% strongly agree they are willing to give up access to some of their money in order provide that guarantee. About 50% strongly agree they want the freedom to spend their retirement savings however they choose, even if that means prematurely running out of money.29

Yet, we have a relatively well-designed regulatory system governing the financial markets. The U.S. system based on capitalism allows competition to drive evolution of better products and services, which has resulted in a system with remarkable access and much lower costs than investors have experienced in the past. So let's quickly review some of the developments of the last century that have contributed to the evolution in investing based on the United States experience (many countries have similar structures and options).

Some of the main reasons employers are shifting from defined benefit to defined contribution plans are cost and risk reduction, but the U.S. government arguably played a role through tax laws and regulations. For instance, Laurence Siegel has pointed out the government placed caps on defined contribution plan tax deferrals.30

1924 - The First Mutual Fund

Massachusetts Investors Trust was created on March 21, 1924, which initiated the mutual fund era. Mutual funds provide investors with the opportunity to diversify and choose managers to select securities rather than choose individual securities on their own (or by a broker or adviser). There are costs (primarily the mutual funds management fee) and potential tax implications, but the diversification via mutual funds is a major benefit for investors.1960 - Real Estate Investment Trusts (REIT)

REITs were created by congress in 1960 as a vehicle allowing investors to buy a portfolio of income producing real estate properties, similar to the structure mutual funds provide for investing in stocks. REITs can own many types of real estate including office or apartment buildings, rental homes, retail properties, warehouses, hospitals, shopping centers, hotels and even timberlands. Some REITs are also financial or mortgage based. The law was intended for income producing assets and REITs generally must pay out at least 90 percent of their taxable income in the form of dividends.1975 - Discount Brokers

In 1973 the Securities and Exchange Commission (SEC) announced that it would eliminate fixed commissions (which it did in 1975). It sounds "un-American" to me that investors weren’t able to negotiate commissions to buy securities (for over a century), but apparently that's the way it was. When the changes took effect, it opened the door for competition and discount brokers (like Charles Schwab, which was founded in 1971) soon began offering lower cost options for investors. That created the option for investors to open an account and buy a stock at more reasonable costs (without hiring a licensed full service broker or adviser). Whether an investor knows what he or she is doing, and how long they hold the security are separate questions of course. But at least the new options became available.1976 - Index Funds

John C. Bogle was known by most as “Jack Bogle” (he passed away in January 2019). He created the First Index Investment Trust at The Vanguard Group, the firm he founded. Some at the time described it as "Bogle's folly" and called it "un-American." Of course the investment industry has always been very lucrative and many rightfully felt their income was threatened by index funds. I'm not sure who would have predicted the vast amounts of money that would be invested in index funds, but there is no dispute that Bogle's creation of Vanguard and the first index fund has benefitted investors by remarkable proportions (more on Bogle and his legacy later).

Others were also working on index funds and ways to invest passively without picking individual securities. My former bosses Wayne Wagner and Larry Cuneo who were part of the team using technology to buy portfolios intended to get market returns with minimal costs, and Mark Edwards was at the Minnesota State Board of Investment which was working on a total market fund, prior to his joining Plexus group. Wayne and Larry later participated in created the Wilshire 5000 total U.S. stock market index. Indexing has grown tremendously in popularity as people have come to recognize its benefits relative to the alternatives. Index funds offer expanded diversification and usually reduced costs. Lowering trading costs is one of my areas of expertise, and index funds tend to have among the lowest trading costs, as well as lower expense ratios (more on that in chapter seven).

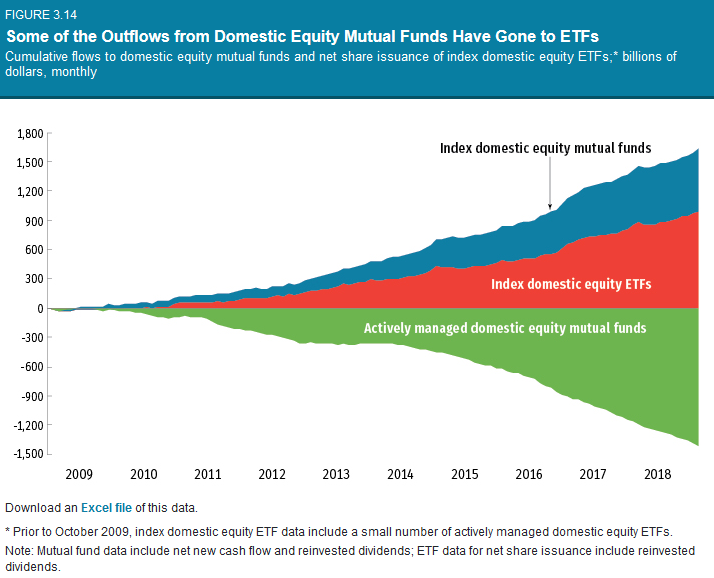

The chart above illustrates the fact that investors have been adding to index equity funds and ETFs at a rapid rate in recent years, while investors have been taking money out of actively managed equity mutual funds.31

1993 - Exchange Traded Funds (ETF)

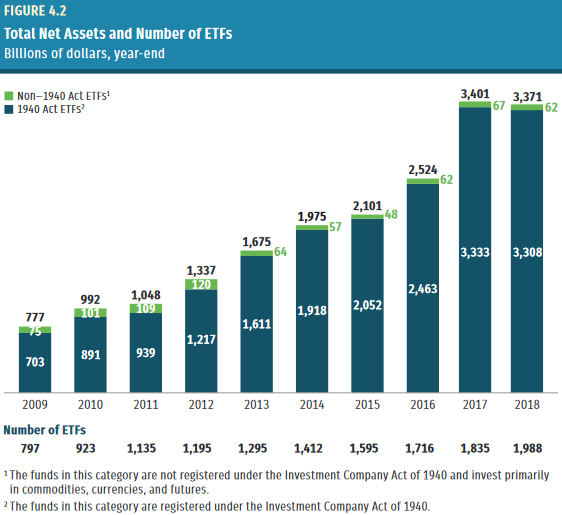

In 1993 the American Stock Exchange released the S&P 500 Depository Receipt (ticker symbol SPDR often called "spider"). This set off the Exchange Traded Fund (ETF) era. One advantage of ETFs is that they can be traded during the day by anyone with a brokerage account, unlike mutual funds which only trade on the close (plus all investors don't necessarily have equal access to all mutual funds depending on their brokerage accounts). As a result, you have more control over timing and pricing with ETFs. ETFs can also be actively managed, but the vast majority of ETF activity is in passive funds that track indexes. ETFs tend to have higher turnover, which implies many are using them for speculative purposes and there is some evidence that ETF investors tend to underperform mutual fund investors. ETF investors should also keep in mind the commissions and trading costs when transacting in ETFs, but when used appropriately they offer many advantages. The following chart from the Investment Company Institute shows the recent growth in the number and assets in ETFs.32

Source: ICI (page 83)1990s-2000s - Target Date Funds

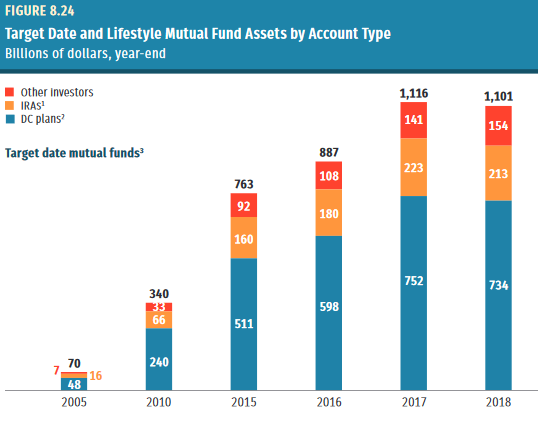

A more recent investing option is the creation of target date, or life cycle funds. The concept began taking shape in the 1990's and in the early 2000's target date funds began to accumulate substantial assets. According to Morningstar, Target-Date fund assets exceeded $1.7 Billion at the end of 2018.33 Target date funds are designed to provide a simple investment solution through a portfolio that becomes more conservative as time passes and the investor gets closer to the target (or retirement) date. Their popularity in the U.S. is fueled in part by efforts to improve retirement options through auto-enrollment and other techniques. They are designed to be attractive options for individuals as a simple, efficient, and appropriate investment option. They have become a type of default option for many employer linked retirement accounts. The following chart from the Investment Company Institute shows the recent growth in the number and assets in target date funds.34

Source: ICI (page 183)2010s - Robo-Advisors and Micro investing firms

As I mentioned in the preface, Financial Engines and other firms began offering automated services to investors in the 1990's, but more recently, so-called Robo-Advisor firms like Wealthfront, Betterment, and Acorns have been attracting substantial assets. Vanguard, Charles Schwab, Fidelity, Morningstar, and scores of others have also introduced variants, with many firms offering either pure technology based options, or hybrid offerings that combine technology and human interaction. I discuss the evolution of Robo-Advisors and how they are impacting the investment business in more detail in Chapter 30.

Robo-Advisors and target date funds can often be managed in a similar way, but Robo-Advisor accounts are separate rather than commingled with other clients (like a traditional mutual fund). The Robo-Advisors and micro investing firms often use fractional shares and other technology to keep costs low, which they hope will allow them to make money despite typically smaller account sizes. Some allow you to start accounts with virtually nothing, while some others require a minimum to open an account. Some also charge a minimum monthly fee.

These innovations and others have combined to create an environment where virtually every major investment asset class is accessible to individual investors, and in many cases at much lower costs than in the past. In many asset classes, individuals now have access to investment options that are superior to those commonly used by institutional and accredited investors just a few decades ago.

Rapid globalization and modernization of investment markets is also allowing investors to diversify globally at low costs. Many countries have been characterized by rapid financial innovation, in fact most European markets were completely electronic many years ago. I've worked with many investment firms that employ investment professionals around the clock (during the work week). It used to be that to get equal treatment in some countries you had to have staff in that country or at a minimum in the region, but many people now feel that is no longer the case in many countries.

There are positives and negatives to the fact that investors can now invest 24 hours a day around the globe. Easy access can add to the information overload and it can encourage speculative trading. Some are even enticed to become day traders, but as I summarize in chapter eight, the vast majority that try day trading don’t end up making a living out of it and are more likely to end up eating into their portfolio than growing it. While investors have tremendous opportunities and access, it doesn’t necessarily translate into better performance, or achieving appropriate goals. Yet, for those that use the markets appropriately, the good far outweighs the bad.

The internet has also been a game changer for educational purposes. Search tools, web sites, and videos are potentially excellent educational tools for finding information and for learning. Just by googling simple questions and watching videos from reputable sources, people can learn more in short periods of time than we really could have imagined a few centuries ago. The ability to access websites, pdf documents, and books in real time accelerates the potential learning window. All the newer tools can be used in beneficial ways.

Investment costs have also dropped in the investment business thanks to the internet and other improvements. Jack Bogle noted in his book Common Sense on Mutual funds that computer costs plummeted 99% from 1985 to 1998 ($150,000 per million instructions per second to $2,000) and printed fund prospectus costs were $8, while delivering them over the internet had dropped to under $1 by 1999.

We've also learned a lot more about our own brains and behavior in recent decades. Many standard finance theories are based on the assumption that people act logically and in profit maximizing ways. We now know that is often not the case, which has many implications. Primarily, it is important to attempt to identify common mistakes and correct them before they can harm individual investors. But it also potentially impacts markets and economies while creating opportunities for others to take advantage of those mistakes (assuming people continue to make them).

Most investors admit that they need more financial education, in fact 88% of those sampled by Schroders globally acknowledged the need to improve their investment knowledge, which may be necessary in part because many have unrealistically high annual return expectations for their investments.35 Interest rates are near historic lows and arguably long-term return projections should also be lower than many are expecting. Costs are always important, but they are especially important in low return environments.

In a negative return environment, many financial firms and professionals make money even if their clients don't. In a low return environment, it is not uncommon for investment firms to make more money than their clients. The bottom line is that controlling and minimizing investment costs (in negative, low return, and high return environments) can be critical to your financial success.

Truly efficient investing can be boring and for most, the idea is to get rich slowly, and then to stay rich. Investors should avoid taking chances that can make them poor, and avoid anything or anyone that can be an unnecessary leech on their portfolios. The primary goal is to maximize the probability that you will reach your financial goals, and to do it sooner rather than later.

Many investors are also wary about interacting with financial professionals. That is a concern that is often warranted, but shouldn’t prevent people from investing. Investors should be educated in their own biases and conflicts of interests, as well as the biases and conflicts in financial media, financial firms, and financial professionals.

There are many talented, honest, and ethical firms and individuals in the investment business. But, I will advise investors throughout this book to be wary of those in the industry, particularly those with significant conflicts of interests, and especially those that are not “fiduciaries.” I’ll elaborate on that topic in chapter 30, but in short, a fiduciary is required to put an investor’s interests before his or her own. The following are a few quick examples that are arguably somewhat extreme, but they highlight why this point is so important.

A group of researchers sent hundreds of secret shoppers to so-called financial advisers. They published a 2012 paper via the National Bureau of Economic Research. The authors concluded that the Advisers “encourage returns-chasing behavior and push for actively managed funds that have higher fees, even if the client starts with a well-diversified, low-fee portfolio." In other words, many of the advisors encouraged investors with appropriate portfolios to instead invest in actively managed, higher cost funds that would have likely made the advisors money, but probably would have provided weaker performance than what they already had. The paper was criticized for not actually qualifying the advisors they selected (most were salespeople at banks and retail brokerage firms and apparently were not registered investment advisors, which are fiduciaries), but the results were troubling and informative nonetheless.36

In another troubling piece of research, a 2015 report sponsored by Public Investors Arbitration Bar Association concluded that "while brokerage firms advertise as though they are trusted guardians of their clients’ best interests, they arbitrate any resulting disputes as though they are used car salesmen.” The organization shined the spotlight on nine major brokerage firms that “advertise in a fashion that is designed to lull investors into the belief that they are being offered the services of a fiduciary."37

More recently Jason Zweig and Anne Tergesen at the Wall Street Journal wrote in “Discount Brokers Push Pricier Services” that some discount brokerage firms encouraged and compensated their employees to sell plans and products that were more lucrative for the firms and employees, yet cost their customers more. The firms and employees can also often earn additional income referring clients to other advisors.38

Many in the financial press have pointed out that mutual fund costs have been dropping. The problem is that it’s not necessarily because the industry has been charging less. It is primarily because investors themselves (and to some extent their advisors) have been moving to lower cost funds. Reshma Kapadia at Barron’s summarized in Barron’s "dollar-weighted average expense ratio has declined, falling to 0.63% for stock funds in 2016 from 0.88% a decade earlier...But dollar-weighted averages just tell the story of where investors are putting their money—into the cheapest funds—and are not a reflection of the fund industry slashing prices."39

While advisors and investment firms can and should be used by some to help with their planning and investing, investors can and should get educated, be wary of conflicts of interest, negotiate when possible, and do everything they can to minimize their costs.

Overview

Ultimately this book is about the process of investing, but it is also about sleeping well and being comfortable and confident in your investing. So the first step is actually getting your head in the right frame of mind. Chapter two begins with some perspective on how money and wealth fit into the big picture. Before discussing finance and investing, in chapter three I discuss psychology, behavioral finance and how people think about money and risk. Next comes an introduction to the business of investing, which leads into a discussion of what financial activities are actually investing (which investors should focus on) versus those that are speculative (which investors should most likely avoid). I then move onto how financial markets operate in discussing the efficient market hypothesis and the random walk theories.

Students of finance and investors can sift through mountains of data and studies, but most conclusions can be summarized into a few relevant action items. I will discuss what we know from the historical data and the probabilities of success for various investments, strategies, and techniques. I'll then discuss the importance of asset allocation, before summarizing what investors need to know about the major asset classes that they should consider investing in. I include my perspective on stocks, real estate, bonds, and tangible investments, as well as a discussion about international investing and so-called "alternative" investments.

Many individuals have investments in private businesses, which can be comparable to alternative investments which are utilized by larger investors in a more diversified form. I’ll discuss alternatives (including venture capital, private equity, and hedge funds) from the perspective of which offer advantages to institutional investors and which are likely to underperform traditional assets thus giving individuals an opportunity to outperform the so-called professional investors.

A fascinating collection of studies have documented stock market anomalies or risk factors, and investors should evaluate whether and how those discoveries should affect their investing strategies. Deciding whether to try to take advantage of those anomalies is a logical question, but the answers may not be as simple as they seem. I then summarize the actual process of investing and offer guidelines for creating a formal investment plan, as well as offering guidance on whether an investor should seek help from one of the various types of advisors.

The stock market has achieved all-time highs in 2019. The finance industry and global economy are in relatively good shape, but many, unfortunately, did not participate in the bull market in stocks. Stock market holdings as a percentage of total financial assets (in the United States) recently increased to 37% (the highest percentage since 2010), but the percentage of people invested in stocks is lower than it has been fairly recently.40

According to Gallup, stock market participation by U.S. adults was 65% in 2007, but had hovered around 60% from 1999-2006. In 2013 it dropped to 52%, which it hit again in 2016, before bumping up to 54% in 2017.41 Bankrate's 2015 study found 52% of Americans reported not owning any stocks or stock-based investments such as mutual funds.42

There are less than 5,000 publicly traded stocks in the U.S. total stock market index and there are roughly as many equity mutual funds investing in those stocks.43 According to Mercer Insights there are about 6,000 unique asset management firms and 33,000 investment strategies.44 There are also close to 10,000 hedge funds, which tend to have the highest costs of all the options. Yet, extensive evidence continues to show that buying anything other than a broad index of on asset class is likely to result in worse performance, which partially explains why indexing has grown so much in the last few decades despite the massive number of options and attempts to beat the indexes. Explaining why so many continue trying to outperform indexes involves many factors including faulty reasoning, agency conflicts, and other explanations.

Table of Contents and Launch Site

Most investors still have strong memories of the global financial crisis and before concluding, I discuss the history of financial crisis, which periodically threaten economies, markets, careers, and individual portfolios. Yet historically, we learn from crisis and they usually present new opportunities for the future.

Notes - The Footnotes in the Book are sequential and for this chapter start at #3 and end at #46.

1. United States Government Accountability Office (May 2015) citing Department of Labor http://www.gao.gov/assets/680/670153.pdf

2. http://science.sciencemag.org/content/339/6124/1152

http://faculty.chicagobooth.edu/richard.thaler/research/pdf/Behavioral%20Economics%20and%20the%20Retirement%20Savings%20Crisis.pdf

3. https://www.gobankingrates.com/investing/why-americans-will-retire-broke/

4.Charles Ellis, “Our #1 Challenge: Retirement Insecurity" Financial Analysts Journal, Fourth Quarter 2018

https://www.cfapubs.org/doi/pdf/10.2469/faj.v74.n4.2

Ellis suggests "Best Practices" including automatic participation in defined contribution plans (unless opting out), the use of target date funds, and low cost index funds.

5. http://www.bankrate.com/finance/consumer-index/financial-security-charts-0217.aspx

6. http://www.bankrate.com/pdfs/pr/20160706-July-Money-Pulse.pdf

http://www.bankrate.com/finance/consumer-index/money-pulse-0716.aspx

7. https://www.cnbc.com/2018/03/06/42-percent-of-americans-are-at-risk-of-retiring-broke.html

8. http://www.usfinancialcapability.org/downloads/NFCS_2015_Report_Natl_Findings.pdf

9.(OECD, 2005) https://www.oecd.org

10. Adele Atkinson, Flore-Anne Messy 2012 Measuring Financial Literacy

http://www.oecd-ilibrary.org/finance-and-investment/measuring-financial-literacy_5k9csfs90fr4-en

11. PISA 2012 Results: Students and Money Financial Literacy Skills for the 21st CENTURY

https://www.oecd.org/pisa/keyfindings/PISA-2012-results-volume-vi.pdf

12. Steven Kaplan, Joshua Rauh, "Family, Education, and Sources of Wealth among the Richest Americans, 1982-2012," American Economic Review, May 2013 https://www.aeaweb.org/articles?id=10.1257/aer.103.3.158

13. https://newsroom.bmo.com/2013-06-13-BMO-Private-Bank-Changing-Face-of-Wealth-Study-Two-Thirds-of-Nations-Wealthy-Are-Self-Made-Millionaires

14. https://newsroom.bankofamerica.com/press-releases/global-wealth-and-investment-management/us-trust-study-finds-10-common-success

15. https://www.forbes.com/sites/luisakroll/2018/10/03/the-forbes-400-self-made-score-from-silver-spooners-to-bootstrappers/#2330e01b6cd9

16. https://en.wikipedia.org/wiki/Millionaire - Some estimate many more, for instance https://dqydj.com/how-many-millionaires-decamillionaires-america/

17. Peterson Institute for International Economics, "The Origins of the Superrich: The Billionaire Characteristics Database" February 2016 https://piie.com/publications/wp/wp16-1.pdf

18. See page 19 of https://www.ici.org/pdf/per23-08.pdf (Characteristics of Mutual Fund Investors, 2017) for a visualization of age of first mutual fund investment purchase by generation.

19. https://www.ici.org/pdf/per23-08.pdf Characteristics of Mutual Fund Investors (see graphic on page 19 for investing ages)

20. https://www.quora.com/How-many-people-are-born-die-every-day-in-the-world-What-is-birth-to-death-ratio-in-the-world

21. The U.S. government's IRA Required Minimum Distribution Worksheet is a good tool for estimating cash flow withdrawal rates because it sets the minimum you must withdraw from your tax deferred accounts, based on your age. At age 70.5 you must start withdrawing your balance divided by the distribution period. At that age it is 27.4, which equates to about 3.65%. By Age 73 the distribution period is 24.7 which equites to more than 4%.

22. https://www.irs.gov/pub/irs-tege/uniform_rmd_wksht.pdf">

23. https://www.morningstar.com/articles/917708/your-rmd-amounts-are-more-conservative-than-you-mi.html

24. https://www.aboutschwab.com/schwab-401k-participant-study-2019

25. https://www.ssa.gov/myaccount/

26. https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf (accessed 12/6/2018 - 2019 was 64 million as of 4/11/2019)

27. US Census Bureau, Income Distribution to $250,000 or More for Households: 2013". Census.gov. Retrieved 2015-03-02

28. https://fred.stlouisfed.org/series/MAFAINUSA646N

29. http://news.gallup.com/poll/225023/investors-no-strings-attached-retirement-income-stream.aspx

30. Laurence Siegel "After 70 Years of Fruitful Research, Why is there Still a Retirement Crisis" January/February 2015 Financial Analysts Journal https://www.cfapubs.org/doi/full/10.2469/faj.v71.n1.1

31. https://www.ici.org/pdf/2019_factbook.pdf (page 74) or https://www.icifactbook.org/ch3/19_fb_ch3

32. https://www.ici.org/pdf/2019_factbook.pdf (page 83) or https://www.icifactbook.org/ch4/19_fb_ch4

33. Price Continues to Rule the Target-Date Fund Landscape, May 20,2019 https://www.morningstar.com/articles/929906/price-continues-to-rule-the-targetdate-fund-landsc.html

34. http://www.icifactbook.org/deployedfiles/FactBook/Site%20Properties/pdf/2018/2018_factbook.pdf (page 197)

The 2019 version shows a slight decrease in assets in 2018 https://www.ici.org/pdf/2019_factbook.pdf (page 183) or https://www.icifactbook.org/ch8/19_fb_ch8

35. http://www.schroders.com/en/sysglobalassets/digital/insights/2017/pdf/global-investor-study-2017/theme2/schroders_report-2__eng_master.pdf

36. Sendhil Mullainathan, Markus Noeth, Antoinette Schoar, Conflicts who can you Trust The Market for Financial Advice: An Audit Study NBER Working Paper No. 17929 Issued in March 2012 http://www.nber.org/papers/w17929, https://www.kitces.com/blog/how-the-advisor-sting-study-completely-missed-the-mark/

37. Joseph C. Peiffer and Christine Lazaro BROKERAGE INDUSTRY ADVERTISING CREATES THE ILLUSION OF A FIDUCIARY DUTY Misleading Ads Fuel Confusion, Underscore Need for Fiduciary Standard (3/25/2015) https://piaba.org/system/files/pdfs/PIABA%20Conflicted%20Advice%20Report.pdf

38. https://www.wsj.com/articles/advisers-at-leading-discount-brokers-win-bonuses-to-push-higher-priced-products-1515604130 (1/11/2018 print edition)

39. https://www.barrons.com/articles/the-great-fund-fee-divide-1515214360 (1/6/2018)

40. https://www.federalreserve.gov/releases/z1/20180308/z1.pdf 4Q2017 Z.1 data on households http://jlfmi.tumblr.com/post/171919215760/household-stock-exposure-inches-closer-to-dotcom

41. https://news.gallup.com/poll/233699/young-americans-wary-investing-stocks.aspx (5/4/2018) http://news.gallup.com/poll/211052/stock-ownership-down-among-older-higher-income.aspx (5/24/2017) http://news.gallup.com/poll/190883/half-americans-own-stocks-matching-record-low.aspx (4/20/2016)

42. https://www.bankrate.com/investing/did-you-miss-the-stock-market-rally-youre-not-alone/ (4/9/2015)

43. https://qz.com/1272280/there-are-now-almost-as-many-equity-funds-as-there-are-stocks-for-them-to-invest-in/

44. https://www.institutionalinvestor.com/article/b1dd82391ds6sz/Allocators-Need-Them-Asset-Managers-Resent-Them-And-Everyone-Is-Afraid-of-Them

I am offering the online chapters of The Peaceful Investor using "The Honor System." If you don't plan to purchase a version of the book, yet you think it was worth your time and you learned a significant amount, you can tip or compensate me in a number of ways. This will probably not be tax deductible for you, but I will report and pay taxes on any payments.

If you don't think the material was worthwhile, I would appreciate emails letting me know what you read and whether you disagree with anything in particular. I would also appreciate anyone letting me know if they find any typos, mistakes, or suggestions how to improve the material.

- Paypal me at gkarz@aol.com

- Pay me by credit card. Email me (proficient at aol.com) with an amount you'd like to donate and I will email you an invoice via Square.com. I will not have access to your information - you would enter it on the secure square website.

- Before you make purchases at Amazon, link through one of my links. As an Amazon Associate I earn from qualifying purchases.

- Contact me to inquire about a review or second opinion of your finances.

Gary Karz, CFA

Author of The Peaceful Investor and Publisher of InvestorHome.com

twitter.com/GKarz (email)