|

Links

The Bogle EBlog

John C. Bogle Center for Financial Literacy

Bogle Financial Marlets Research Center

Speeches (1996-2009)

Bogle's articles @ Financial Analysts Journal

Bogle's Papers @ Princeton

Bogleheads forum (>64,000 members)

Wikipedia. In 2005 Paul Samuelson ranked Bogle's index fund "invention along with the invention of the wheel, the alphabet, Gutenberg printing".

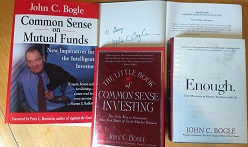

Bogle's books (> 1.1 million sold per Brooke Southall @ riabiz.com)

- Bogle on Mutual Funds: New Perspectives for the Intelligent Investor (1993)

- Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor(1999)

- John Bogle on Investing: The First 50 Years (2000)

- Character Counts: The Creation and Building of The Vanguard Group (2002)

- Battle for the Soul of Capitalism (2005)

- The Little Book of Common Sense Investing (2007)

- Enough: True Measures of Money, Business, and Life (2008)

- Common Sense on Mutual Funds, Fully Updated 10th Anniversary Edition (2009)

- Don't Count On It! Reflections on Investment Illusions, Capitalism, "Mutual" Funds, Indexing, Entrepreneurship, Idealism, and Heroes (2010)

- Clash of the Cultures: Investment vs. Speculation (2012)

- Stay the Course: The Story of Vanguard and the Index Revolution (2018)

Books about Bogle

- John Bogle and the Vanguard Experiment (1996, by Robert Slater)

- Investment Titans (2000, by Jonathan Burton)

- The House that Bogle Built (2011, by Lewis Braham)

- The Bogleheads' Guide to Retirement Planning (2011, by Larimore, Lindauer, Ferri, & Dogu)

- The Man in the Arena (2013, by Knut Rostad)

- The Bogleheads' Guide to Investing (2014, by Larimore, Lindauer, & LeBoeuf

- The Bogleheads' Guide to the Three-Fund Portfolio (2018, by Taylor Larimore)

|

Eulogies and Tributes (over 100 tributes)

Compendiums of links and quotes

"If a statue is ever erected to honor the person who has done the most for American investors, the handsdown choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds ... He is a hero to them and to me."

Warren Buffett @ Berkshire Hathaway

"The best example of an American business hero was Jack Bogle, whose ideas transformed an industry and who gave generations of investors a way to participate in the growth of the American economy, to save efficiently, and to achieve financial security and a comfortable retirement ... The skeptics called index funds ‘Bogle’s folly.’ They are now almost 50% of all mutual-fund assets."

Burton Malkiel in The Secrets of Jack Bogle’s Investment Success via Wall Street Journal

"Jack could have been a multibillionaire on a par with Gates and Buffett ... He basically chose to forgo an enormous fortune to do something right for millions of people. I don’t know any other story like it in American business history."

William Bernstein via Philly.com

"The world lost a giant and I lost my hero. Nobody has ever done more for investors, and asked less for himself, than Jack Bogle."

Cliff Asness @AQR Capital

"I can't think of anyone who has done more for investors than Bogle."

Russell Kinnell @Morningstar

"The so-called fiduciary rule is something he truly believed in and championed for. In Jack's honor, I propose we rename this effort "The Bogle Rule". Most people choose a career in the investment business to make money; Jack Bogle chose to use that career to make a difference."

Rick Ferri via Forbes

"Jack was the ultimate titan ... He democratized investing and gave everyone a chance at investing in the progress of America."

Jim Cramer @The Street

"It’s certainly the end of an era. Everyone in the industry today is standing on the shoulders of that giant."

Sallie Krawcheck @Ellevest via Bloomberg

"We have lost the leading voice for the customer in the financial services industry."

Jon Stein @ Betterment

"Jack Bogle has given investors throughout the world more wisdom and good financial judgement than any person in the history of markets."

Arthur Levitt Jr.

Bogle was the ultimate competitor to many in the investment industry. In 2017 Bogle summarized at a CFA conference "Vanguard is an anti-hero—dare I say “villain”? —to Wall Street." Yet many of the most prominent individuals in the industry have respectfully acknowledged his enormous contributions.

Larry Edelman via Boston Globe summarized "Jack Bogle was an investment industry legend. In Boston, he was also a legendary pain in the butt." He noted Abby Johnson, chairman of Fidelity, said in a statement to the Globe “Jack was always a tough competitor of ours and kept us on our toes, and for that I am grateful.” Bogle was the ultimate competitor to many in the investment industry. In 2017 Bogle summarized at a CFA conference "Vanguard is an anti-hero—dare I say “villain”? —to Wall Street." Yet many of the most prominent individuals in the industry have respectfully acknowledged his enormous contributions.

Larry Edelman via Boston Globe summarized "Jack Bogle was an investment industry legend. In Boston, he was also a legendary pain in the butt." He noted Abby Johnson, chairman of Fidelity, said in a statement to the Globe “Jack was always a tough competitor of ours and kept us on our toes, and for that I am grateful.”

In 2013, Allan Roth made calculations for Knut Rostad’s book about Bogle called The Man in the Arena, and calculated his work was saving investors $25 billion a year between the lower Vanguard fees and forcing competitors like Fidelity and Schwab to lower their fees. In 2016 Eric Balchunas wrote @Bloomberg "How the Vanguard Effect Adds Up to $1 Trillion." Hamilton Nolan in blunt language praised Bogle for keeping more money out of the hands of Wall Street. Helaine Olen (via Washington Post) summarized, "many Americans are richer and the financial services industry is poorer thanks to Bogle’s existence." In 2013, Allan Roth made calculations for Knut Rostad’s book about Bogle called The Man in the Arena, and calculated his work was saving investors $25 billion a year between the lower Vanguard fees and forcing competitors like Fidelity and Schwab to lower their fees. In 2016 Eric Balchunas wrote @Bloomberg "How the Vanguard Effect Adds Up to $1 Trillion." Hamilton Nolan in blunt language praised Bogle for keeping more money out of the hands of Wall Street. Helaine Olen (via Washington Post) summarized, "many Americans are richer and the financial services industry is poorer thanks to Bogle’s existence."

“What he meant to most people in the investment business was that he was a royal pain in the bottom. In a world where increasingly everyone is trying to maximize short-term profits, he was a complete outlier. He was more concerned about the long-term benefits for society. There were so few in that group. And he was the patron saint."

Jeremy Grantham @GMO via Bloomberg

“Jack created more wealth for more people than anyone in the history of investing and probably in its future as well. He combined great originality, drive and moral purpose with unusual kindness, compassion and a sense of duty. He was always a gentleman and combined two traits rarely seen together: exceptional competitiveness and no ego. I feel honored to have known him.”

Bill Miller via Bloomberg

“He was a giant in the past half century of investment strategy -- not because he knew which way markets were headed at any one time, but because he hectored Wall Street and encouraged investors to keep more of what they earned. Egregious fees were his enemy and index funds were his solution. While I still remain an advocate of active management, there is no doubt that indexing at much lower fees will outperform almost all managers over a long period of time. Both his old and his new hearts were always with the small investor as opposed to Wall Street.”

Bill Gross via Bloomberg

"He wasn’t the first to do an index fund but he was the first to do it in a fashion that regular people could invest in."

Rob Arnott @Research Affiliates via Bloomberg

"Farewell, John C. Bogle. You left the world a far, far better place than you found it and, for that, the rest of us will be forever grateful."

Jonathan Clements

© COPYRIGHT 2019 ALL RIGHTS RESERVED Gary Karz (3/13/2019) DISCLAIMER |

(excerpt from the forthcoming book The Peaceful Investor)

I was working on the final draft of this book when Jack Bogle passed away on January 16, 2019, at the age of 89. I only had the pleasure of meeting him once, but he had an enormous impact on me. Scores of individuals in the financial press and social media wrote public tributes to Bogle following the news of his passing (see this partial list), yet it seems difficult to do justice to Bogle because his influence has been so profound on the investment industry. Some of the terms used to describe Bogle that I've seen have included gentleman, entrepreneur, innovator, giant, titan, legend, centurion, hero, and saint. I was working on the final draft of this book when Jack Bogle passed away on January 16, 2019, at the age of 89. I only had the pleasure of meeting him once, but he had an enormous impact on me. Scores of individuals in the financial press and social media wrote public tributes to Bogle following the news of his passing (see this partial list), yet it seems difficult to do justice to Bogle because his influence has been so profound on the investment industry. Some of the terms used to describe Bogle that I've seen have included gentleman, entrepreneur, innovator, giant, titan, legend, centurion, hero, and saint.

Bogle is usually credited for creating the first index mutual fund, but his impact was immense in multiple ways beyond that pioneering creation. Vanguard was not the only firm introducing and promoting index funds, in fact, my former bosses were involved in some of the initial attempts to develop funds that would effectively match the market, rather than try to beat it. Some firms now offer index funds for free (at a loss, expecting to make up the losses through other means). See for instance,

Cheapest Index Fund Providers via riabiz.com. Bogle is usually credited for creating the first index mutual fund, but his impact was immense in multiple ways beyond that pioneering creation. Vanguard was not the only firm introducing and promoting index funds, in fact, my former bosses were involved in some of the initial attempts to develop funds that would effectively match the market, rather than try to beat it. Some firms now offer index funds for free (at a loss, expecting to make up the losses through other means). See for instance,

Cheapest Index Fund Providers via riabiz.com.

Jack Bogle created a unique structure at Vanguard whereby the fund manager is owned by its fund shareholders, rather than by insiders or stockholders. As a result, Vanguard’s interests are aligned with the shareholders and rather than maximize revenues or profit, fees are set to match the costs of running the funds, and the organization. When revenue exceeds costs, Vanguard cuts the fees (something they have done hundreds of times). The unique structure that Bogle created at Vanguard forced the industry to be even more competitive. Laurence Siegel noted in 2018 that Vanguard had reached a 25% market share of long-term mutual fund assets. No firm had ever been over 15% before (Massachusetts Investors, Investors Diversified Services, and Fidelity all got 15% market share). Of the 50 largest fund companies, Vanguard is the only one mutually owned (something Bogle actually considered a failure, according to Allan Roth). Jack Bogle created a unique structure at Vanguard whereby the fund manager is owned by its fund shareholders, rather than by insiders or stockholders. As a result, Vanguard’s interests are aligned with the shareholders and rather than maximize revenues or profit, fees are set to match the costs of running the funds, and the organization. When revenue exceeds costs, Vanguard cuts the fees (something they have done hundreds of times). The unique structure that Bogle created at Vanguard forced the industry to be even more competitive. Laurence Siegel noted in 2018 that Vanguard had reached a 25% market share of long-term mutual fund assets. No firm had ever been over 15% before (Massachusetts Investors, Investors Diversified Services, and Fidelity all got 15% market share). Of the 50 largest fund companies, Vanguard is the only one mutually owned (something Bogle actually considered a failure, according to Allan Roth).

A third major innovation by Bogle was Vanguard's decision to go no-load in 1977. Vanguard summarized "Mr. Bogle and Vanguard again broke from industry tradition in 1977, when Vanguard ceased to market its funds through brokers and instead offered them directly to investors. The company eliminated sales charges and became a pure no-load mutual fund complex—a move that would save shareholders hundreds of millions of dollars in sales commissions." A third major innovation by Bogle was Vanguard's decision to go no-load in 1977. Vanguard summarized "Mr. Bogle and Vanguard again broke from industry tradition in 1977, when Vanguard ceased to market its funds through brokers and instead offered them directly to investors. The company eliminated sales charges and became a pure no-load mutual fund complex—a move that would save shareholders hundreds of millions of dollars in sales commissions."

Another impressive achievement is the fact that Vanguard has had such high customer service rankings. Vanguard historically ranks at or among the top of customer service surveys (despite occasional glitches). Vanguard's hybrid Robo-Advisor "Personal Advisor Services" claimed the top position in Backend Benchmarking's first edition of The Robo Ranking. Bogle described Vanguard's hybrid Robo-Advisor as "robo-plus" in a late 2018 interview, several weeks after having a pacemaker implanted in his transplanted heart. Another impressive achievement is the fact that Vanguard has had such high customer service rankings. Vanguard historically ranks at or among the top of customer service surveys (despite occasional glitches). Vanguard's hybrid Robo-Advisor "Personal Advisor Services" claimed the top position in Backend Benchmarking's first edition of The Robo Ranking. Bogle described Vanguard's hybrid Robo-Advisor as "robo-plus" in a late 2018 interview, several weeks after having a pacemaker implanted in his transplanted heart.

Customer satisfaction is, of course, related to performance and the performance of Vanguard's funds speaks for itself. Whether you look at all funds, money market funds, stock, bond, or balanced funds, over the long run, Vanguard's funds tend to outperform roughly 90% of the time. 86% of Vanguard's funds beat their peer-group averages over the five-years, and 94% surpassed their peer-group averages over the ten-year period ended December 31, 2017 (Source &

3Q2018 data) Customer satisfaction is, of course, related to performance and the performance of Vanguard's funds speaks for itself. Whether you look at all funds, money market funds, stock, bond, or balanced funds, over the long run, Vanguard's funds tend to outperform roughly 90% of the time. 86% of Vanguard's funds beat their peer-group averages over the five-years, and 94% surpassed their peer-group averages over the ten-year period ended December 31, 2017 (Source &

3Q2018 data)

Bogle's remarkable list of accomplishments includes the following. Bogle's remarkable list of accomplishments includes the following.

- Over 64000 registered users at Bogleheads.org, the forum of Bogle followers

- He sold over one million books (riabiz)

- Vanguard reportedly has over 20 million clients (Siegel)

- Vanguard manages over $5 trillion in assets

I have no idea whether the Nobel committee ever considered Bogle for the Nobel Prize (by rule they do not consider the award posthumously). I would certainly give him credit for being the most important and impactful person in the history of investing. Bogle made it possible for tens of millions of investors to live more peaceful financial lives. Nobel laureate Paul Samuelson is credited with the idea of the index fund and he ranked Bogle's index fund "invention along with the invention of the wheel, the alphabet, Gutenberg printing, and wine and cheese." I have no idea whether the Nobel committee ever considered Bogle for the Nobel Prize (by rule they do not consider the award posthumously). I would certainly give him credit for being the most important and impactful person in the history of investing. Bogle made it possible for tens of millions of investors to live more peaceful financial lives. Nobel laureate Paul Samuelson is credited with the idea of the index fund and he ranked Bogle's index fund "invention along with the invention of the wheel, the alphabet, Gutenberg printing, and wine and cheese."

In 1995 Tyler Mathisen wrote in Money Magazine in an article titled "BOGLE WINS: INDEX FUNDS SHOULD BE THE CORE OF MOST PORTFOLIOS TODAY" that "Indexing should form the core of most investors' fund portfolios." For most investors in public securities, Vanguard's index funds are a good default. There are other index fund providers and assets that Vanguard that does not offer directly through funds, but given Vanguard's structure and history, it should be the first choice. All other firms and funds need to have a strong enough advantage to justify getting ahead of Vanguard in the pecking order. That's not to say there aren't other good firms and investing options (in fact, I use others in addition to Vanguard). It's just rational to start with Vanguard and only use others if there are compelling reasons. In 1995 Tyler Mathisen wrote in Money Magazine in an article titled "BOGLE WINS: INDEX FUNDS SHOULD BE THE CORE OF MOST PORTFOLIOS TODAY" that "Indexing should form the core of most investors' fund portfolios." For most investors in public securities, Vanguard's index funds are a good default. There are other index fund providers and assets that Vanguard that does not offer directly through funds, but given Vanguard's structure and history, it should be the first choice. All other firms and funds need to have a strong enough advantage to justify getting ahead of Vanguard in the pecking order. That's not to say there aren't other good firms and investing options (in fact, I use others in addition to Vanguard). It's just rational to start with Vanguard and only use others if there are compelling reasons.

The question of whether too much money is chasing stock market anomalies or risk factors like value investing (as I discussed in chapters 20-24) at any given time is a very legitimate concern. Others ask whether index investing has become too popular. Given the marginal costs of active investing and the argument that most active investing is speculative rather than investment oriented, I think more investors and money should be indexed than less. But the fewer the number of active investors and the lower the turnover from active investors, the less liquid markets can become and the more volatile markets can be. The question of whether too much money is chasing stock market anomalies or risk factors like value investing (as I discussed in chapters 20-24) at any given time is a very legitimate concern. Others ask whether index investing has become too popular. Given the marginal costs of active investing and the argument that most active investing is speculative rather than investment oriented, I think more investors and money should be indexed than less. But the fewer the number of active investors and the lower the turnover from active investors, the less liquid markets can become and the more volatile markets can be.

Estimates of the percentage of investment funds that are indexed vary depending on the date and metric, but the trend toward indexing that Bogle initiated is continuing. Index fund assets under management have grown from near zero in the 1980s to about 30% of registered fund assets globally in 2017 according to a January 2018 Vanguard release (Source). In 1997, I posted a commentary titled The Magic Number about the significant of Vanguard's index fund becoming the largest in the country. I updated an online scorecard through 2000 when the Vanguard index fund outgrew the Fidelity Magellan fund to take the title of largest mutual fund. By the end of 2018, Vanguard not only managed the largest mutual fund, they managed the three largest U.S. stock and three largest U.S. bond funds. Estimates of the percentage of investment funds that are indexed vary depending on the date and metric, but the trend toward indexing that Bogle initiated is continuing. Index fund assets under management have grown from near zero in the 1980s to about 30% of registered fund assets globally in 2017 according to a January 2018 Vanguard release (Source). In 1997, I posted a commentary titled The Magic Number about the significant of Vanguard's index fund becoming the largest in the country. I updated an online scorecard through 2000 when the Vanguard index fund outgrew the Fidelity Magellan fund to take the title of largest mutual fund. By the end of 2018, Vanguard not only managed the largest mutual fund, they managed the three largest U.S. stock and three largest U.S. bond funds.

Barron's noted in May of 2018, that index funds accounted for 43% of all stock fund assets, and were expected to reach 50% in the next three years. In total, there were almost $7 trillion in U.S. funds that don’t use active managers. The Wall Street Journal noted in 2018 that active mutual funds accounted for 92% of U.S. stock funds in 1997, but that had fallen to 56% and Bloomberg reported in early 2019 that according Morningstar, large cap equity index funds already had more assets than large cap active equity funds as of the end of 2018. Barron's noted in May of 2018, that index funds accounted for 43% of all stock fund assets, and were expected to reach 50% in the next three years. In total, there were almost $7 trillion in U.S. funds that don’t use active managers. The Wall Street Journal noted in 2018 that active mutual funds accounted for 92% of U.S. stock funds in 1997, but that had fallen to 56% and Bloomberg reported in early 2019 that according Morningstar, large cap equity index funds already had more assets than large cap active equity funds as of the end of 2018.

Calvin Coolidge said “After all, the chief business of the American people is business." U.S. investors depend on the success of America's business to generate returns on their investments. While many have won Nobel and other prizes for academic and other advancements, no one has had the tangible impact on America's investment business like Jack Bogle. Occupy Wall Street and many commentators have argued that Wall Street and investment professionals make too much money, and there is some validity to those arguments. What we know for sure, is that the financial industry would have made a lot more money, and millions of investors would have less, if it weren't for Jack Bogle. Calvin Coolidge said “After all, the chief business of the American people is business." U.S. investors depend on the success of America's business to generate returns on their investments. While many have won Nobel and other prizes for academic and other advancements, no one has had the tangible impact on America's investment business like Jack Bogle. Occupy Wall Street and many commentators have argued that Wall Street and investment professionals make too much money, and there is some validity to those arguments. What we know for sure, is that the financial industry would have made a lot more money, and millions of investors would have less, if it weren't for Jack Bogle.

|

|