Real Estate Investment Trusts (REITs) account for about 3-4% of total US stock market index funds. Therefore, most diversified stock market investors own some REITs. In a Humbledollar article at the end of 2019 Adam Grossman argued that publicly traded REITs are a good investment, BUT there isn't a strong enough reason for an investor using a broadly diversified stock index fund to buy any more REITs than the percentage already included in the index fund. More recently, Nicolas Rabener at AlphaArchitect.com posted The Case Against REITs. I will be presenting the argument that for many investors, there are more persuasive arguments FOR overweighting REITs (above the market index percentages).

This discussion focuses mostly on publicly traded US equity REITs, which exclude mortgage REITs and non-publicly traded REITs (which tend to have higher costs, underperform, and are less liquid than public REITs). I am also not focusing here on current valuations, interest rate movement, mortgages and leverage, as well as tax differences between stocks and REITs. I am focusing on the big picture question of roughly what percentage of an investor's portfolio or net worth should be in real estate and REITs.

The debate about an appropriate allocation to REITs partially revolves around REIT performance (absolute and relative to stocks), whether REITs are riskier than stocks and whether the diversification benefit from adding REITs to a stock portfolio is worthwhile (or can be replicated, or improved upon with alternatives).

Let's start with REIT returns data. Many cite REIT returns for the past 20-30 years, but REITs were created in the United States by congress in 1960 and we have reliable index data on REITs for roughly 50 years. REIT.com provides the data from 1972-2019 and other sources go back even farther. Given some of the arguments against overweighting REITs, you might suspect that stocks have significantly outperformed REITs, but the data actually demonstrates the opposite. From 1972-2019 US equity REITs actually outperformed the S&P 500 by more than 1% per year.

Other data sources also show equity REITs outperforming stocks over recent decades. For instance, Larry Swedroe noted in 2017 that from January 1978 through May 2017 the Dow Jones Select REIT Index returned 12.2% annually versus 11.7% for the S&P 500 Index and 7.1% for five-year Treasury bonds The prior year, Brad Case pointed out looking at roughly the same period (1979 through 1Q2016) that REIT returns outpaced stock returns during 82% of the available 30-year periods and the FTSE NAREIT All Equity REITs had outperformed the Russell 3000 Index in 100% of the time for periods of at least 32 years.

Craig Israelsen documents REIT data back to 1970 (and summarized in this 2017 article). The REIT index had annualized returns averaging 11.63% versus 10.88 for the small cap stocks and 10.60% for the large caps stocks. REITs were also arguably less risky based on the percentage of years with positive returns. The REIT index had gains in 83% of the years versus 81% for large caps and 70% for small caps. Israelson emailed me that the data from 1970 and 1971 come from this book.

Ralph Block is the author of Investing in REITs (2011) and he cited returns data for several decades starting with the creation of REITs in the 1960s (referencing Goldman Sachs’ 1996 “The REIT Investment Summary”). There were apparently ten REITs of significant size in the 1960s ranging from $11 million to $44 million (for REIT of America). According to that data from 1963-1970 Equity REITs returned 11.5% versus 6.7% for the S&P 500. According to the same report, in the 1970s equity REITS returned 12.9% versus 5.8% for the S&P 500. So the farther back you go, the more the data seems to support the conclusion that REITs have outperformed stocks in the US. We have about 60 years of data on equity REITs in the US and we know they have outperformed stocks for their existence, as well as for every period of 32 years or more.

In 2017 Ronald Doeswijk, Trevin Lam, and Laurens Swinkels published research on global data from 1960-2015 and they also found real estate outperformed global stocks (by about 1% annually). Their data suggests the global market portfolio return for the period was 8.3%, with real estate returning almost 10.5%, while equities returned almost 9.5% and inflation averaged 3.8% (Brett Arends summarized at Marketwatch). So the global real estate data is also consistent with the US outperformance.

A separate argument for a large allocation to real estate (and REITs) is that real estate makes up a large percentage of the world's wealth. I discuss this in more depth in Chapter 13 of The Peaceful Investor. William Sharpe first suggested in 1964 the market portfolio was the natural starting point in portfolio construction. In theory you can attempt to buy funds to replicate all investable assets globally in proportion to their market capitalization, but not all assets are investable or measurable. There are many complications (and some unknown quantities) in estimating the total value of all assets. Roger Ibbotson and Laurence Siegel published the first comprehensive attempt to quantify the The World Market Wealth Portfolio in 1983 and they estimated that real estate accounted for over 52% of the total (about 20% US and 32% foreign).

A 2014 paper titled The Global Multi-Asset Market Portfolio 1959-2012 estimated real estate only accounting for 5% of global market portfolio at the end of 2012. But, they focused on the invested market portfolio, which included publicly available financial assets only (in other words, no private real estate). That discrepancy highlights one of the primary points of this argument. The publicly available securities are underweighting the actual wealth, because so much real estate is privately held. Gregory Gadzinski, Markus Schuller, and Andrea Vacchino broadened the discussion with their 2018 paper The Global Capital Stock: Finding a Proxy for the Unobservable Global Market Portfolio published in The Journal of Portfolio Management (see also this article). They noted that real estate is an asset class that is underweighted in the global market and "A global market portfolio aiming at including the major economic forces would need to take into account this weight accordingly, instead of only accounting for assets under management held by REITs."

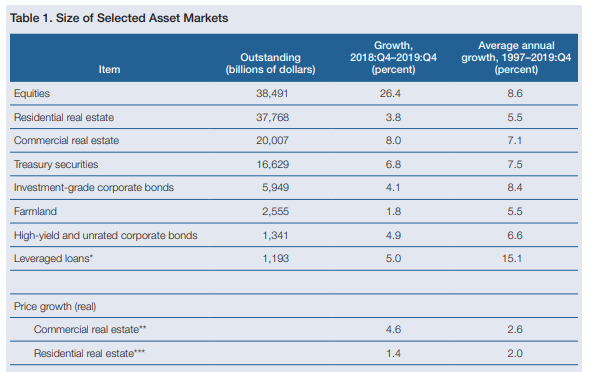

The Federal Reserve's just released Financial Stability Report (May 2020) illustrates the size of real estate asset values (see below). Residential real estate nearly equals the valuation of equities, and commercial real estate and farmland also have significant valuations

Frank Fabozzi and Robert Shiller wrote in 2010 "The property market represents the largest market in developed countries in Europe and the world, estimated between 30% and 40% of the value of all the underlying physical capital. But estimations of the value of the global stock of land are rare." William Larson estimated in 2002 that US real estate land was worth 60% of the total value, while agricultural and forestry were both worth 8%. One of the additional complications is that real estate and land owned by corporations are included in equity values, and mortgage values on real estate are included in the respective bond and fixed income categories. Shuller's team discounted those values in arriving at their calculations. For the end of 2015, they came to the conclusion that real estate accounted for 20%, and land accounted for 2%, of the global capital stock.

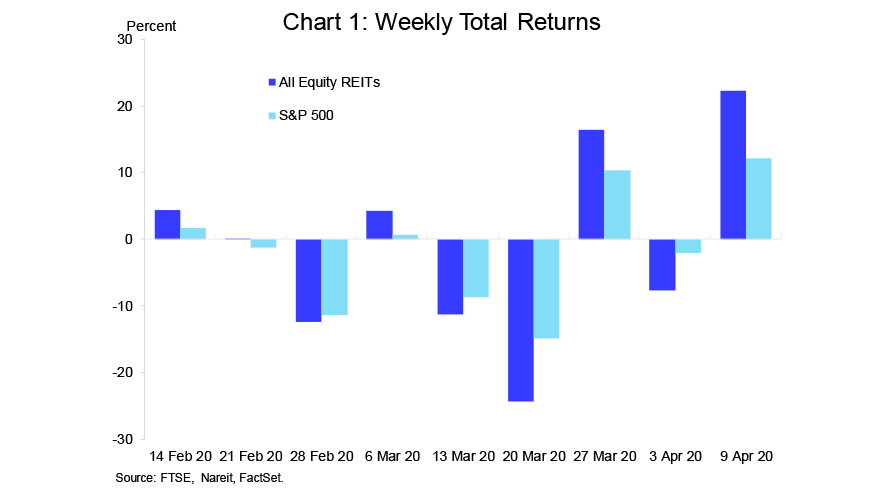

Many commentators have argued REITs are less attractive because of their volatility. For instance, Jeremy Siegel noted in Stocks for the Long Run that the Dow Jones REIT Index peaked in 2008, and REITs lost on average an astounding two-thirds of their value over a ten week period and “fell a total of 75 percent by the time the bear market ended in March 2009." Volatility of REITs also increased recently during the COVID crisis with weekly REIT returns on both the upside and downside exceeding those of S&P 500 for seven straight weeks beginning at the end of February 2020 (see graphic below - source). Risk can be measured by various metrics and while some imply REITs are riskier than stocks, others imply the opposite. For instance, Craig Israelsen found that REITs had both higher returns than stocks, and were arguably less risky than stocks based on having a higher percentage of years with positive returns (and standard deviation of annual returns were similar).

The real estate risk debate leads us into a discussion about returns and risks in homes. Credit Suisse Global 2012 Investment Returns Yearbook included commentary citing housing data for more than a century (including 2011 data from Neil Monnery, who studied house prices in the U.K., the U.S., France, Holland, Norway, Germany and Australia). One study by professors at the London Business School found that housing returned only 1.3 percent per year after inflation from 1900 to 2011, while stocks tended to perform more than four times better. They also compared the long-term capital appreciation of housing to gold’s performance. The best-performing house-price indexes were Australia and the United Kingdom. The United States was the worst with barely positive returns. According to the 2018 Credit Suisse Yearbook, US homes were the weakest performers among 11 countries rising just 2.2% annually over 118 years, or just 0.3% above inflation. But the key is this data and many other data sources do not include rental income, or an imputed cost savings for those living in their homes. Excluding rent or imputed costs for real estate or homes is similar to comparing bond values without the income, or stocks without the dividends. More recent research attempts to make the comparisons closer to an apples to apples discussion.

That brings us to the research and data published in recent years by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan Taylor. Their widely circulated paper titled "The Rate of Return on Everything, 1870–2015" was formally published in the August 2019 issue of The Quarterly Journal of Economics. The authors reviewed a new and comprehensive dataset covering total returns for housing as well as equity, bonds, and bills in 16 advanced economies from 1870 to 2015 (Australia, Belgium, Denmark, Finland, France, Germany, Italy, Japan, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States). Rather than looking at just home prices, they estimated home rents using various data sources to arrive at total returns summarized below.

"The first key finding is that residential real estate, not equity, has been the best long-run investment over the course of modern history. Although returns on housing and equities are similar, the volatility of housing returns is substantially lower."

They came to the conclusion that in many countries residential real estate, not equity, had been the best long-run investment. That finding appears to contradict the assumption that higher risks should come with higher rewards. See also the recently published paper The Total Return and Risk to Residential Real Estate by Piet Eichholtz and Matthijs Korevaar (4/6/2020). They conclude "the total rate of return to residential real estate investments ... for individual houses in Paris (1809-1942) and Amsterdam (1900-1979) ... net of costs and taxes, is 4.2% for Paris and 5.0% for Amsterdam"

Some have suggested that the managers of public REITs are often well payed, which could be a cost disadvantage. But the critical question is whether the managers create more value than their compensation, which is similar to the question of whether corporate managers are overpaid. With REITs you are hiring the managers to manage the real estate for you. Some private real estate investors make extraordinary returns, especially when they leverage their real estate investments. But many others underperform, or even lose money. Those investors that aren't confident in their ability to invest in real estate on their own can use professional managers, which obviously comes at a cost. Real Estate is arguably more complicated than investing in stocks so it makes sense for those that do not have real estate experience to employ others that are more experienced. To answer the question of whether REIT managers add value we again can look at the growing collection of data.

It may not be possible to get an accurate estimate of aggregate individual investors returns from various real estate investing options, but we do have useful and reliable data on real estate returns of institutional investors. For instance, REIT.com cites results from various investment options citing CEM Benchmarking's 2019 study, which provided a "comprehensive look at realized investment performance across asset classes over a 20-year period (1998-2017) using a unique dataset covering over 200 public and private sector pensions with nearly $3.8 trillion in combined assets under management." Big institutional investors invest in real estate in several ways. They invest in REITs, private real estate funds managed by professional managers, and they invest in real estate directly (their internal staff decides on the investments and manages them). REIT returns over the last 20 years significantly beat both the private funds, and internally managed real estate.

Listed equity REITs had gross returns averaging 11.4 percent and net returns of 10.9 percent (private equity was the only asset class in the study with higher net returns). The key finding is that listed REITs outperformed internally managed real estate and private partnerships. So in other words, rather than the cost of the REIT managers harming performance (which is what we often see with other asset classes), with REITs it would seem that the managers are adding value well above their cost. Perhaps the REIT structure, which results in liquid tradeable securities as well as transparency, results in a synergistic structure leading to stronger, rather than weaker returns.

Those that ask about the results prior to that study can find additional support for the argument from other sources. Some older data is even more favorable for public REITs. A 2011 article by Arleen Jacobius at P&I refers to Morningstar research that found an even wider performance discrepancy - "REITs provided an annualized rate of return of 9.3%, compared with 4.4% for private equity core funds, 3.7% for value-added funds and 6.1% for opportunistic funds between 1989 and 2009." Jacobius also cited a Cohen & Steers white paper that compared the returns of REITs and core real estate funds in finding that for 30 years ending 2010, "REITs outperformed by 487 basis points per year.”

In 2011, Morningstar found that for the 21 years 1989—2009, REITs were the top performer with a compound net total return of 9.3% versus 4.4% for private core funds. They also noted the fact that REIT fees and expenses averaged one-half to one-fourth of private equity real estate fees (which I would suggest is not unrelated to the underperformance). They concluded "Publicly traded equity REITs have outperformed core, value-added, and opportunistic funds consistently over the long term, experienced stronger bull markets, recovered faster from downturns, and had lower fees and expenses on average compared with private equity real estate funds."

Green Street Advisors commented in 2014 that REITs behave like real estate over extended time periods and deliver superior returns relative to what pension funds achieve via private real estate investing. They concluded "While this evidence has been accumulating for quite some time, an exhaustive new study by CEM Benchmarking of real-world investment performance should serve as the nail in the coffin of the crowd that eschews listed REITs." They noted at the time that listed REITs had only a 0.6% allocation, while private real estate had captured a 3.3% share.

Green Street Advisors found that on average, the return produced by nontraded REITs lagged their publicly-traded peers that specialize in the same kind of property by 3.6% per year. Non-traded REITs were even compared to Neanderthals (inferior to Homo sapiens, yet they managed to co-exist with them for thousands of years before going extinct). The average annualized returns for nontraded REITs were 10.9% for the 34 companies examined, compared to 14.5% for listed REITs. Cambridge Associates reported in 2017 that private equity real estate funds underperformed listed equity REITs by 3.9% per year over the prior 25 years.

The question for individuals investing in real estate is whether they should do the work themselves, invest in a partnership, or invest in REITs. The experience of institutional investors implies that publicly traded REITs are a better option than both internal management, and non public partnerships. But I will note, that new options have evolved in recent years, including several so-called crowd-funding options. Is Real Estate Crowdfunding Worth It? by Alana Benson (2/4/2020) noted that Fundrise (which charges a not unreasonable 1%) and Patch of Land launched in 2012, followed by RealtyMogul in 2013 and CrowdStreet in 2014. But she adds some reasons for caution, given that 1) RealtyShares, founded in 2013, shut down only five years later when it ran out of funding, 2) none of these companies has experienced a severe economic downturn, and 3) crowdfunded real estate platforms are also not required to register with the SEC. Some new organizations have also sprouted up in recent years offering private farmland investing options, including Farmtogether and AcreTrader.

There are many individuals and organizations that encourage individuals to invest directly in real estate and there are many that sell products or services to help people invest in fixer-uppers, or to "flip" real estate. I tend to be somewhat skeptical, given that REITs are a simpler option that is likely to result in stronger returns. I tend to be very skeptical of those that claim it is easy to make money in real estate, but there are also individuals that I find more credible, like popular youtuber Graham Stephan and Sam Dogen at FinancialSamurai. But I would caution real estate investors not to assume they can replicate the experiences of these two financial professionals. Both are relatively young, and I can relate to them because I was licensed as a California real estate agent, and as a stockbroker before I turned 21. Graham is a seasoned, motivated, and very driven real estate professional and Sam is an intelligent, hardworking, and very experienced investment professional with an MBA.

Fortunately, for both institutional investors and individual investors, REITs provide an option that doesn't require any unique expertise, and their investors don't have to do the work of finding reasonably priced real estate, negotiating, dealing with tenants, repairs, or any of the other property management activities. Returns for individuals can often be dramatically higher (or lower) if they employ more leverage, but that's a separate discussion, and in down cycles leverage could result in severe losses.

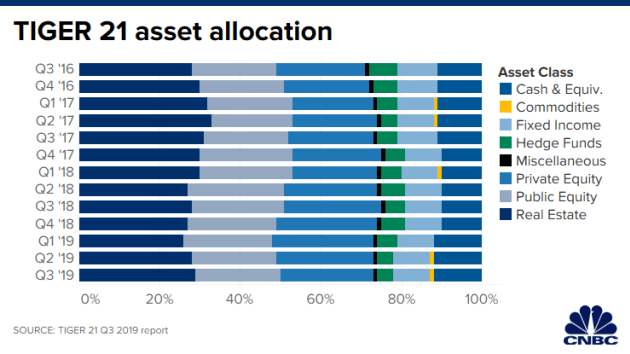

Another argument for overweighting REITs comes from wealthy investors. Tiger21 is a group of hundreds of individuals with at least $10 million to invest. Real estate was consistently the largest component of their asset allocation between 2016-2019. They reportedly had 29% allocated in real estate at the end of 3Q2019. Burton Malkiel also recently suggested investors consider higher REIT allocations, and many organization (like CALSTERS) have announced plans to increase REIT allocations.

Investment professionals tend to support specific strategies and narratives, and we know from behavioral finance that investors and investment professionals have many biases that can affect their financial decision making. Those that employ a factor based model often try to determine if an asset class can be replicated with other stocks or factors, but in my opinion using that information to argue for limiting REIT exposure to it's publicly traded market cap percentage is shortsighted. Contrary to the argument that REIT managers are paid too much, the data implies they are generally well worth their compensation. And given the strong returns, REIT outperformance of other forms of real estate investing, and real estate accounting for a much larger percentage of non-public universes, I find the argument for overweighting REITs to be much more persuasive. Recent polls have found the public tends to agree that real estate is the best long term investment (see Gallup's latest annual survey where 35% chose real estate versus 21% for stocks/mutual funds).

Public approval of Congress has been pretty weak recently, but in 1960 Congress may have created one of the best investing options for investors, and in fact over 35 countries have since created their own versions of REITs. REITs give investors the opportunity to buy one of the best long term investments in a liquid form. By using index mutual funds or ETFs that buy broad collections of REITs, investors can employ modern tools to create efficient portfolios that achieve both high returns and lower risk. The recent bear market triggered by the COVID-19 crisis may have made REITs even more attractive given that REITs overall have underperformed stocks this year, but that's a discussion for another day (some have argued real estate is facing problems, while others have suggested real estate has a positive outlook).

Before concluding I want to clarify that an appropriate allocation to real estate is complicated by whether you own a home, or other real estate assets. Large allocations to REITs can be especially attractive to young investors that don't own homes and have a high risk tolerance, and those with substantial wealth that have little or no real estate exposure. Perhaps Elon Musk's plans to sell his physical assets implies there are other wealthy investors with little or no direct real estate ownership. INVH - Invitation Homes and AMH - American Homes For Rent are recently created housing REITs that evolved following the global financial crisis and each owns tens of thousands of rental homes. Individuals that don't own homes might consider housing REITs, but with their limited history we don't know yet how their performance will compare to home indexes.

Additional Information and Links

I will be presenting a webinar on June 4, 2020 for the Los Angeles Chapter of AAII on the topic of Real Estate vs Stocks. Which is the better long term investment?. There is a no upfront charge, but donations are encouraged. I will also be writing more soon about an investing strategy based partly on this information. If you are interested in being notified about that, you can email me (host@investorhome.com).

The Case Against Overweighting REITs

- The Case Against REIT’s by Nicolas Rabener (2/6/2020) - "...real estate stocks are just not unique enough and introduce additional, unnecessary complexity for asset allocation models."

- The REIT Stuff? by Adam Grossman (12/22/2019)

- Swedroe: Real Estate Isn’t Special (4/30/2018) - Peter Mladina contributes to the literature on REITs as an asset class with the study Real Estate Betas and the Implications for Asset Allocation, (prior version) ... Mladina also concluded that if one were taking a factor-based approach to asset allocation, then “real estate would not be considered a separate source of return.” ... Jared Kizer and Sean Grover in their May 2017 paper, Are REITs a Distinct Asset Class? ... REITs are likely not a distinct asset class, especially when compared to the results of other industries. "For investors using asset classes to determine their allocation, the findings suggest that REITs should receive no more than a market-cap weighting. Data from Morningstar show REITs represent approximately 3.5% of the iShares Russell 3000 ETF (IWV) on a market-capitalization basis, which is a valid starting point for a REIT allocation."

- The Role of REITs in a Diversified Portfolio by Larry Swedroe (8/21/2017) - "According to data from Morningstar, REITs currently represent approximately 3.7% of the iShares Russell 3000 ETF (IWV) on a market-capitalization basis, which is a valid starting point for a REIT allocation in a diversified portfolio."

The Case For Overweighting REITs

- Why should I invest in REITs? from reit.com estimates approximately 87 million adult Americans, or roughly 44 percent of American households, own REIT stocks directly or indirectly through mutual funds, ETFs or target date funds.

- Time for a Second Look at REITs by Amy Arnott Morningstar (2/4/2020). Real estate (specifically REITs, as measured by the FTSE NAREIT All Equity REITs Index), has lagged the broader market for the past four years, but outperformed the S&P 500 by more than 1 percentage point per year, on average, over the period between May 1972 and December 2019. As of the end of 2018, the U.S. commercial real estate market totaled an estimated $16 trillion, compared with about $45.8 trillion for equities and $39.2 trillion for outstanding debt based on 2017 data from the Securities Industry and Financial Markets Association. In other words, real estate translates into a roughly 16% slice of the total market pie.

- REITs vs. Stocks In 2020 by Jussi Askola (2/4/2020). Over long time periods, REITs always have outperformed Stocks. During the past 20-year period, REITs generated nearly 2x higher annual returns

- Why Real Estate Will Always Be More Desirable Than Stocks and What Percentage Of Americans Own Stocks Or Real Estate? by Sam Dogen at FinancialSamurai.

- Help clients overcome fear when markets gyrate by Craig Israelsen (October 20, 2017)

Other References

- There are many good resources for learning about and researching REITs, for instance see Wikipedia and REIT.com. The following assumptions don't seem to be in dispute.

- Real estate is a relatively easy to understand asset, and arguably offers an attractive compromise between bonds and stocks.

- REIT indexes usually have higher dividend rates than stock indexes.

- REITs tend to offer some diversification benefits to stock investors due to price movement that is not perfectly correlated with the stock market.

- REITs are included in most broad US stock indexes and typically account for about 4% of capitalization recently.

- Real Estate for Long Term Investing - Chapter 16 of The Peaceful Investor.

- REITs Aren't a True Alternative. They're just stocks that look a little different, by Daniel Sotiroff Morningstar (8/14/2019) "Real estate investment trusts’ long-term total returns have been on par with the broader U.S. stock market. Between January 1972 and December 2018, the FTSE NAREIT Equity REIT Index returned 11.4% annually, which compares with 10.3% for the CRSP U.S. Total Market Index ... Real estate investment trusts are included in most broad stock index funds, like Vanguard Total Stock Market ETF (VTI), where they represent 4% of the portfolio."

- Is Real Estate Crowdfunding Worth It? by Alana Benson at Nerdwallet (2/4/2020)

- Has Real Estate or the Stock Market Performed Better Historically? By Sean Ross (7/15/2019) at Investopedia. According to the Case-Shiller Housing Index, the average annualized rate of return for housing increased 3.7% between 1928 and 2013. Stocks returned 9.5% annualized during the same time.

- Is It Just A Myth That Real Estate Is A Better Investment Than Stocks?

- 1200+ charts and data on US finances

“Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate.”Gary Karz, CFAAndrew Carnegie (1835-1919)

This quote is commonly attributed to the famous industrialist (for instance see 1, 2, 3, or 4) and doesn't seem to be disputed, but when I asked historian Martin Fridson about its origin, he suggested being skeptical that it is an accurate quote given there doesn't seem to be an actual original verifiable source.

Author of The Peaceful Investor and Publisher of InvestorHome.com

twitter.com/GKarz (email)

Check out Peaceful Investor at Amazon

Last update 5/22/2020. Copyright © 2020 Investor Home. All rights reserved. Disclaimer