The earliest investment portfolio and asset allocation recommendation dates back more than a millennium and it's relevance to modern investing was rediscovered by prominent investment professionals in the United States more than three centuries ago. The first time I recall reading about a "Talmud" strategy was in Jack Bogle's book Common Sense on Mutual funds, but many others have cited what is often referred to as “The Talmud Portfolio.”

The Talmud is a collection of Jewish texts under the category of the Oral Torah. The Jerusalem Talmud was published around 350–400 CE, while the widely cited Babylonian Talmud was published about 500 CE. The two components that make up the Talmud are the original source or Mishnah, and the Gemara (which is written in aramaic and includes additional writings that expand on the topics discussed in the Mishnah). The Talmud has impacted many fields, in fact many have suggested that the British and American legal systems were heavily influenced by the Talmud. This 1951 paper titled The Talmud--A Gateway to the Common Law by Charles Auerbach coincidentally also mentions the specific Gemara passage that is the source of The Talmud Portfolio.

There are many English translations of the specific Gemara. One online version of the specific section of Bava Metzia 42 translates as “Rebbi Yitzchak advises a person to invest his money - one third in land and one third in business, and the remaining third, he should hold in cash.” Another common translation is "Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep by him in reserve.” The translations I found generally agree that the first third should be invested in land (although some suggest the inference is to bury the money), but the second third has also been translated as merchandise, and the final third has also been translated as keeping money readily available. The Gemara expands on the Mishnah, which in the respective section discusses the concept of negligence by a custodian. I discussed the background of the Talmud and this passage in more depth with Sal Litvak at AccidentalTalmudist.com (see video embedded below).

Many investment commentators have summarized that a modern day version of a Talmud strategy could be one third REITs, one third stocks, and one third bonds. Modern versions of these investments can be bought on public exchanges and are very liquid, which arguably satisfies the recommendation to have your money readily available.

I haven't been able to find a source that identifies the Rabbi Yitzchak being cited in the Gemara, so I still don't know which century the advice sources to, but given that the Gemara dates back to at least 500 CE, we know the original advice is at least 15 centuries old. While I first heard about the Talmud Portfolio in Bogle's book, Bogle cited a 1997 paper by Ken Fisher and Meir Statman titled Investment Advice from Mutual Fund Companies, and subtitled "Closer to the Talmud than to Markowitz" (Journal of Portfolio Management, Fall 1997). I asked Professor Statman if he recalled where he first learned of the strategy and he told me he heard about it from a lecture by Meir Tamari.

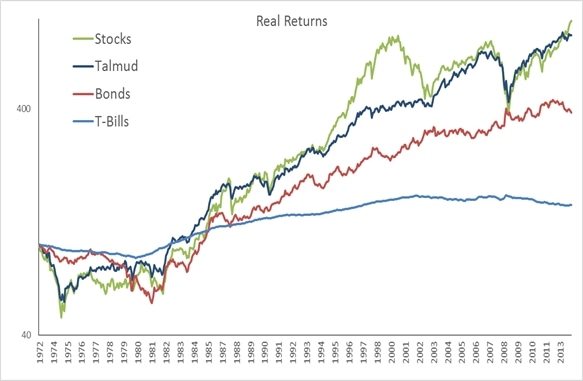

Others also picked up on the idea (some apparently independently), including Roger Gibson who wrote about a Talmud Strategy in his book Asset Allocation: Balancing Financial Risk (first published in 1989). Gibson, like Bogle is not Jewish, and he recently told me that he found the quote in a book of quotations. There are many web sites I've found that have backtested versions of the Talmud Portfolio, for instance Lazy Portfolio ETF updates monthly (with data back to 1994) and they even include Gibson in the portfolio name. They have the simple portfolio divided into a third each in ETFs VTI, VNQ, and BND. Meb Faber also refers to the strategy and summarized 40 years of data on a US version of "The Talmud Portfolio" in his book Global Asset Allocation (including the graphic below, which shows returns only slightly below 100% stocks, but with much less risk).

Many that discuss The Talmud Portfolio have focused on a US only version, but I believe for most investors a global version is most appropriate. Rabbi Yitzhak probably lived in the middle east when he made the recommendation and the United States of America did not exist. In fact, the paragraph in Bogle's book that introduces the discussion about the Talmud Portfolio starts with a discussion of modern portfolio theory, which "dictates the portfolio composition should include all liquid assets-not only U.S. stocks, bonds, and cash reserves, but international investments ..." The global wealth portfolio is a more logical benchmark than a US oriented portfolio (see Chapter 13 of The Peaceful Investor). William Sharpe first suggested in 1964 the market portfolio was the natural starting point in portfolio construction. In theory you can attempt to buy index funds owning the investable assets globally in proportion to their market capitalization (but not all assets are investable, or easily measurable). There are many complications (and some unknown quantities) in estimating the total value of all assets. Bogle mentioned the Talmud recommendation as a simpler option relative to the arguably complex strategy of replicating the global wealth portfolio.

In 1983 Roger Ibbotson and Laurence Siegel made the first public attempt to quantify The World Market Wealth Portfolio and they estimated that real estate accounted for over 52% of the world's wealth as of 1980 (about 20% US and 32% foreign). A 2014 titled The Global Multi-Asset Market Portfolio 1959-2012 estimated real estate only accounting for 5% of the global market portfolio, but they focused on the invested market portfolio, which included publicly available financial assets only (in other words, no private real estate). Gregory Gadzinski, Markus Schuller, and Andrea Vacchino broadened the discussion with their 2018 paper The Global Capital Stock: Finding a Proxy for the Unobservable Global Market Portfolio (see also Benchmarking Multi-Asset Portfolios: The Global Capital Stock). Solactive has a market index that seeks to track the performance of the World Market Portfolio (backfilled from a starting value of 100 on 5/9/2007). One of the largest components of that index is the global REIT ETF "REET" which is one example of a global alternative to the frequently cited US focused Vanguard REIT ETF VNQ. Adding VNQI to VNQ would be another option for adding international real estate. Similarly, international bond fund BNDX can be added to BND, while AGG and IAGG are alternative domestic and international bond funds. There are also many options for the third in stocks, including the ETF VT as a global alternative to VTI.

For more on REITs and why many investors are underweight real estate, see my prior articles Betting on Bricks (5/27/2020 via Humble$) and The Case for Overweighting REITS (5/22/2020).

While it is relatively easy to create a portfolio attempting to replicate The Talmud Portfolio it could become even easier. If you are interested, email me (at host at investorhome dot com). To be continued...

Category Equity (business) Real Estate Bonds US only Talmud Portfolio 1/3 VTI 1/3 VNQ 1/3 BND Global Talmud Portfolio 1/3 VT (or other) 1/3 REET (or VNQ/VNQI) 1/3 BND/BNDX (or AGG/IAGG) Global Capital Stock (2015) 33% Private & Public Equity 22% Global Real Estate & Land World Market Wealth (1980) 33% Foreign + 20% US Real Estate

The Talmud Portfolio from Salvador Litvak on Vimeo.

Gary Karz, CFA

Author of The Peaceful Investor and Publisher of InvestorHome.com

twitter.com/GKarz (email)

Check out Peaceful Investor at Amazon