Buy The Peaceful Investor at Amazon

Table of Contents and Launch Site

I am offering the online chapters of the book using "The Honor System." Tip options at the bottom of the page.

"To keep your money safe, you must rely not on regulators, but on your own care and due diligence. Look into fees and risks before you give the slightest thought to performance. Ask plenty of questions, and never trust anyone who promises to make you rich quick or to increase your return without raising risk."

Jason Zweig, "The Best Interest Is Self-Interest," Wall Street Journal, March 8, 2019

Should you be handling your own investments?

![]() Hiring an advisor doesn’t necessarily mean giving complete control of your finances to someone else. For many, it is appropriate to pay someone to oversee the decision making, as well as the actual transactions, paperwork, and other activities. But for some investors just adding an advisor to provide advice or give a second opinion may be appropriate. Before you complete an investment plan you should ask yourself several important questions.

Hiring an advisor doesn’t necessarily mean giving complete control of your finances to someone else. For many, it is appropriate to pay someone to oversee the decision making, as well as the actual transactions, paperwork, and other activities. But for some investors just adding an advisor to provide advice or give a second opinion may be appropriate. Before you complete an investment plan you should ask yourself several important questions.

![]() If the answer is no to any of those questions, you should consider seeking an advisor who is qualified to help you invest your money (the alternative is to spend more time and effort on educating yourself). If the answers are yes and you have a significant amount of money, you may want to test yourself to determine whether you really do know as much about investing as you think you do (see http://www.investorhome.com/tests.htm). You should also revisit chapter three and consider whether you exhibit any of the common investor biases that could cause you to underperform, or take unnecessary risks.

If the answer is no to any of those questions, you should consider seeking an advisor who is qualified to help you invest your money (the alternative is to spend more time and effort on educating yourself). If the answers are yes and you have a significant amount of money, you may want to test yourself to determine whether you really do know as much about investing as you think you do (see http://www.investorhome.com/tests.htm). You should also revisit chapter three and consider whether you exhibit any of the common investor biases that could cause you to underperform, or take unnecessary risks.

![]() If you aren't well educated but you enjoy investing, you should ask yourself whether you are willing to accept lower returns and higher risk than you might get by using a qualified advisor. It's not a bad idea to take a serious look in the mirror and ask yourself whether you would hire the person you are looking at (as if you were a stranger) knowing how much experience you have and your education in investments, finance, and portfolio theory. Your investment decisions and actions can have a major impact on your financial future and they should not be taken lightly.

If you aren't well educated but you enjoy investing, you should ask yourself whether you are willing to accept lower returns and higher risk than you might get by using a qualified advisor. It's not a bad idea to take a serious look in the mirror and ask yourself whether you would hire the person you are looking at (as if you were a stranger) knowing how much experience you have and your education in investments, finance, and portfolio theory. Your investment decisions and actions can have a major impact on your financial future and they should not be taken lightly.

![]() According to a recent study from Charles Schwab, self-directed clients who have help from a financial advisor are more fully invested, better diversified and on average have a higher account balance when compared to investors who do it all by themselves.1 The survey reviewed over 100,000 self-directed Schwab accounts (about 19% of them were run with the help of an advisor). On average non-advised accounts had 16% sitting in cash, versus 4% for those who had assistance from advisors, plus advised accounts were less concentrated in individual stocks.

According to a recent study from Charles Schwab, self-directed clients who have help from a financial advisor are more fully invested, better diversified and on average have a higher account balance when compared to investors who do it all by themselves.1 The survey reviewed over 100,000 self-directed Schwab accounts (about 19% of them were run with the help of an advisor). On average non-advised accounts had 16% sitting in cash, versus 4% for those who had assistance from advisors, plus advised accounts were less concentrated in individual stocks.

![]() Investing does not have to be rocket science, but at a minimum, you should understand the basics of portfolio management and diversification and be familiar with historical rates of returns and risks for the major asset classes. Another question is whether you have the time to handle your own investments and is it the best use of your time? If you are foregoing significant income opportunities with the time you spend on investing, you may be losing money. You might also want to consider what you'd prefer to do with the time you'd otherwise spend on investing. If you have the education, the time, and the willingness to be responsible for your own investment performance (good or bad) you can continue managing your own money (and skip the next sections about choosing an advisor).

Investing does not have to be rocket science, but at a minimum, you should understand the basics of portfolio management and diversification and be familiar with historical rates of returns and risks for the major asset classes. Another question is whether you have the time to handle your own investments and is it the best use of your time? If you are foregoing significant income opportunities with the time you spend on investing, you may be losing money. You might also want to consider what you'd prefer to do with the time you'd otherwise spend on investing. If you have the education, the time, and the willingness to be responsible for your own investment performance (good or bad) you can continue managing your own money (and skip the next sections about choosing an advisor).

Six in 10 non-retirees who hold self-directed retirement savings accounts, such as a 401(k) or IRA, have little or no comfort in managing their investments.Report on the Economic Well-Being of U.S. Households in 2018 (May 2019)2

Researching Advisors (if you decide to get help)

ou should first define your objectives when potentially hiring an advisor. Before contacting potential advisors, it’s a good idea to know in advance what your expectations are. The following are common reasons for getting help, and identifying reasons in advance should assist your interactions with advisors, as well as possibly help you reduce your costs.

![]() An advisor may not be able to help you if they don't know what you want. It is your own responsibility to make sure that you provide an advisor with the information they will need to advise you appropriately.

An advisor may not be able to help you if they don't know what you want. It is your own responsibility to make sure that you provide an advisor with the information they will need to advise you appropriately.

![]() When asked what they most want from a financial advisor, 83% of consumers listed education first, according to a survey of 4,000 households by Dalbar in 1996.3 80% chose minimize taxes, 70% highest returns, 68% protect from loss, 68% prevent mistakes, 64% written plan, 63% help define goals, and 58% chose change investments.

When asked what they most want from a financial advisor, 83% of consumers listed education first, according to a survey of 4,000 households by Dalbar in 1996.3 80% chose minimize taxes, 70% highest returns, 68% protect from loss, 68% prevent mistakes, 64% written plan, 63% help define goals, and 58% chose change investments.

![]() A 2015 Certified Financial Planner Board survey of 1002 adults found that 4 in 10 consumers indicated they were working with or using a financial planner or advisor, which was a 12 point increase from 2010. The most common concerns were retirement goals and planning, savings goals and planning, cash and debt management, balancing short-and long-term goals and planning, and Investment goals and planning.4

A 2015 Certified Financial Planner Board survey of 1002 adults found that 4 in 10 consumers indicated they were working with or using a financial planner or advisor, which was a 12 point increase from 2010. The most common concerns were retirement goals and planning, savings goals and planning, cash and debt management, balancing short-and long-term goals and planning, and Investment goals and planning.4

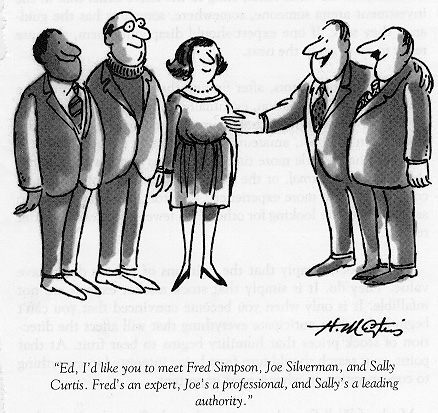

![]() Before deciding on an advisor it can be helpful to make a list of candidates. The following are some questions that may be helpful in evaluating advisors and their organizations. You can choose any that you feel are relevant to your needs (or you can ask all of them if you're looking for weaknesses, or trying to discourage an advisor that won’t leave you alone).

Before deciding on an advisor it can be helpful to make a list of candidates. The following are some questions that may be helpful in evaluating advisors and their organizations. You can choose any that you feel are relevant to your needs (or you can ask all of them if you're looking for weaknesses, or trying to discourage an advisor that won’t leave you alone).

![]() It is very likely if you interview multiple advisors, that several will appear to be very experienced and very qualified. For your own protection you should verify as much as possible, especially about credential and licenses. You can check U.S. licensed advisors and brokers at https://brokercheck.finra.org/.

It is very likely if you interview multiple advisors, that several will appear to be very experienced and very qualified. For your own protection you should verify as much as possible, especially about credential and licenses. You can check U.S. licensed advisors and brokers at https://brokercheck.finra.org/.

![]() There are many types of advisors. Banks, Stockbrokers, Money Managers, Registered Investment Advisors (RIA), and Financial Planners are all potential advisers for your investments. There are estimated to be about 300,000 "financial advisors" in the United States5 and the U.S. Bureau of Labor Statistics actually projected that number will grow 15% by 2026.6

There are many types of advisors. Banks, Stockbrokers, Money Managers, Registered Investment Advisors (RIA), and Financial Planners are all potential advisers for your investments. There are estimated to be about 300,000 "financial advisors" in the United States5 and the U.S. Bureau of Labor Statistics actually projected that number will grow 15% by 2026.6

![]() A “Registered Representative” is licensed to transact securities and they used to commonly be known by the term “Stockbroker” but they often use other terms like “financial advisor.” They must pass one or more National Association of Securities Dealers (NASD) series exams, but there may not be an explicit financial planning component depending on the specific license. Representatives are licensed through the Financial Industry Regulatory Authority (FINRA) which is a private corporation that acts as a self-regulatory organization (NASD is also self-regulated).

A “Registered Representative” is licensed to transact securities and they used to commonly be known by the term “Stockbroker” but they often use other terms like “financial advisor.” They must pass one or more National Association of Securities Dealers (NASD) series exams, but there may not be an explicit financial planning component depending on the specific license. Representatives are licensed through the Financial Industry Regulatory Authority (FINRA) which is a private corporation that acts as a self-regulatory organization (NASD is also self-regulated).

![]() A Registered Investment Advisor (or RIA) is an individual, or a firm, that has filed with the SEC or state(s) and paid a modest fee. RIAs are fiduciaries, meaning they agree to place the client’s interests first, before their own. Registered Representatives that are not fiduciaries can advise clients to invest in securities or products that may not be in the clients best interest as long as they are “suitable“ (more on this topic later in this chapter, including new regulations expected to be implemented in the U.S. in 2020). RIAs with no FINRA licenses make up just 8% of all types of registered representatives, but the number of SEC-registered RIAs has risen 20% from 2012.7

A Registered Investment Advisor (or RIA) is an individual, or a firm, that has filed with the SEC or state(s) and paid a modest fee. RIAs are fiduciaries, meaning they agree to place the client’s interests first, before their own. Registered Representatives that are not fiduciaries can advise clients to invest in securities or products that may not be in the clients best interest as long as they are “suitable“ (more on this topic later in this chapter, including new regulations expected to be implemented in the U.S. in 2020). RIAs with no FINRA licenses make up just 8% of all types of registered representatives, but the number of SEC-registered RIAs has risen 20% from 2012.7

![]() Some Certified Public Accountants (CPAs) offer investment services. To become a CPA, an individual must pass a rigorous test administered nationally and receive state accountancy board approval. CPAs may or may not also have some investment education and a license, in fact many CPAs choose not to offer investment services because they consider it a conflict of interest. Those that do offer both accounting and investment services tend to have existing relationships with their accounting clients which can be an advantage for also offering investment services.

Some Certified Public Accountants (CPAs) offer investment services. To become a CPA, an individual must pass a rigorous test administered nationally and receive state accountancy board approval. CPAs may or may not also have some investment education and a license, in fact many CPAs choose not to offer investment services because they consider it a conflict of interest. Those that do offer both accounting and investment services tend to have existing relationships with their accounting clients which can be an advantage for also offering investment services.

![]() The Certified Financial Planner (CFP) credential is generally highly regarded for professionals that work with individual investors. The credential is certified by the Financial Planner Board of Standards and candidates must pass a 10 hour exam and agree to abide by their code of ethics.

The Certified Financial Planner (CFP) credential is generally highly regarded for professionals that work with individual investors. The credential is certified by the Financial Planner Board of Standards and candidates must pass a 10 hour exam and agree to abide by their code of ethics.

![]() The Chartered Financial Analyst (CFA) designation is considered the gold standard in the investment business and it is awarded by the CFA Institute (I am a CFA Charterholder). It is recognized worldwide and commonly held by institutional money managers, investment advisors, and stock analysts. Candidates must pass three extensive and rigorous six hour exams sequentially covering a comprehensive curriculum and must provide character references and agree to adhere to the Code of Ethics and Standards of Professional Conduct.

The Chartered Financial Analyst (CFA) designation is considered the gold standard in the investment business and it is awarded by the CFA Institute (I am a CFA Charterholder). It is recognized worldwide and commonly held by institutional money managers, investment advisors, and stock analysts. Candidates must pass three extensive and rigorous six hour exams sequentially covering a comprehensive curriculum and must provide character references and agree to adhere to the Code of Ethics and Standards of Professional Conduct.

![]() While there are many credentials and licenses, keep in mind that some may advertise and claim to be advisors, but not be licensed. Others may have a license, but not an investment license. For example, there are individuals that are licensed to sell insurance, or some are licensed accountants that sell investments, but they may not be a Registered Investment Advisor.

While there are many credentials and licenses, keep in mind that some may advertise and claim to be advisors, but not be licensed. Others may have a license, but not an investment license. For example, there are individuals that are licensed to sell insurance, or some are licensed accountants that sell investments, but they may not be a Registered Investment Advisor.

![]() Money magazine noted that there are “at least 100 financial designations, and many are just empty titles that don't mean much. The title ‘retirement specialist,’ for example, is a made-up label that has no backing from any industry group.”8 Allan Roth showed off the plaque earned by "Max Tailwager" for being one of “America's Top Financial Planners” in a 2009 column. The problem is that Max is Roth’s dog, yet he was able to order the plaque just by responding to a mailer and paying for it.[9]9

Money magazine noted that there are “at least 100 financial designations, and many are just empty titles that don't mean much. The title ‘retirement specialist,’ for example, is a made-up label that has no backing from any industry group.”8 Allan Roth showed off the plaque earned by "Max Tailwager" for being one of “America's Top Financial Planners” in a 2009 column. The problem is that Max is Roth’s dog, yet he was able to order the plaque just by responding to a mailer and paying for it.[9]9

There are no requirements for managing billions of dollars, but before somebody can trim your sideburns, he or she has to pass some sort of test. Given the record of the average fund manager over the last decade, maybe it should be the other way around.

Peter Lynch, Beating the Street

Choosing an Advisor

When you choose a doctor, you want someone with the appropriate credentials, experience, and preferably a good bed side manner. Likewise, with choosing a financial advisor you should seek an advisor that you feel comfortable with both personally and professionally. You should also be confident in the advisor’s ethics. In that regard you should be aware of how an advisor is compensated. There are many ways advisors can get compensated. Registered representatives historically were paid on commissions on transactions, but the industry has been shifting in recent decades to a fee based on the respective assets, which is also the common model for RIAs and funds. Commission based compensation can encourage trading and churning, which may not be in the client’s best interest. But for some investors, like those that buy and hold securities for long periods, commissions may actually be a good option, in fact some clients that were switched to fee based accounts have filed law suits against their advisors.10 Hedge funds and other private funds also tend to have performance based compensation structures and some advisors also have a performance incentive. Hourly fees have also become more common for financial planners and advisors and some also charge flat fees for investment services.

![]() Business Week's cover story on February 20, 1995 was titled "Can you trust your broker?" The issue discussed full commission brokers' compensation structures that "can encourage 'churning,' excessive trading of customer accounts." The article focused on incentives "such as Rolex watches and all-expense-paid vacations" given to brokers to sell certain products. The industry has been moving away from the controversial compensation structures for decades, and there are certainly plenty of honest brokers who provide valuable services, but the bottom line is that investors should be aware of full service brokers' conflicts of interests when they evaluate the broker and their recommendations. The broker's knowledge, experience, and reputation are obviously important elements to consider as well.

Business Week's cover story on February 20, 1995 was titled "Can you trust your broker?" The issue discussed full commission brokers' compensation structures that "can encourage 'churning,' excessive trading of customer accounts." The article focused on incentives "such as Rolex watches and all-expense-paid vacations" given to brokers to sell certain products. The industry has been moving away from the controversial compensation structures for decades, and there are certainly plenty of honest brokers who provide valuable services, but the bottom line is that investors should be aware of full service brokers' conflicts of interests when they evaluate the broker and their recommendations. The broker's knowledge, experience, and reputation are obviously important elements to consider as well.

![]() Evidence of another potential problem was also discussed in Worth Magazine's September 1996 issue which included the following. "A study by Prophet Market Research & Consulting of San Francisco has found that stockbrokers often dispense specific investment advice with little or no basic knowledge of the customer's individual needs. Prophet used 93 'mystery shoppers' who presented themselves as first-time investors to 21 brokerage firms. Prophet said that many of the brokers who dealt with its shoppers failed to inquire about even such basic matters as the income level or tax bracket of the customers. More than a quarter of the brokers provided investment advice without asking about a customer's investment history or willingness to tolerate risk, the study reports."11

Evidence of another potential problem was also discussed in Worth Magazine's September 1996 issue which included the following. "A study by Prophet Market Research & Consulting of San Francisco has found that stockbrokers often dispense specific investment advice with little or no basic knowledge of the customer's individual needs. Prophet used 93 'mystery shoppers' who presented themselves as first-time investors to 21 brokerage firms. Prophet said that many of the brokers who dealt with its shoppers failed to inquire about even such basic matters as the income level or tax bracket of the customers. More than a quarter of the brokers provided investment advice without asking about a customer's investment history or willingness to tolerate risk, the study reports."11

You are engaged in a life-and-death struggle with the financial services industry. Every dollar in fees, expenses, and spreads you pay them comes directly out of your pocket. If you act on the assumption that every broker, insurance salesman, mutual fund salesperson, and financial advisor you encounter is a hardened criminal, you will do just fine.

William Bernstein in The Investor's Manifesto

![]() There are many activities that can be suspicious and not in a client’s best interest. Failing to diversify adequately and choosing investments not suited to a client’s goals and constraints aren’t as common these days, but they do still occur and generally you want an advisor that does not react emotionally or with a short-term orientation. Some managers may be excessively risk averse which can result in less likelihood of losses (and losing an account), but may also result in lower returns than are available elsewhere. Some managers attempt to match the market (commonly referred to as closet indexing), which can reduce the risk of significantly underperforming and getting fired. Closet indexing is good in that the client gets close to market returns, but the client can get that by indexing themselves without having to pay the advisor. This behavior can occur typically when an advisor has performed well in the recent past. This can be similar to a football team playing a "prevent defense" near the end of a game (whereby a team with a lead tries to prevent big plays, but allows short and medium gains that will run the clock out). Likewise a manager is unlikely to be fired for slight underperformance, therefore taking few risks may reduce the likelihood of losing an account in some cases.

There are many activities that can be suspicious and not in a client’s best interest. Failing to diversify adequately and choosing investments not suited to a client’s goals and constraints aren’t as common these days, but they do still occur and generally you want an advisor that does not react emotionally or with a short-term orientation. Some managers may be excessively risk averse which can result in less likelihood of losses (and losing an account), but may also result in lower returns than are available elsewhere. Some managers attempt to match the market (commonly referred to as closet indexing), which can reduce the risk of significantly underperforming and getting fired. Closet indexing is good in that the client gets close to market returns, but the client can get that by indexing themselves without having to pay the advisor. This behavior can occur typically when an advisor has performed well in the recent past. This can be similar to a football team playing a "prevent defense" near the end of a game (whereby a team with a lead tries to prevent big plays, but allows short and medium gains that will run the clock out). Likewise a manager is unlikely to be fired for slight underperformance, therefore taking few risks may reduce the likelihood of losing an account in some cases.

![]() In contrast, a manager that has significantly underperformed may also exhibit behavior that is not in the client’s best interest. When a team is losing and time is about to run out, they will typically through a bomb (or “Hail Mary” implying that it would take divine intervention for the play to succeed). Similarly, active managers that have underperformed will be tempted to take additional risk in an effort to catch up. An active manager on the verge of getting fired may take larger risks since he or she is likely to get fired anyway. Throwing the bomb may be his last chance to keep a client. Researchers have documented that mid-year managers that are underperforming tend to increase fund volatility relative to managers that are outperforming.12

In contrast, a manager that has significantly underperformed may also exhibit behavior that is not in the client’s best interest. When a team is losing and time is about to run out, they will typically through a bomb (or “Hail Mary” implying that it would take divine intervention for the play to succeed). Similarly, active managers that have underperformed will be tempted to take additional risk in an effort to catch up. An active manager on the verge of getting fired may take larger risks since he or she is likely to get fired anyway. Throwing the bomb may be his last chance to keep a client. Researchers have documented that mid-year managers that are underperforming tend to increase fund volatility relative to managers that are outperforming.12

![]() There are many other potential positives and negatives to consider in evaluating individuals and companies that provide financial services. Public companies in the investment business generally have a conflict of interest. Public companies have a duty to their shareholders to maximize their profits, which may conflict with the interest of their clients. For much more in depth discussions on that topic see “A New Order of Things – Bringing Mutuality to the ‘Mutual’ Fund” by Jack Bogle (or William Bernstein's The The Investor's Manifesto). Bogle documented that returns for mutual funds of nonprofit and privately owned mutual fund companies outperform those of publicly owned mutual fund companies.13

There are many other potential positives and negatives to consider in evaluating individuals and companies that provide financial services. Public companies in the investment business generally have a conflict of interest. Public companies have a duty to their shareholders to maximize their profits, which may conflict with the interest of their clients. For much more in depth discussions on that topic see “A New Order of Things – Bringing Mutuality to the ‘Mutual’ Fund” by Jack Bogle (or William Bernstein's The The Investor's Manifesto). Bogle documented that returns for mutual funds of nonprofit and privately owned mutual fund companies outperform those of publicly owned mutual fund companies.13

![]() A separate, but related question about working with advisors that goes beyond the fees, is when they charge the client. I generally don’t have a problem with investors paying a reasonable commission charge or one-time expense for a service (financial planning for example) that they know about in advance and agree to (although there may often be a way to avoid the charges), but I am skeptical of advisors that charge fees in advance (for instance, quarterly management fees). Regulators tend to interpret RIAs charging management fees in advance as making the advisor a debtor of the client. For obvious reasons, it’s preferable to work with an advisor that only collects their compensation after providing the service rather than in advance. Logically, if an advisor is going to help you make money (rather than lose money) they should prefer to earn their fee on the assumed larger account at the end of a quarter, or period.

A separate, but related question about working with advisors that goes beyond the fees, is when they charge the client. I generally don’t have a problem with investors paying a reasonable commission charge or one-time expense for a service (financial planning for example) that they know about in advance and agree to (although there may often be a way to avoid the charges), but I am skeptical of advisors that charge fees in advance (for instance, quarterly management fees). Regulators tend to interpret RIAs charging management fees in advance as making the advisor a debtor of the client. For obvious reasons, it’s preferable to work with an advisor that only collects their compensation after providing the service rather than in advance. Logically, if an advisor is going to help you make money (rather than lose money) they should prefer to earn their fee on the assumed larger account at the end of a quarter, or period.

![]() As I discussed in depth in chapter seven, investment costs reduce returns. Each layer of fees decreases your expected return, while increasing the amount you pay advisors and subadvisors. Wrap fees effectively mean your advisor makes money and the wrap manager also makes money, likely at your expense. Portfolios of active funds or managers also reduce your odds of success in investing. As discussed in chapter nine, active management is a zero-sum game and the more active funds you own (and the longer the time frame) the worse your odds get of beating the market and fully diversified index funds. You should double and triple check to make sure that you are aware of all the charges and fees you are incurring when you use investment advisors and services.

As I discussed in depth in chapter seven, investment costs reduce returns. Each layer of fees decreases your expected return, while increasing the amount you pay advisors and subadvisors. Wrap fees effectively mean your advisor makes money and the wrap manager also makes money, likely at your expense. Portfolios of active funds or managers also reduce your odds of success in investing. As discussed in chapter nine, active management is a zero-sum game and the more active funds you own (and the longer the time frame) the worse your odds get of beating the market and fully diversified index funds. You should double and triple check to make sure that you are aware of all the charges and fees you are incurring when you use investment advisors and services.

While we are on the subject of minimizing costs, we need to warn you to beware of stockbrokers. Brokers have one priority: to make a good income for themselves. That's why they do what they do the way they do it. The stockbroker's real job is not to make money for you but to make money from you. Of course, brokers tend to be nice, friendly, and personally enjoyable for one major reason: Being friendly enables them to get more business. So don't get confused. Your broker is your broker-period.Burton Malkiel and Charles Ellis in The Elements of Investing

Suitability, Best Interest, and Fiduciary Standards

![]() On January 22, 2010 the SEC issued a report in response to the Dodd-Frank Wall Street Reform and Consumer Protection Act. The SEC's mandate was to resolve differences between the suitability standard that Stockbrokers are held to and the fiduciary standard that Registered Investment Advisors are held to. The report continued a debate that has gone on for decades.14

On January 22, 2010 the SEC issued a report in response to the Dodd-Frank Wall Street Reform and Consumer Protection Act. The SEC's mandate was to resolve differences between the suitability standard that Stockbrokers are held to and the fiduciary standard that Registered Investment Advisors are held to. The report continued a debate that has gone on for decades.14

Brokers have never enjoyed the purest of reputations in our popular imagination. From the corruptible Bud Fox of Wall Street to the manipulative bond salesmen of Liar's Poker, the people whose job it is to push investments out the door and into investors' arms have often been depicted as morally elastic. After all, brokers are ultimately salespeople who are generally compensated by commission and whose primary loyalty is to their employers . . . You wouldn't go to a doctor who earns a commission on every prescription he writes. Why treat your finances with any less respect.Elizabeth Ody15

![]() Elizabeth Ody wrote a thought provoking summary of the then pending SEC decision in the December 2010 issue of Kiplinger's. She directly asked the question “Whose Advice Can You Trust?” in the title and noted in the subtitle "The feds want to level the playing field between brokers and advisors. It may not make a difference." One critical issue revolves around the current situation whereby Stockbrokers can have two hats (one broker hat and one advisor hat). The standard they must meet depends on which hat they wear. Stockbrokers are relatively easy to identify because they are required by law to identify themselves with the phrase “Securities offered through (firm name).”16

Elizabeth Ody wrote a thought provoking summary of the then pending SEC decision in the December 2010 issue of Kiplinger's. She directly asked the question “Whose Advice Can You Trust?” in the title and noted in the subtitle "The feds want to level the playing field between brokers and advisors. It may not make a difference." One critical issue revolves around the current situation whereby Stockbrokers can have two hats (one broker hat and one advisor hat). The standard they must meet depends on which hat they wear. Stockbrokers are relatively easy to identify because they are required by law to identify themselves with the phrase “Securities offered through (firm name).”16

![]() When Stockbrokers are not providing financial advice, they can wear the broker hat. By providing products that are suitable, but possibly not in the client's best interest, Stockbrokers are often placed in situations which create conflicts of interest with those clients. Research (cited below) has consistently found that investors are confused regarding regulations and standards for investment professionals, mistakenly believe investment professionals have their best interests in mind, and the industry takes advantage of the environment to make more money from investors. Troubling research findings include the following.

When Stockbrokers are not providing financial advice, they can wear the broker hat. By providing products that are suitable, but possibly not in the client's best interest, Stockbrokers are often placed in situations which create conflicts of interest with those clients. Research (cited below) has consistently found that investors are confused regarding regulations and standards for investment professionals, mistakenly believe investment professionals have their best interests in mind, and the industry takes advantage of the environment to make more money from investors. Troubling research findings include the following.

![]() There is a long list of reasons why investors should be on guard regarding interaction with a Stockbroker given the gap between the suitability and fiduciary standards. In particular, when a Stockbroker moves from one firm to another, the Stockbroker may have entered into an agreement with the new firm that pays them upfront out of future earnings they are expected to generate from their clients.

There is a long list of reasons why investors should be on guard regarding interaction with a Stockbroker given the gap between the suitability and fiduciary standards. In particular, when a Stockbroker moves from one firm to another, the Stockbroker may have entered into an agreement with the new firm that pays them upfront out of future earnings they are expected to generate from their clients.

![]() Approximately 9% (27,000) of advisors in the U.S. switched firms in 2018.25 InvestmentNews maintains a web page listing advisors that move from one to another firm along with their assets under management and Advisorhub.com maintains a “Recruiting Wire Scoreboard.”26 Sadly, what you are unlikely to hear in articles about advisers switching firms is how the client portfolios of those advisers performed. The focus is generally on how much money the adviser made for themselves and their firms, which by definition comes out of their clients' returns.

Approximately 9% (27,000) of advisors in the U.S. switched firms in 2018.25 InvestmentNews maintains a web page listing advisors that move from one to another firm along with their assets under management and Advisorhub.com maintains a “Recruiting Wire Scoreboard.”26 Sadly, what you are unlikely to hear in articles about advisers switching firms is how the client portfolios of those advisers performed. The focus is generally on how much money the adviser made for themselves and their firms, which by definition comes out of their clients' returns.

![]() How much is it worth to the brokerage industry to not have to meet a fiduciary standard? Since many of the brokerage firms are public companies, we actually got some good estimates from the analysts at some of those brokerage firms that are trained in making those types of financial projections. There was one estimate in a 2010 New York Times article which included the following very telling note. "Guy Moszkowski, a securities industry analyst at Bank of America Merrill Lynch, said that the impact of a fiduciary standard was hard to determine because it would depend on how tightly the rules were interpreted. But he said it could cost a firm like Morgan Stanley Smith Barney as much as $300 million, or about 6 to 7 percent of this year’s expected earnings, if the rules were tightly defined."27 So if you extrapolate to other public brokerage firms, it's easy to speculate that the brokerage industry makes $ billions annually and brokers themselves make $ billions more taking advantage of their option to sell their clients higher cost "suitable" products that may not be in their clients best interest.28

How much is it worth to the brokerage industry to not have to meet a fiduciary standard? Since many of the brokerage firms are public companies, we actually got some good estimates from the analysts at some of those brokerage firms that are trained in making those types of financial projections. There was one estimate in a 2010 New York Times article which included the following very telling note. "Guy Moszkowski, a securities industry analyst at Bank of America Merrill Lynch, said that the impact of a fiduciary standard was hard to determine because it would depend on how tightly the rules were interpreted. But he said it could cost a firm like Morgan Stanley Smith Barney as much as $300 million, or about 6 to 7 percent of this year’s expected earnings, if the rules were tightly defined."27 So if you extrapolate to other public brokerage firms, it's easy to speculate that the brokerage industry makes $ billions annually and brokers themselves make $ billions more taking advantage of their option to sell their clients higher cost "suitable" products that may not be in their clients best interest.28

![]() On April 6, 2016, the Department of Labor finalized a rule and related exemptions to ensure that retirement savers get investment advice in their best interest with a phased implementation approach beginning in 2018, but that was put on hold several years later and may not get implemented. The rule followed a White House report in February 2015 titled “THE EFFECTS OF CONFLICTED INVESTMENT ADVICE ON RETIREMENT SAVINGS.”29 The report summarized as follows. "Conflicted advice leads to lower investment returns. Savers receiving conflicted advice earn returns roughly 1 percentage point lower each year (for example, conflicted advice reduces what would be a 6 percent return to a 5 percent return). An estimated $1.7 trillion of IRA assets are invested in products that generally provide payments that generate conflicts of interest. Thus, we estimate the aggregate annual cost of conflicted advice is about $17 billion each year."

On April 6, 2016, the Department of Labor finalized a rule and related exemptions to ensure that retirement savers get investment advice in their best interest with a phased implementation approach beginning in 2018, but that was put on hold several years later and may not get implemented. The rule followed a White House report in February 2015 titled “THE EFFECTS OF CONFLICTED INVESTMENT ADVICE ON RETIREMENT SAVINGS.”29 The report summarized as follows. "Conflicted advice leads to lower investment returns. Savers receiving conflicted advice earn returns roughly 1 percentage point lower each year (for example, conflicted advice reduces what would be a 6 percent return to a 5 percent return). An estimated $1.7 trillion of IRA assets are invested in products that generally provide payments that generate conflicts of interest. Thus, we estimate the aggregate annual cost of conflicted advice is about $17 billion each year."

![]() In the week after the Labor Department’s announcement, then SEC Chairwoman Mary Jo White had said her agency was continuing to draft a uniform fiduciary standard that would apply industrywide. "I have to emphasize though, the SEC looked at this issue for many, many, many years. It's complicated."30

In the week after the Labor Department’s announcement, then SEC Chairwoman Mary Jo White had said her agency was continuing to draft a uniform fiduciary standard that would apply industrywide. "I have to emphasize though, the SEC looked at this issue for many, many, many years. It's complicated."30

![]() Not surprisingly, Rand Corporation released data in November 2018 and found many participants of their survey did not understand the meaning of the word “fiduciary” and many struggled to understand the differences between brokerage and advisory accounts.31 While financial education is generally helpful, there is also conflicting evidence about the best way to educate different categories of investors.32

Not surprisingly, Rand Corporation released data in November 2018 and found many participants of their survey did not understand the meaning of the word “fiduciary” and many struggled to understand the differences between brokerage and advisory accounts.31 While financial education is generally helpful, there is also conflicting evidence about the best way to educate different categories of investors.32

![]() In April of 2018, following a 4-1 vote, the SEC moved ahead with a 90 day public comment period on a Regulation Best Interest33 and in June 2019, following a 3-1 vote the SEC voted to move forward with the Best Interest legislation that will require registered investment advisers and broker-dealers to provide retail investors with simple, easy-to-understand information about the nature of their relationship.34 The new rules are expected to become effective June 30, 2020, but it’s uncertain if that will occur as planned and other regulatory agencies like individual states may take separate action.

In April of 2018, following a 4-1 vote, the SEC moved ahead with a 90 day public comment period on a Regulation Best Interest33 and in June 2019, following a 3-1 vote the SEC voted to move forward with the Best Interest legislation that will require registered investment advisers and broker-dealers to provide retail investors with simple, easy-to-understand information about the nature of their relationship.34 The new rules are expected to become effective June 30, 2020, but it’s uncertain if that will occur as planned and other regulatory agencies like individual states may take separate action.

![]() Rick Fleming was appointed as the Securities and Exchange Commission first "Investor Advocate" in 2014 (pursuant to a Congressional mandate). The office of the Investor Advocate works to provide a voice for Investors, assist retail investors, study investor behavior, and support the SEC's Investor Advisory Committee. While the Investor Advocate reports to the Chair of the SEC, it submits reports directly to Congress, without any prior review or comment from the Commissioners or SEC staff.

Rick Fleming was appointed as the Securities and Exchange Commission first "Investor Advocate" in 2014 (pursuant to a Congressional mandate). The office of the Investor Advocate works to provide a voice for Investors, assist retail investors, study investor behavior, and support the SEC's Investor Advisory Committee. While the Investor Advocate reports to the Chair of the SEC, it submits reports directly to Congress, without any prior review or comment from the Commissioners or SEC staff.

![]() After the SEC voted in favor of the Best Interest rule, Fleming released a critical statement that challenged some of the conclusions that many of the rule’s supporters had been claiming. He wrote the following.

After the SEC voted in favor of the Best Interest rule, Fleming released a critical statement that challenged some of the conclusions that many of the rule’s supporters had been claiming. He wrote the following.

"In summary, I believe Regulation Best Interest, while not as strong as it could be, is a step in the right direction because it is an improvement over the existing suitability standard for broker-dealers. However, what investors have gained in Reg BI has been undermined by what investors have lost in the Commission’s interpretation of the fiduciary duty that applies to investment advisers ... We have known for more than a decade that many investors do not understand the differences between investment advisers and broker-dealers. Regrettably, I anticipate that the same confusion will exist a decade from now … the Commission had an opportunity to help investors by brightening the lines between investment advisers and broker-dealers, but instead the Commission has formalized its longstanding acquiescence to the preferences of the brokerage industry.“Rick Fleming (Investor Advocate)35

![]() Patrick Lach, Leisa Reinecke Flynn, and G. Wayne Kelly have also argued that individuals are confused by the titles used by investment professionals and they cannot distinguish between investment advisers and brokers. They suggested in a recently published article for the Financial Analysts Journal that a simpler solution to help clarify the confusion between brokers and advisors, based on surveys results, would be to identify brokers as “an investment sales representative.”36

Patrick Lach, Leisa Reinecke Flynn, and G. Wayne Kelly have also argued that individuals are confused by the titles used by investment professionals and they cannot distinguish between investment advisers and brokers. They suggested in a recently published article for the Financial Analysts Journal that a simpler solution to help clarify the confusion between brokers and advisors, based on surveys results, would be to identify brokers as “an investment sales representative.”36

…beginning on June 30, 2020, investors will be better protected from conflicts of interest, high costs, and bad advice. But, we don’t know how strong the protection will be, because we don’t know how broker-dealers are going to apply the Best Interest standard or how they will mitigate material financial conflicts of interest."Fred Reish37

![]() While the United States appears headed to a possibly improved, but still confusing environment for investors, some other nations have moved toward fiduciary duties for advisors. India banned upfront commissions on open-ended mutual funds in 2009, Australia followed with reforms in 2012 and the United Kingdom and the Dutch followed in 2013 effectively banning investment commissions. However, the Financial Conduct Authority was investigating the U.K. investment management industry in 2018 and a watchdog report found “substantial customer detriment” in the way advisers and fiduciary managers ply their trades.38

While the United States appears headed to a possibly improved, but still confusing environment for investors, some other nations have moved toward fiduciary duties for advisors. India banned upfront commissions on open-ended mutual funds in 2009, Australia followed with reforms in 2012 and the United Kingdom and the Dutch followed in 2013 effectively banning investment commissions. However, the Financial Conduct Authority was investigating the U.K. investment management industry in 2018 and a watchdog report found “substantial customer detriment” in the way advisers and fiduciary managers ply their trades.38

![]() The European Union Markets in Financial Instruments Directive (MiFID) was effective as of January 3, 2018 and it regulates payments for certain advisers and requires policies and procedures to ensure that any advisers who accept conflicted payments are properly incentivized to serve clients’ interests. The bottom line for investors is to educate yourself, don’t assume your advisor will always put your interests first, and be aware of the potential problems noted in this chapter.

The European Union Markets in Financial Instruments Directive (MiFID) was effective as of January 3, 2018 and it regulates payments for certain advisers and requires policies and procedures to ensure that any advisers who accept conflicted payments are properly incentivized to serve clients’ interests. The bottom line for investors is to educate yourself, don’t assume your advisor will always put your interests first, and be aware of the potential problems noted in this chapter.

![]() There are basically three main avenues for investment products with loads and commissions to disappear.

There are basically three main avenues for investment products with loads and commissions to disappear.

![]() Jason Zweig, writing in March of 2019 about the state of fiduciary and best interest regulations, pointed out that in some states like Nevada and New Jersey, regulators were moving forward with their own legislation that may impose a fiduciary responsibility on advisors regardless of the pending SEC rules.39 Following the SEC Best Interest rule vote, Massachusetts Secretary of the Commonwealth William Galvin announced that state will propose a rule that would mandate brokers and investment advisers apply a fiduciary standard of care in interactions with clients.40 Maryland was also mentioned in Zweig’s article, but later articles have suggested lawmakers in that state have put a bill on hold for now. There have also been reports that some firms have threatened to stop doing business in some states (Nevada in particular) if they adopt a fiduciary rule.41 Then in September of 2019, seven states (New York, California, Connecticut, Delaware, Maine, New Mexico, Oregon and the District of Columbia) filed a lawsuit arguing that the SEC exceeded its authority and deviating from a model authorized by the 2010 Dodd-Frank financial overhaul law. The following day another law suit was filed by financial firms.42 So the resolution seems to continue to be in doubt.43

Jason Zweig, writing in March of 2019 about the state of fiduciary and best interest regulations, pointed out that in some states like Nevada and New Jersey, regulators were moving forward with their own legislation that may impose a fiduciary responsibility on advisors regardless of the pending SEC rules.39 Following the SEC Best Interest rule vote, Massachusetts Secretary of the Commonwealth William Galvin announced that state will propose a rule that would mandate brokers and investment advisers apply a fiduciary standard of care in interactions with clients.40 Maryland was also mentioned in Zweig’s article, but later articles have suggested lawmakers in that state have put a bill on hold for now. There have also been reports that some firms have threatened to stop doing business in some states (Nevada in particular) if they adopt a fiduciary rule.41 Then in September of 2019, seven states (New York, California, Connecticut, Delaware, Maine, New Mexico, Oregon and the District of Columbia) filed a lawsuit arguing that the SEC exceeded its authority and deviating from a model authorized by the 2010 Dodd-Frank financial overhaul law. The following day another law suit was filed by financial firms.42 So the resolution seems to continue to be in doubt.43

![]() In several countries noted above, the government has effectively banned commissions, but in the United States it has mostly been investors themselves who have reduced the frequency of paying commissions. There are many advisors that have also switched from commission based compensation, but in many cases management fees have gone up, countering the drop in fees.

In several countries noted above, the government has effectively banned commissions, but in the United States it has mostly been investors themselves who have reduced the frequency of paying commissions. There are many advisors that have also switched from commission based compensation, but in many cases management fees have gone up, countering the drop in fees.

![]() Technically I am included in the group of advisors that stopped selling mutual funds with loads. After I became licensed in 1987, a high school friend of mine received some money from a car accident. I helped him invest the money in a balanced mutual fund that had a 4% load. Sadly, he used the rest of his money to buy a car, but got in an accident less than a year later and told me he needed to sell the fund and take the money back out. That was the last and only time I ever sold a mutual fund with a load.

Technically I am included in the group of advisors that stopped selling mutual funds with loads. After I became licensed in 1987, a high school friend of mine received some money from a car accident. I helped him invest the money in a balanced mutual fund that had a 4% load. Sadly, he used the rest of his money to buy a car, but got in an accident less than a year later and told me he needed to sell the fund and take the money back out. That was the last and only time I ever sold a mutual fund with a load.

The evolution of Robo-Advisors

![]() Some in the financial industry had argued against a harmonized fiduciary standard suggested that it would effectively prevent the financial industry from being able to charge small investors enough to make it worth their while, and therefore they would not work with small investors. Thus they argued small investors would not be able to get the advice they need (and therefore there shouldn’t be a fiduciary standard implemented). The introduction of Robo-Advisors effectively took the air out of that argument, since most Robo-Advisors specifically target smaller investors, and they usually provide investment services at much lower costs than traditional advisors. Doug Black, for example, made that point in 2014 in the Wall Street Journal.44

Some in the financial industry had argued against a harmonized fiduciary standard suggested that it would effectively prevent the financial industry from being able to charge small investors enough to make it worth their while, and therefore they would not work with small investors. Thus they argued small investors would not be able to get the advice they need (and therefore there shouldn’t be a fiduciary standard implemented). The introduction of Robo-Advisors effectively took the air out of that argument, since most Robo-Advisors specifically target smaller investors, and they usually provide investment services at much lower costs than traditional advisors. Doug Black, for example, made that point in 2014 in the Wall Street Journal.44

![]() A Robo-Advisor is generally considered to be an online financial services firm that has automated the financial planning or investment processes. They greatly simplify the initial process of opening an account, determining an initial portfolio (often invested in low cost ETFs), and rebalancing that portfolio over time. Many Robo-Advisors offer a hybrid service that combines the automated services with access to an actual advisor (and as time has passed many traditional advisors also began offering types of automated services). Automating parts of the investment process can help reduce costs, and possibly help prevent behavioral issues from harming performance because the automated systems take emotions out of the process.

A Robo-Advisor is generally considered to be an online financial services firm that has automated the financial planning or investment processes. They greatly simplify the initial process of opening an account, determining an initial portfolio (often invested in low cost ETFs), and rebalancing that portfolio over time. Many Robo-Advisors offer a hybrid service that combines the automated services with access to an actual advisor (and as time has passed many traditional advisors also began offering types of automated services). Automating parts of the investment process can help reduce costs, and possibly help prevent behavioral issues from harming performance because the automated systems take emotions out of the process.

![]() I've given many speeches about the so-called Robo-Advisor industry, in which I summarized the origins of the industry and its impact on the investment industry. The term Robo-Advisor became popular in the last decade, but the initial companies that began offering computerized investment tools over the internet were started in the mid-1990s. BusinessInsider researched the derivation of the term “Robo Advisor” and found a March 2002 article in "Financial Planning" magazine, titled "Robo-Adviser“ by Richard Koreto, which discussed the use of software and the Internet in the management of 401(k) plans (citing Financial Engines and mPower, which was later acquired by Morningstar).45 Bill Winterberg started using the term regularly in 2012 and probably deserves much of the credit for popularizing the term.46

I've given many speeches about the so-called Robo-Advisor industry, in which I summarized the origins of the industry and its impact on the investment industry. The term Robo-Advisor became popular in the last decade, but the initial companies that began offering computerized investment tools over the internet were started in the mid-1990s. BusinessInsider researched the derivation of the term “Robo Advisor” and found a March 2002 article in "Financial Planning" magazine, titled "Robo-Adviser“ by Richard Koreto, which discussed the use of software and the Internet in the management of 401(k) plans (citing Financial Engines and mPower, which was later acquired by Morningstar).45 Bill Winterberg started using the term regularly in 2012 and probably deserves much of the credit for popularizing the term.46

![]() One advantage for investors offered by many of the Robo-Advisors is you can try them with a very small commitment of capital, so there is little risk in opening a small account to begin the process and effectively giving them a trial run. Ideally you want the Robo-Advisor to have all the summary data on your other investments, so the recommendations are appropriate for your big picture. The low costs (for most of them) make them well suited for smaller investors that are starting to accumulate assets.

One advantage for investors offered by many of the Robo-Advisors is you can try them with a very small commitment of capital, so there is little risk in opening a small account to begin the process and effectively giving them a trial run. Ideally you want the Robo-Advisor to have all the summary data on your other investments, so the recommendations are appropriate for your big picture. The low costs (for most of them) make them well suited for smaller investors that are starting to accumulate assets.

![]() A Robo-Advisor may have limited options and flexibility for cash management and other needs relative to traditional advisors. They may also limit your ability to use multiple types of securities. For instance sometimes you may want to use ETFs, sometimes mutual funds, and sometimes individual securities, in which case a Robo-Advisor may not be the best choice for all the assets.

A Robo-Advisor may have limited options and flexibility for cash management and other needs relative to traditional advisors. They may also limit your ability to use multiple types of securities. For instance sometimes you may want to use ETFs, sometimes mutual funds, and sometimes individual securities, in which case a Robo-Advisor may not be the best choice for all the assets.

![]() A July 2015 Financial Planning article titled “Your Clients Haven't Even Heard of Robo Advisors… Yet” cited a Wells Fargo survey that concluded only about one in five investors with over $250,000 were familiar with Robo-Advisors. 71% of those in their 30s said they would use a Robo-Advisor in the next five years versus only 27% that were over 60.47

A July 2015 Financial Planning article titled “Your Clients Haven't Even Heard of Robo Advisors… Yet” cited a Wells Fargo survey that concluded only about one in five investors with over $250,000 were familiar with Robo-Advisors. 71% of those in their 30s said they would use a Robo-Advisor in the next five years versus only 27% that were over 60.47

![]() A Charles Schwab study, also in 2015, found that younger investors were more likely to be comfortable with a computer generated portfolio, but most in the young and older age groups still preferred a human advisor. But just as technology has changed practices in fields like travel planning and researching large purchases, it’s likely that acceptance of automated investment advice will continue to increase.48

A Charles Schwab study, also in 2015, found that younger investors were more likely to be comfortable with a computer generated portfolio, but most in the young and older age groups still preferred a human advisor. But just as technology has changed practices in fields like travel planning and researching large purchases, it’s likely that acceptance of automated investment advice will continue to increase.48

![]() Consistent with the success of hybrid products, Gallup also found in a 2015 survey that most investors preferred to get advice from digital tools as well as humans (a follow-up 2016 survey had virtually unchanged overall results). Nearly two in three investors said they preferred to get financial advice from both sources, including 39% who wanted advice to come mostly from advisers and 26% who wanted it to come mostly from digital tools. A combined 62% prefer getting financial advice exclusively (23%) or mostly (39%) from a personal financial adviser, whereas a combined 35% prefer mostly (26%) or exclusively (9%) digital advice. Also, when asked to choose between three sources of advice, 50% opted for a strong relationship with a financial adviser, 24% for access to state-of-the-art online or digital investing tools, and 19% for access to on-call financial advisers.49

Consistent with the success of hybrid products, Gallup also found in a 2015 survey that most investors preferred to get advice from digital tools as well as humans (a follow-up 2016 survey had virtually unchanged overall results). Nearly two in three investors said they preferred to get financial advice from both sources, including 39% who wanted advice to come mostly from advisers and 26% who wanted it to come mostly from digital tools. A combined 62% prefer getting financial advice exclusively (23%) or mostly (39%) from a personal financial adviser, whereas a combined 35% prefer mostly (26%) or exclusively (9%) digital advice. Also, when asked to choose between three sources of advice, 50% opted for a strong relationship with a financial adviser, 24% for access to state-of-the-art online or digital investing tools, and 19% for access to on-call financial advisers.49

![]() While some are hesitant to allow computers to control their finances, other studies report investors being scared to talk to financial advisors in person. The fears include the thought that advisors would not be able to help them, concerns about trusting the advisors, concerns about the cost, and others were afraid that the advisor would give them bad news about the state of their finances.50

While some are hesitant to allow computers to control their finances, other studies report investors being scared to talk to financial advisors in person. The fears include the thought that advisors would not be able to help them, concerns about trusting the advisors, concerns about the cost, and others were afraid that the advisor would give them bad news about the state of their finances.50

![]() Many industries (like travel agencies) have evolved over time as a result of computer and internet innovations. Similarly, the investment business is being impacted in many ways by computerization and the internet, and the process of determining your risk tolerance is one of the most important. A traditional investment advisor would typically spend a significant amount of time becoming familiar with an investor, but some of the newer firms advertise (as a benefit) that you can open an account and have a portfolio chosen for you within minutes. Speed is often good, and simplification is in most cases good, but it is reasonable to ask whether your risk tolerance and an appropriate asset allocation can or should be determined based on a small sample of answers. Keep in mind, that some believe the questionnaires used by most Robo-Advisers are inadequate for determining client’s risk tolerance and ability to take on risk. Some questionnaires are designed for limiting legal liability of the financial firms providing the advice. Robo-Advisers are likely a good starting point, but investors should carefully evaluate whether they are comfortable using the automated systems.51

Many industries (like travel agencies) have evolved over time as a result of computer and internet innovations. Similarly, the investment business is being impacted in many ways by computerization and the internet, and the process of determining your risk tolerance is one of the most important. A traditional investment advisor would typically spend a significant amount of time becoming familiar with an investor, but some of the newer firms advertise (as a benefit) that you can open an account and have a portfolio chosen for you within minutes. Speed is often good, and simplification is in most cases good, but it is reasonable to ask whether your risk tolerance and an appropriate asset allocation can or should be determined based on a small sample of answers. Keep in mind, that some believe the questionnaires used by most Robo-Advisers are inadequate for determining client’s risk tolerance and ability to take on risk. Some questionnaires are designed for limiting legal liability of the financial firms providing the advice. Robo-Advisers are likely a good starting point, but investors should carefully evaluate whether they are comfortable using the automated systems.51

Vanguard argues that robo-advisors and packaged services are far more efficient at portfolio construction than are advisors. Vanguard maintains that advisors should focus on client relationships, perhaps including behavioral coaching and some more complex financial planning, but certainly advisors should have very little to do with traditional investment selection ... Advisors have been increasingly removed from the investment process—first from security selection, then from manager selection, and now from portfolio construction.

52

Don Phillips in “The Rise of Non-Investment Advisors” June 4, 2018

![]() Melanie Fein argued that Robo-Advisors do not provide personalized investment advice because their questionnaires do not elicit all relevant information and may ignore key facts. She pointed out that Robo-Advisor agreements provide that the client is responsible for ensuring that the Robo-Advisor’s recommendations are in the client’s best interests.53

Melanie Fein argued that Robo-Advisors do not provide personalized investment advice because their questionnaires do not elicit all relevant information and may ignore key facts. She pointed out that Robo-Advisor agreements provide that the client is responsible for ensuring that the Robo-Advisor’s recommendations are in the client’s best interests.53

![]() I would suggest investors revisit risk tolerance and investment questionnaires regularly, and during periods of high stress. People's expectations, optimism, and fear levels change over time, so it’s important to reevaluate periodically and not assume your circumstances and risk tolerance won't change over time.

I would suggest investors revisit risk tolerance and investment questionnaires regularly, and during periods of high stress. People's expectations, optimism, and fear levels change over time, so it’s important to reevaluate periodically and not assume your circumstances and risk tolerance won't change over time.

![]() While the Robo-advisor industry has grown dramatically and public recognition and adoption has increased,54 there have also been some warnings. In 2015, as many new Robo-Advisor products were being introduced, the SEC actually issued an “Investor Alert” which included multiple warnings for investors. For instance, the SEC advised safeguarding your personal information, considering the tool’s limitations including what can be inferred from the limited information you supply, recognizing that the tools may steer you to affiliated products, and the limited options they supply may not be the best options for you.55

While the Robo-advisor industry has grown dramatically and public recognition and adoption has increased,54 there have also been some warnings. In 2015, as many new Robo-Advisor products were being introduced, the SEC actually issued an “Investor Alert” which included multiple warnings for investors. For instance, the SEC advised safeguarding your personal information, considering the tool’s limitations including what can be inferred from the limited information you supply, recognizing that the tools may steer you to affiliated products, and the limited options they supply may not be the best options for you.55

![]() By the start of the second quarter of 2019, Robo-Advisors in the United States had accumulated several hundred billion dollars, but the assets are skewed, with Vanguard’s hybrid “Personal Advisor Services” advisor accumulating over $140 billion in assets (Vanguard also may be planning to launch a new digital financial planning service called Vanguard Digital Advisor with even lower costs and minimum investments).56 The brokerage offerings including Charles Schwab’s “Intelligent Portfolios” and TD Ameritrade’s “Selective and Essential Portfolios” had accumulated tens of billions dollars (I haven’t seen a recent figure for Fidelity’s “Go” service) and the two main venture capital backed firms, Betterment and Wealthfront had also both accumulated over $18 billion in assets.57 Personal Capital, which takes more of a hybrid approach and employs more than 200 advisors, had over $10 billion in assets.58

By the start of the second quarter of 2019, Robo-Advisors in the United States had accumulated several hundred billion dollars, but the assets are skewed, with Vanguard’s hybrid “Personal Advisor Services” advisor accumulating over $140 billion in assets (Vanguard also may be planning to launch a new digital financial planning service called Vanguard Digital Advisor with even lower costs and minimum investments).56 The brokerage offerings including Charles Schwab’s “Intelligent Portfolios” and TD Ameritrade’s “Selective and Essential Portfolios” had accumulated tens of billions dollars (I haven’t seen a recent figure for Fidelity’s “Go” service) and the two main venture capital backed firms, Betterment and Wealthfront had also both accumulated over $18 billion in assets.57 Personal Capital, which takes more of a hybrid approach and employs more than 200 advisors, had over $10 billion in assets.58

![]() Acorns has taken a different approach with a phone app allowing investors to start with small commitments and round-ups from credit card purchases and claims to have signed up 4 million customers to date (although according to recent regulatory filings, the number of customer accounts was less). Investors placed $105 million in funding into Acorns in January 2019 reportedly valuing the company at $860 million (which exceeded the 2017 valuation of Betterment).59 The Acorns portfolios have a fee of only 0.25% per year (but also a minimum of a dollar a month). Stash, which only requires a $5 minimum account has claimed to have several million customers as well. A recent report estimated that about a third of new accounts in the U.K. are being opened with Robo-Advisors, although they tend to be much smaller than accounts opened with traditional investment firms.50

Acorns has taken a different approach with a phone app allowing investors to start with small commitments and round-ups from credit card purchases and claims to have signed up 4 million customers to date (although according to recent regulatory filings, the number of customer accounts was less). Investors placed $105 million in funding into Acorns in January 2019 reportedly valuing the company at $860 million (which exceeded the 2017 valuation of Betterment).59 The Acorns portfolios have a fee of only 0.25% per year (but also a minimum of a dollar a month). Stash, which only requires a $5 minimum account has claimed to have several million customers as well. A recent report estimated that about a third of new accounts in the U.K. are being opened with Robo-Advisors, although they tend to be much smaller than accounts opened with traditional investment firms.50

![]() A December 2018 Financial Planning article listed three projections for assets managed on digital platforms. Aite Group projected they will have $1.56 trillion for 2021, while Juniper Research and BI Intelligence projected $4.1 trillion and $4.6 trillion respectively for 2022.61

A December 2018 Financial Planning article listed three projections for assets managed on digital platforms. Aite Group projected they will have $1.56 trillion for 2021, while Juniper Research and BI Intelligence projected $4.1 trillion and $4.6 trillion respectively for 2022.61

"Households working with a financial planner were found to be making the best overall financial decisions, followed by those using the Internet, while those working with a transactional adviser were making the worst financial decisions."

62

David Blanchett, April 2019

Notes - The Footnotes in the Book are sequential and for this chapter start at #529 and end at #591.

1. https://corporateservices.schwab.com/public/file/P-11701974

https://citywireusa.com/registered-investment-advisor/news/what-a-difference-advice-makes-schwab-research-finds/a1180776

2. https://www.federalreserve.gov/publications/files/2018-report-economic-well-being-us-households-201905.pdf

3. Source: Los Angeles Times October 13, 1996

4. https://www.cfp.net/docs/default-source/news-events---research-facts-figures/2015-consumer-opinion-survey.pdf

5. See https://www.financial-planning.com/news/cerulli-is-wrong-about-financial-advisor-headcount-hiring or https://www.kitces.com/blog/financial-advisor-headcount-total-addressable-market-tam-technology-hiring-growth/ for November 2018 discussion by Michael Kitces of the number of advisors based on several data sources.

6. https://www.bls.gov/ooh/business-and-financial/personal-financial-advisors.htm

7. Tobias Salinger, "IBD Going Full RIA?" Financial Planning, January 2019

8. http://money.cnn.com/retirement/guide/gettinghelp_basics.moneymag/index4.htm

9. https://www.cbsnews.com/news/my-dog-americas-top-financial-planner/

10. http://financialadvisoriq.com/c/1932444/227054/clients_edward_jones_over_getting_switched_based_accounts

11. “Keeping up” page 57,58 second paragraph

12. Keith Brown, W. V. Harlow, Laura Starks, “Of Tournaments and Temptations: An Analysis of Managerial Incentives in the Mutual Fund Industry” Journal of finance March 1996 http://onlinelibrary.wiley.com/doi/10.1111/j.1540-6261.1996.tb05203.x/abstract

13. http://johncbogle.com/wordpress/wp-content/uploads/2008/02/gw_2-08.pdf

14. For instance, see “Can You Trust Your Broker?” in BusinessWeek - 2/20/95.

15. Elizabeth Ody in “Whose advice can you trust?” from Kiplinger's (December 2010)

16. Elizabeth (Ody) Leary, "Whose Investment Advice Can You Trust?" Kiplingers December 2009 https://www.kiplinger.com/article/business/T008-C000-S002-whose-investment-advice-can-you-trust.html

17. http://www.sec.gov/news/press/2008/2008-1_randiabdreport.pdf

18. http://www.investmentnews.com/article/20100915/FREE/100919956

19. http://www.investmentnews.com/article/20100915/FREE/100919956

20. http://www.financial-planning.com/news/fiduciary-Infogroup-ORC-2668775-1.html

21. http://www.biz.uiowa.edu/faculty/thouge/fund_fees_paper.pdf

22. http://rfs.oxfordjournals.org/content/early/2009/05/21/rfs.hhp022.short

23. http://www.amtd.com/news/releasedetail.cfm?ReleaseID=196031