What to expect from an advisor.

- Assess your relevant financial history, such as tax returns, investments, retirement plan, wills, and insurance policies.

- Identify areas where you may need assistance, such as building up a retirement income or improving your investment returns.

- Determine the appropriate level of risk and manage a portfolio at that risk level.

- Discuss, write and explain a personalized financial plan based on your situation.

- Help you implement your financial plan, including referring you to specialists, such as lawyers or accountants, if necessary.

- Minimizing tax and transactions costs.

- Review your situation and financial plan periodically and suggest changes in your program when needed.

Before contacting potential advisors its a good idea to know in advance what you are expecting from an advisor. Make a list of expectations to go along with you financial goals. An advisor may not be able to help you if they don't know what you want. Its your own responsibility to make sure that you've provided an advisor with the information they need to advise you appropriately. When asked what they most want from a financial advisor, 83% of consumers listed education first, according to a survey of 4,000 households by Dalbar Inc. 80% said Minimize taxes, 70% said highest returns, 68% said protect from loss, 68% said prevent mistakes, 64% said written plan, 63% said help define goals, 58% said change investments. (Source: LA Times October 13, 1996)

There are many types of advisors. Banks, Stock Brokers, Money Managers/Registered Investment Advisors (RIA), and Financial Planners are all potential advisers for your investments. See Investment Advisers: What You Need to Know Before Choosing One from the SEC and Now Everyone Has Plans For Your Money from Business Week (9/2/96).

The following is a collection of questions you may want to use in evaluating advisors and their organizations. You can choose any that you feel are relevant to your needs (or you can ask all of them if you're looking for weaknesses or trying to get rid of an advisor that will not leave you alone).

- Are you registered with a state agency and the SEC?

- Are you a member of the NASD and/or NYSE?

- What licenses, certificates and registrations do you have?

- What services do you provide?

- What kind of clients do you serve?

- How many clients do you have?

- How much money do you manage?

- How long have you been in the business?

- How would you summarize your philosophy of money management?

- What types of investments do you recommend?

- What is your area of expertise?

- What separates you from others in the field?

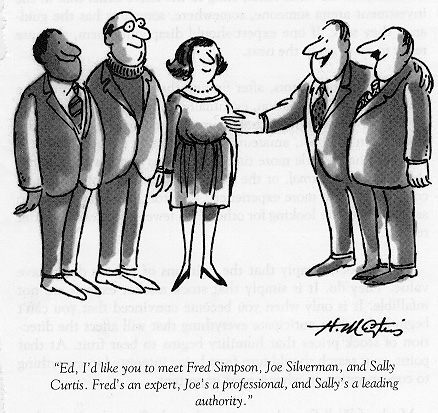

- Why are you qualified to advise me?

- What are your educational credentials and business experience?

- How do you keep up to date in the field?

- How does your past investment performance rank against your benchmarks and peers?

- What references can you give?

- Is your performance record verified by independent sources?

- Is your performance record in compliance with AIMR Performance Presentation Standards?

- What process will you use to help me with my investments?

- How are you compensated and how do you set your fees?

- How are fees calculated?

- Do you have a minimum account fee or minimum investment?

- What do I receive for that fee?

- Will you have direct access to my assets?

- Who will review my financial affairs with me?

- Will you provide an individual financial plan?

- How often do you communicate with your clients?

- How often will the portfolio be reviewed?

Investigating Advisors

See Brokers for researching Stock Brokers.

You can call the CFP Board of Standards (303) 830-7543, ext. 219 to check on license and disciplinary record of Financial Planners.

See also The National Association of Personal Financial Advisors and NAIC.

Call (202) 737-0900 to get state securities commissioners phone numbers.

You can call (800) 732-0330 SEC to see if an advisor is a licensed RIA (See below).

Credentials Information

- CFA - Chartered Financial Analyst. Awarded by the CFA Institute (800) 247-8132. The CFA is a prestigious credential recognized worldwide and held mostly by institutional money managers, investment advisors, and stock analysts. Candidates must pass three extensive and rigorous six hour exams (See Tests) sequentially covering a comprehensive curriculum. Applicants must provide character references and agree to adhere to the Code of Ethics and Standards of Professional Conduct.

- CFP - Certified Financial Planner Certified. Financial Planner Board of Standards 800-487-1497. Must pass a 10 hour exam and agree to abide by code of ethics.

- CLU - Chartered Life underwriter. American College (610) 526-1000. Held mostly by life insurance agents.

- CPA - Certified Public Accountant. Must pass a rigorous test administered nationally and receive state accountancy board approval.

- MBA - Master of Business Administration. Graduate level degree generally seen as a solid background. Education in finance and investments will depend on school and major field. See Education for MBA schools and rankings.

- Registered Representative - Stockbroker. Must pass NASD series exam(s). There is no explicit financial planning component to the testing.

- RIA - Registered Investment Advisor - means an individual or a firm has filed with the SEC or state(s) and paid a modest fee. They are required to present a copy of the filing.

When you choose a doctor, you want someone with the appropriate credentials as well as good bed side manner. Likewise, with choosing a financial advisor you should select an advisor that you feel comfortable with both personally and professionally. You also should be confident in the advisors morals and ethics. In that regard you should be aware of how they are compensated. Money management clients typically pay a percentage of assets under management. The managers compensation is not based on the commissions generated on trades. The manager has no incentive to churn but does have an incentive to grow the assets, thereby growing his own income. The managers incentive is therefore in line with the clients and in the clients best interest. Less than ethical practices that do exist include accepting kickbacks from brokers for using the brokers products, and undisclosed self-dealing with an affiliated broker. Stock Brokers historically were compensated by commissions, but percentage of asset based accounts have become more common (See The Trust Issue). See also "New study finds most 'fee-only' financial planners misrepresent how they get paid" in Money Daily (1/10/97).

Behavior by managers you may want to avoid.

- Choosing investments not suited to goals and constraints.

- Failing to diversify and failing to move to an efficient portfolio.

- Reacting to short term, not long term market movements.

- Reacting emotionally.

Behavior that can work against the client is behavior that is likely NOT to lose the business of a client. A manager may be excessively risk averse and liquid by not allowing enough risk therefore resulting in lower returns. By simply matching the market or not straying far from a benchmark, a manager can reduce the risk of significantly underperforming and getting fired. This behavior can occur typically when an advisor has performed well in the recent past. An analogy can be drawn to a football team with a large lead near the end of a game. They play a "prevent defense" which prevents big plays but allows short and medium gains that will run the clock out. Likewise a manager is unlikely to be fired for slight underperformance, therefore taking few risks may reduce the likelihood of losing an account in some cases.

In contrast, a manager that has significantly underperformed may also exhibit behavior that is not in the clients best interest. What does a quarterback do when he's trailing at the end of a game and his back is against the wall. He throws the bomb. Similarly, managers that have underperformed will be tempted to take additional risk in an effort to catch up. A manager on the verge of getting fired may take larger risks since he/she is likely to get fired anyway. Throwing the bomb may be his last chance to keep a client. See Of Tournaments and Temptations, an interesting Journal of Finance article that discussed mutual fund fees and how fund managers act depending on their performance.

"There are no requirements for managing billions of dollars, but before somebody can trim your sideburns, he or she has to pass some sort of test. Given the record of the average fund manager over the last decade, maybe it should be the other way around."

Peter Lynch, Beating the Street

Last update 6/11/2017. Copyright © 2017 Investor Home. All rights reserved. Disclaimer